When you buy a share option, it is transferred from one investor to another. However, if you have a warrant exercise and note conversion agreement with a company, it entitles you to convert the warrants into share. When you convert, the company will issue new shares in your name.

It is prudent to realize that there is a conversion cap, and this information will be detailed in the agreement. Furthermore, the agreement mentions how the warrant holder can opt for conversion.

When you have a warrant exercise and note conversion agreement, it merely gives you the right to buy a security at a specific price and quantity in the future. It does not obligate you to convert the share warrants.

Purpose of Warrant Exercise and Note Conversion Agreement

The purpose of this agreement is to set the rules for the conversion. The agreement clearly states the cost of making the conversion, the rate at which the conversion will take and the date by which you can exercise the warrants (some warrants do not have a fixed date for conversion). It helps to make the conversion and exercise simpler and more efficient.

When Do You Need Warrant Exercise and Note Conversion Agreement?

A company issues an agreement when it wants to boost its share capital through the conversion of warrants or a convertible note. The warrant is a negotiable instrument and the warrant holder can transfer it without registering the transfer.

Inclusions in Warrant Exercise and Note Conversion Agreement

The warrant exercise and note conversion agreement will have commercial terms which will be specific to the agreement. In addition, it will contain standard boilerplate clauses. Some of the inclusions in the agreement are as follows:

- Names of the parties

- Every stakeholder’s registered address

- Effective date

- Warranties

- Date, if any, by which the warrant and convertible note can exercise the conversion

- Representations

How to Draft Warrant Exercise and Note Conversion Agreement?

When drafting this agreement, the company would have to adhere to the following guidelines:

- The agreement should mention the number of convertible notes and warrants being issues and the kind of shares they can be converted into

- Warrants and notes are usually issues against a fixed number of shares and the same should be mentioned in the agreement

- The price of the conversion is pre-determined and is usually in accordance with the applicable law. However, many times the price can be negotiable and the agreement holder may negotiate it. So, the price of the conversion should be clearly stated

- Under what circumstances can the warrant and note holder can exercise their right should be detailed in the agreement

- The time frame within which the conversion can take place should also be stated

Pros and Cons of Warrant Exercise and Note Conversion Agreement

Some of the advantages are as follows:

- Investors can track the instrument’s performance by observing the movement of the security

- Ideal for speculators and hedgers who can profit in a bear or bull market

- Warrants and convertible notes are cheaper than shares, making them ideal for small investors

- They offer high returns as they are created for long-term investing

- Warrants are transferrable without needing any registration formality

Here are a few disadvantages associated with this agreement:

- Since the warrant’s performance is dependent on the underlying stock, they are high-risk investment instruments

- A warrant’s value can become zero, leading to the loss of investment

- Warrant holders do not have the rights that shareholder enjoy and hence, cannot participate in annual general meetings

Types of Warrant Exercise and Note Conversion Agreement

There are primarily two types of warrant exercise and note conversion agreement, and they are as follows:

- Call Warrant, where the warrant holder agrees to buy the securities on or before a specific date in the future at a fixed price

- Put Warrant, where the warrant holder can sell the securities back to the company on or before a fixed date at a specific price

Key Terms / Clauses in Warrant Exercise and Note Conversion Agreement

Some of the key terms of the agreement are as follows:

- Number of Shares: It refers to the specific number of shares the investor will be entitled to when they exercise the warrant

- Expiry Date: The date before which the investor should exercise the warrant

- Strike Price: This refers to the pre-determined price at which the investor exercises the warrant

- Conversion Ratio: The ratio at which the warrant is converted into the underlying security

- Time Value: It refers to the difference between the intrinsic value and the price of the warrant

What Happens When You Violate Warrant Exercise and Note Conversion?

If you violate or infringe the warrant and exercise and note conversion agreement, you could become ineligible to exercise the conversion, causing you to lose your investment. If the issuing company breaches the agreement, you can opt for contractual remedies listed in the agreement or take legal action.

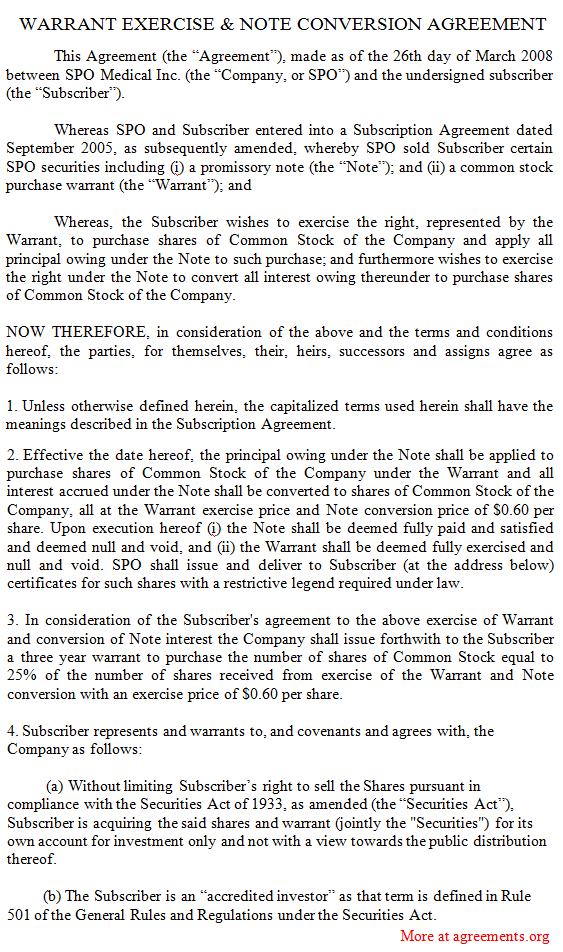

Download Warrant Exercise and Note Conversion Agreement Sample

You can download a sample below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.