A Brief Introduction About the Warrant Agreement

The definition of a warrant agreement is a legally binding document drawn between a warrant holder and the company, that allows individuals or companies to purchase shares of another company at a specific date and a specific price. It is issued by the company whose shares are being bought by the investor. It must be noted that the shares that the investors received are from the company directly and not from other investors in the market. In contrast to a stock option, stock warrants render an obligation on the holder to sell the shares as per the agreement. In finance, a warrant is treated as a security. It is also called a form of warrant agreement, stock warrant, share warrants, and warrants to purchase shares.

Who Takes the Warrant Agreement – People Involved

You would need to enter into a warrant agreement if:

- You are a company or individual that is looking to buy shares directly from the company

- You are a company which is directly selling shares to an investor

Purpose of the Warrant Agreement – Why Do You Need It

The purpose of an agreement is to:

- Lay the terms down in a single comprehensive document, so both parties understand them.

- Establish the warrant holder-company relationship.

- Protect the legal rights of the parties and to give the legal transaction validity.

Warrants v/s Options

Stock options are fundamentally different from stock warrants in the way that options are contracts between individual investors, while the company itself issues stock warrants and the proceeds become a source of capital for the company. Stock options are also short-term and usually last a month to three years, whereas stock warrants can last for 15 years.

Contents of the Agreement – Inclusions

- Effective Date: This states the date when the agreement comes into effect and is a basic, yet crucial inclusion.

- Information: At the start of the agreement, you should list the name of the company, the number of shares being bought, the class of stock, warrant price per share, issue date, expiration date, and credit facility availed.

- Method of Exercise: This clause defines how the warrant is to be executed. Usually, this involves the holder delivering a notice of exercise to the company.

- Conversion Right: This clause enables the holder to convert the warrant into its equivalent in shares based on the fair market value of the total number of shares being bought, and the fair market value of each unit share.

- Fair Market Value: This clause defines the calculation of the fair market value, which affects the value of the shares on conversion. Usually, the fair market value is the average volume-weighted average trading price of a single share for 15-30 days before the date on which the holder exercises the warrant by delivering a notice of exercise.

- Replacement of Warrants: This clause provides that if the holder manages to provide sufficient satisfactory evidence of theft, loss, mutilation or damage to the warrant, then the company can issue a new warrant in place of the original one.

How to Draft the Warrant Agreement

The procedure to draft an agreement:

- Mention the date on which the agreement takes effect.

- List the names and addresses of the parties.

- Establish the warrant holder-company relationship.

- Explicitly list the name of the company, the number of shares to be bought, class of stock, warrant price per share, issue date, expiration date, and credit facility that was used.

- Include clauses that lay down the terms of exercise, method of exercise, conversion right, fair market value, the delivery of the certificate and new warrant, and replacement of warrants.

- Include a template of a Notice of Exercise as an appendix.

- Mention the name of the governing jurisdiction.

- Get the document ratified by having the parties sign it.

Negotiation Strategy

The terms of the contract must be negotiated such that it is mutually beneficial and agreeable to both the parties, to avoid dissatisfaction that could lead to disputes. The interests of both parties must be kept in mind while framing the document, and neither should be significantly disadvantaged or nourished at the expense of the other.

Benefits & Drawbacks of the Warrant Agreement

The benefits:

- Avoids ambiguity and miscommunication by giving the contracting parties a clear overview of the terms and conditions.

- The interests of both parties are safeguarded.

- Allows resolution of disputes in a systematic way.

- Makes the company legally obligated to sell the shares to the holder upon conversion or exercise

The drawbacks:

- The parties must bear legal costs.

- Negotiations can be time-consuming.

What Happens in Case of Violation?

In case the terms of the agreement are breached, the parties have the option to resolve the dispute by legal means, either by arbitration or conventional dispute resolution methods.

Stock warrants are legally binding documents drawn between an investor and the company from which he wishes to buy shares. Warrants are of two types – call and put. Call options are used when an investor wants to buy shares in the company at a future date, whereas put options are used when an investor wants to sell shares back to the company at a later date. These agreements last up to 15 years and are a better long-term investment than stock options which only last a few months to 3 years.

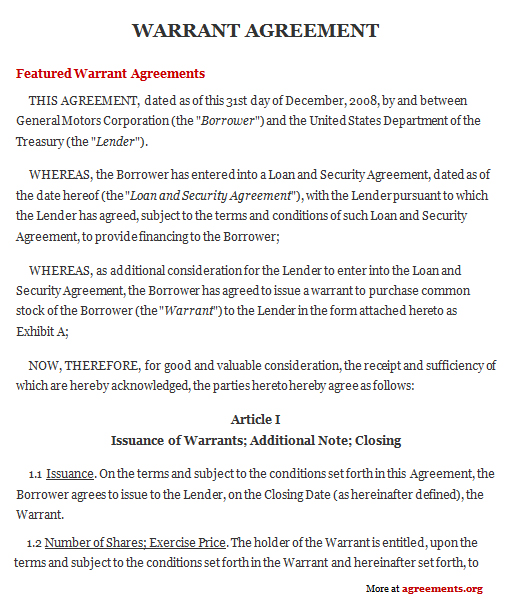

Sample Warrant Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.