A Trust Agreement is a formal legal document whereby the ownership of a property is transferred to a trustee for conservation and safe-keeping. It contains the purpose behind the creation of the trust, the terms and conditions which would govern the trust, and the termination of the agreement upon the fulfillment of the purpose. A trust can either be irrevocable or revocable. Typically, the person who grants the trust is called a trustor, who holds the trust is called a trustee, and the person for whose benefit the trust is held is called the beneficiary of the trust. Before one sets down to draft a trust agreement, one should understand the purpose behind the creation of the trust.

Purpose of the Trust Agreement

A trust agreement is typically entered into in order to conserve or preserve the property till it can be utilized by its rightful owner. For example, the property is kept in trust by A for B, who is a minor. On B’s attainment of the age of majority, the trusteeship will end, and the property will get vested in B. Such an arrangement enables the property to be safeguarded, till the time the beneficiary is ready to take responsibility of the same.

Inclusions in Trust Agreement

A trust agreement typically includes the names of the parties, effective date, the intent or purpose behind the contract, the way in which the trust money has to be preserved, permitted investments if any, limitations on the trustee and standard boilerplate clauses such as waiver, severability, remedies, notices, choice of law and dispute resolution.

Key Terms in a Trust Agreement

A trust agreement sample typically contains the following key terms and clauses:

- Name: Each trust needs to be given a distinct name.

- Purpose: The purpose behind the creation of the trust should be included in the trust contract.

- Beneficiary: The beneficiary of the trust should be clearly identified. The beneficiary may be an individual person or an entity.

- Trust Assets: What all assets (monetary and non-monetary) comprise trust assets need to be clearly laid down in the contract.

- Obligations of trustees: A trusted contract essentially needs to include the names of the trustees and the obligations enjoined upon them vis-à-vis the trust assets and the beneficiary. Typically, certain limitations are imposed on them pertaining to the management of the trust assets in order to prevent misappropriation.

- Duration/Term: A trust may run for an indefinite period or maybe for a certain stipulated period of time.

Drafting of a Trust Agreement

The following guidelines need to be followed in order to draft an effective trust agreement template:

- All the three parties vis-à-vis the trustor, the trustee, and the beneficiary should be aptly captured in the contract.

- The rights of beneficiary qua the trustee should also be reflected in terms of the contract.

- Typically, the term of the agreement should be allowed to run for the time when the purpose of the trust gets over. An indefinite trust should be avoided.

- The beneficiary should have the right to approve in the event the terms of the contract are sought to be changed.

- Proper provisions for the administration of trust should be made.

Types of a Trust Agreement

A trust agreement is of the following types:

- Revocable Trust: A revocable trust is one whose terms and conditions can be altered post its creation.

- Irrevocable trust: An irrevocable trust is one whose terms and conditions cannot be altered post its creation.

- Charitable trust: A charitable trust typically holds trust assets for charitable purposes.

- Asset protection trust: An asset protection trust typically seeks to protect a person’s assets from future creditors.

- Constructive trust: A constructive trust is one where the trust is implied. An implied or constructive trust is typically established by the court and depends upon the particular facts and circumstances.

Pros of a Trust Agreement

A trust agreement has the following benefits:

- It helps in protecting and preserving the trust assets in favor of the beneficiary.

- It makes the beneficiary a party to the contract and hence enables it to exercise at least partial control over the trust assets.

- It enables the smooth transfer of ownership of property.

- It documents the rights and obligations of each party and also lays down the procedure to administer the trust. This ensures that the trust is run in a smooth manner.

A trust agreement typically helps in outlining the rights and obligations of parties involved in the creation of the trust. Despite the documentation of rights and obligations, disputes may arise. Such disputes should preferably be settled through arbitration or mediation. However, litigation should be put down as an option of dispute resolution in the contract.

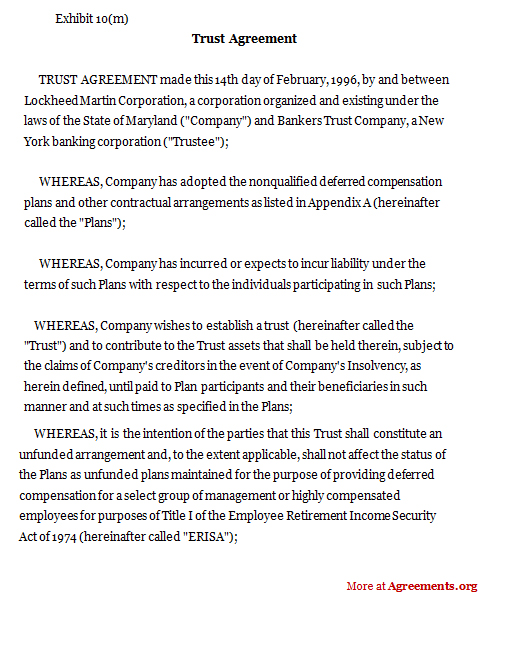

Sample for Trust Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.