What Is a Tax Sharing Agreement?

A contractual agreement created to define the economic expectations among members of a group of corporations used to consolidate/combine tax returns is called a ‘tax sharing agreement.’ In other words, such an agreement describes the situations when one member of the group be expected to owe or receive economic consequences for its tax items.

Who Are the Parties Involved in a Tax Sharing Agreement?

A Corporate Tax Sharing Agreement is an agreement negotiated by the senior management of both the parent company and the subsidiary. It recognizes the full value of the benefit and tax-sharing liability.

What Is the Purpose of a Tax Sharing Agreement?

- To create joint and several liabilities – In a consolidated group, a TSA ensures that there is group liability with regards to payment of the taxes. The TSA tries to determine and allow the tax outcomes attributable to a particular member or a group that is reported in a consolidated return.

- To ease out the separation of members of a group – In the case of a spin-off or corporate reorganization, management usually desires to assess the company’s tax accounts and thereby clarify the departing company’s contingencies.

What Are the Contents of a Tax-Sharing Agreement?

- Definitions and Interpretations – This clause includes definite terms used in the agreement, which have specific meanings. For example, terms like ‘affiliate’ or ‘business day.’

- Methodology for computing the value of taxes – TSAs generally incorporate the method through which tax liability is delegated across the group members.

- Responsibilities for filing and payment of tax returns – This includes delegation of various responsibilities to the parent and the subsidiary company.

- Overpayments and Underpayments – This section deals with any refund/reimbursement, or additional payments to be made to, or to be extracted from the subsidiary.

How to Draft a Tax Sharing Agreement?

Points to be kept in mind while drafting

- Reasonable Allocation – To make a TSA valid, and prevent conflicts with regard to payments, reasonable tax allocation should be made on the basis of the actual or expected tax liability of various contributing members.

- Profitable and Loss-making Entities – Consideration should be given to whether the entities in the group are in a taxable position or not. When parties are in a loss position, it may be appropriate to allocate a nil liability to them. This prevents debts and legal considerations in the future.

- The anticipation of the sale of a subsidiary – The conditions of the sale of a subsidiary member of a consolidated group should be well-thought-out. There should be greater scrutiny, and relevant clauses must be subsequently included in the TSA.

- Substituted accounting periods – When members fulfill their responsibilities on the basis of different accounting periods, alignment of the same for yearly tax consolidation must be kept in mind.

What Are the Benefits and Drawbacks of a Tax Sharing Agreement?

Benefits:

- Increased Accountability – Finances are one of the most critical aspects of any arrangement. By allowing equitable distribution with respect to tax payments, the agreement brings about an increase in accountability to the group in general and the parent company in particular.

- Eased out Finances – By ensuring periodic payments, the company rarely falls into debt or financial mishaps. A TSA prompts all members to satisfy their ends of the bargain to prevent any financial conflict or crisis.

Drawbacks:

- Is it practical? The lack of time and resources in the corporate world often leads to problems in the computation of tax liabilities. The fundamental reality is that precision is satisfied many-a-times for bringing the agreement into force.

- Conflicts with reference to tax attributes – It is not simple to recognize what a tax attribute is. From net operating losses to foreign tax credits, there is a wide range of taxation liabilities that a group has to incur. It requires a great amount of skill to consider all kinds of calculation mechanics which go into a dynamic agreement.

- Confusions in case of reorganization and spin-offs – When subsidiaries leave the group, there is a certain degree of confusion as to continued liability. The parent wants to be economically assured even when there are separations and spin-offs; in such scenarios, there must be a balance of accounts using actual data, well in advance.

What Happens in Case of Violation?

Most breaches of a TSA include non-payment of taxes by a subsidiary. The go-to option in such scenarios is indemnification.

Indemnity clauses in the agreement, protect the other members of a group from the violation or breach of the dealings. So, in the case of unpaid taxes by any subsidiary, a third party, or a group member acts as an indemnifier of the losses.

While the idea of a Tax Sharing Agreement seems like a good one, there are a number of considerations that go into its success. From reasonable allocation to considering the taxable nature of subsidiaries, a TSA involves a large number of complications. While one solution has a separate TSA with each of the subsidiaries, it would still require a far greater degree of certainty and resources. All and all, highly skilled accountants need to be involved in examining the range of factors that influence the division of tax payments in such an arrangement. More importantly, in case the arrangement breaks off, there needs to be indemnification measures taken. While TSAs ease the burden on a single parent company, they bring in a lot more complex calculations, some of which are unreasonable to be imposed on young players in the corporate world.

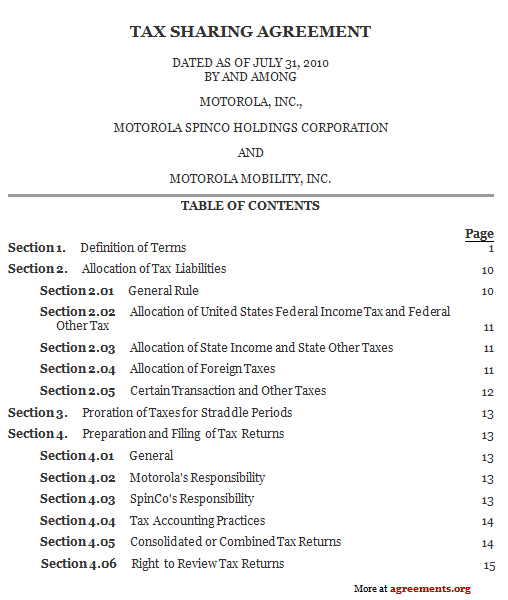

Sample Tax Sharing Agreement

A sample of the Tax Sharing Agreement can be downloaded from below.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.