What Is Tax Receivable Agreement?

When there is a binding contract between a company and its founders to include arrangement regarding tax sharing, then it comes under tax receivable agreement accounting. It also obligates the IPO Company to make cash payments per year to the pre owners of IPO. This agreement helps in around 85% of tax savings. On the other hand, double tax agreement are agreements between two or more countries. So is a tax receivable agreement debt based receivable? The answer is no because you’re making cash payments for a certain period for amount already incurred

When Do You Need Tax Receivable Agreement?

When corporations are required to be brought together in the market during Initial public offerings, then tax agreements are highly beneficial. In this case, a new public firm has to pay the value of tax of the corporation to pre-IPO equity owners. Due to the reforms in tax, investors are able to gain more certainty regarding rates of corporate income tax receivable agreement in the future. It has increased the interest of investors in buying payment rights by using agreements.

Inclusions in Tax Receivable Agreement

A standard tax receivable agreement template contains the following terms:

- The names of the company and its founders

- The details of the capital stock with the founder

- The amount of taxes paid by the founders on behalf of the company

- The date from which the company has to pay the tax to the founders

- Whether any interest component would be added to the agreement for payment

- The representations and warranties by the founders and the company

- The negative covenants implied by the company

- Events that constitute completion and full performance of the obligations

- Grounds for termination of the agreement

- Indemnification by the founders of the company for any misrepresentation or any injury to the company due to the actions of the founders

- Payment amount and payment schedule

- The inclusions and exclusions in the payment amount

- The process of funding for such payments, and the accounting process for the same

- Whether any expert record should be an addendum to the agreement

- Waivers of any future liability and any changes to the agreement

- Assignments and successors to the payments

- Transferability of the right to receive funds

How to Draft Tax Receivable Agreement?

When drafting a tax agreement, some points to keep in mind are

- The capital stock with the founders and the control they have on the company

- The amount of payment that should be paid to the founders

- The funding method that the company would adopt for paying the founders

- The requirement of an advisory firm in determining the liability

- The founders waive any future payments from the company with regard to statutory payments made on behalf of the company during its founding

- Whether the agreement also permits any changes to it after drafting and the process of making such changes

- Whether the interest can be assigned to others or not

Benefits of the Tax Receivable Agreement

- The public firm wants to have a legal document when it comes to making payments to the pre-owners of initial public offerings. (“TRA”), creates private tax benefits in public offerings by allowing pre-IPO owners to effectively keep valuable tax assets for themselves while selling the rest of the company to the public.

- It unlocks the tax value associated with portfolio companies.”

- This protects the rights of the current owners of the company and they aren’t also abused by the previous owners in any manner.

Key Terms/Clauses in Tax Receivable Agreement

Some important terms in this agreement are

- The amount of payment made on behalf of the company and the purpose it is made for

- The payment that will be made to the founders and the schedule that will be employed for that purpose

- The funding process that the company will employ for such payments

- The accounting disclosures and the treatment of such payments must be disclosed

- Waiver of any future liabilities on the company that the founders may impose on it

- The amount of interest that the company needs to pay the founders

- The assignment of interest receivable thereto from the agreement

- Grounds for termination and refusal for future payments

- Voluntary giving up of the receivables from the interest

What Happens in Case of Violation?

Violations of the agreement are dealt in the agreement. While arbitration might help, in some cases, the firms might have to take legal assistance. In that case, the founders may request specific performance or monetary compensation by way of compensatory damages.

[Also Read: Tax Assurance Agreement]

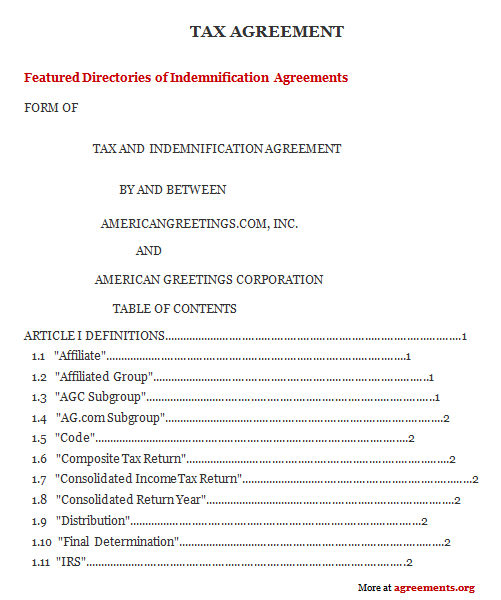

Sample Tax Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.