A Brief Introduction About the Syndicated Term Loan Agreement

A syndicate term loan is also known as a Syndicated Bank facility, which helps in providing funds to a single borrower with the help of a group of lenders. The borrower can be a large project or a government project. The loan will be a fixed amount of credit for the funds. The need for syndicate loans arises as there are several projects, which require funds that are too great or large for a single lender. That is why a group of special lenders combine their assets to provide these funds.

Who Takes the Syndicated Term Loan Agreement?

This agreement is used by a lead bank or underwriter, known as the arranger, the agent, or the lead lender. The primitives between a group of lenders who are known as a syndicate and the funds will be given to a borrower. The borrower can be anyone from a corporation to a government agency. As the finance in the syndicate loans is so big that it is separated amongst various financial institutions so that it can reduce the risk of borrower defaults.

Purpose of the Syndicated Term Loan Agreement

The main purpose of the agreement is to legally bind both the parties regarding the finance. It is needed when a project requires too large a loan for a single lender or when a project needs a specialized lender with expertise in a specific asset class. It helps in reducing the risk so that no party can back out from the terms and deals on which they agree.

Contents of the Syndicated Term Loan Agreement

Generally, this agreement consists of information like the name of the borrower and the landers. It will have all the terms and agreements regarding the loan so that both parties understand the severe repercussions of violating the agreement. The key term of this agreement is as below:

- Name and address of the parties

- The total amount of the borrower’s loan

- Negotiating the loan documents

- Duration of Modification

- Modification of the agreement

- Collateral

- Defaults and events of default

- Termination of the agreement

How to Draft the Syndicated Term Loan Agreement?

Steps to follow while drafting an agreement

- Understand the purpose of a loan agreement.

- Confirm that you want to lend to the borrower.

- Decide on an interest rate

- Negotiate with the other party about the terms.

- Add the dates and the signatures of the parties

- Include a clause about prepayment

- Include default provisions.

- The agreement must bind by nature

- Al the decided terms must be laid down in the agreement

You can check out the syndicated loan agreement pdf if you want to find out about its drafting.

[ Also Read: Term Loan Credit Agreement ]

Benefits & Drawbacks of the Syndicated Term Loan Agreement

You can check the syndicated loan agreement sample, which will help in providing some ideas about the terms and conditions.

- The borrower is not required to meet all the lenders in the syndicate to negotiate the terms of the loan. Rather, the borrower only needs to meet with the arranging bank to negotiate and agree on the terms of the loan.

What Happens in Case of Violation?

If there is a violation of the syndicated loan agreement, then the violating party has to face severe repercussions. If a valid contract is violated and there is no legal excuse, the non-breaching party (the party who did not violate the contract) may sue for damages. Legal action will be taken against the guilty party and they might have to face some severe troubles. So make sure that you discuss all the things related to this agreement with your lawyer.

Syndicated loans are used in the leveraged buyout community to fund large corporate takeovers with primarily debt funding. Every party should consider all the factors before they enter into a legal contract so that they can world various types of major issues.

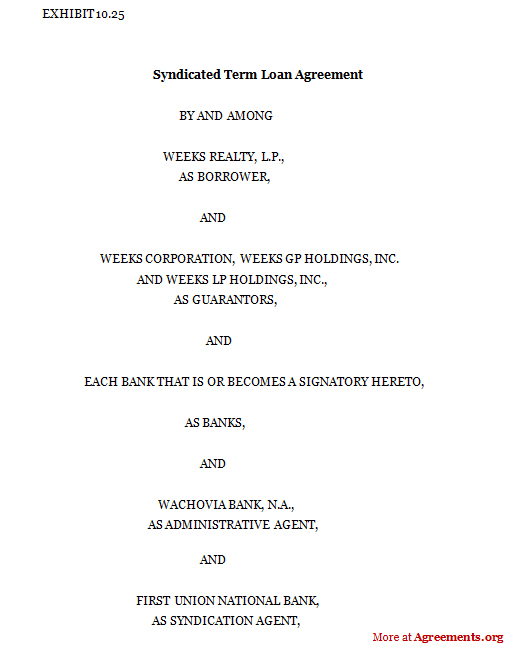

Sample Syndicated Term Loan Agreement