What Is a Surrender of Collateral Agreement?

The Surrender of Collateral Agreement, as the name suggests is a contractual document between the lender and the borrower, wherein the latter voluntarily surrenders the collateral asset against which he or she had secured a loan from the former.

It is typically entered into by the lender and the debtor when the former is unable to repay the debt owing to bankruptcy or can’t pay his debts for any reason, and is thereby resort to surrender of collateral, meaning he forfeits his right to recovery as a means of indemnification for the lender so that the lender may recover his dues and monies that are due from the borrower.

When Do You Need a Surrender of Collateral Agreement?

A collateral surrender agreement is signed when the borrower voluntarily agrees to give away the collateral asset in a securitized loan transaction due to his or her inability to close or repay the debt, thus making it a voluntary surrender agreement. The agreement thus acts as a legal remedy whereby the borrower is relieved from his debts, and the lender takes charge of the property or asset to recover the underlying dues.

This agreement is needed in case of the borrower’s bankruptcy or insolvency. It helps the lender recover his dues with the help of the collateral assets and also enables the borrower to resolve his legal dues in the loan transaction.

What Should Be Included in a Surrender of Collateral Agreement?

A Surrender of Collateral Agreement isn’t simple to draft. It usually involves complex references and needs to clearly indicate the terms and conditions upon which the surrender of collateral is to take place. Some things to include in that are

- Notice to the borrower about unpaid dues

- Any second added agreement for discount factoring or others entered into between the lender and the borrower

- Complete transfer of ownership of all interests to the security to the lender

- Any guarantors to the second agreement

- Acknowledgment that the borrower has failed to repay the loan

- Voluntary consent of the borrower to handover the rights to the collateral

While the contents of an agreement may vary, it should clearly state the name of the borrower and the lender and details such as the registered name and address of the parties along with their signatures. This should also indicate the effective date of surrender along with details of the collateral asset and the securitized loan agreement and amount to which it is tied.

How to Draft a Surrender of Collateral Agreement?

When drafting this agreement, some points need to be kept in mind

- The exact amount of the indebtedness that the borrower had towards the lender

- The value of the security

- Whether there are any liens or charges on the collateral

- Whether the second agreement considers the discount factoring or not

- Whether the guarantors have the solvency to repay the loan

- That the borrower should not have any insolvency claims against him at the time of surrender of collateral

- Debtors agrees to a reasonable sale of the collateral

- The remittance of the surplus less any expenses that would have to be given

While drafting a Surrender of Collateral Contract, the contract should state the debtor’s intent to voluntarily surrender the collateral asset in favour of the lender as a means of release from the pending dues.

The Surrender of Collateral contract should absolve the borrower from his dues and provide the lender all the rights on the collateral asset. It should be drafted in a clear and concise manner and should cover all the terms and conditions for an effective surrender and transfer of collateral.

In case of complex Surrender of Collateral transactions, it is also advisable to involve attorneys in the drafting of the agreement.

Benefits of a Surrender of Collateral Agreement – Pros and Cons

The agreement has the following benefits:

- It allows the lender to recover his dues

- It allows the debtor not to file a bankruptcy petition

- It allows the debtor to avoid legal problems or penalties

- It absolves the debtor of all future claims or repayment

- It also provides the debtor with surplus from the sale of asset

- It allows the lender sufficient money to recover the expenses incurred in the surrender of collateral

Key Terms/Clauses of a Surrender of Collateral Agreement

It should generally include the following clauses:

- Acknowledgement of Debtors and Guarantors

- Lender’s acceptance of collateral

- Effective Date of Surrender

- Details of Loan under which the collateral was extended

- Details and Description of Collateral Asset

- Release of Claims

- Miscellaneous Provisions

- Acknowledgement that the borrower has no claims against him that would lessen the lender’s rights over the collateral

This is a binding contract between the lender and the borrower that entails the cancellation of loan against the collateral. It clearly spells out the terms of surrender and provides legal protection to both the parties to the contract. It is advisable to avail the services of an attorney while drafting a Surrender of Collateral Agreement.

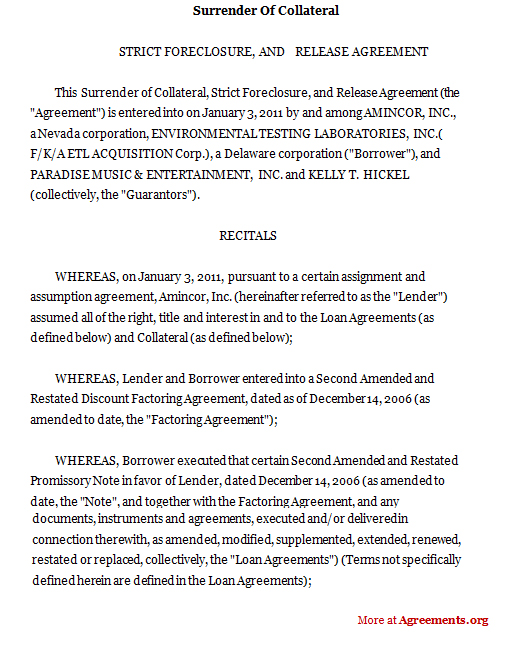

Sample for Surrender of Collateral Agreement

Download a sample Surrender of Collateral Agreement below.