A Brief Introduction About the Subscription Agreement

A subscription agreement is an agreement that is created between a company and a private investor. Through this agreement, the company decides to sell a particular number of shares to the investor at a specific price, and the investor, in turn, promises to subscribe to such shares at the price that has been predetermined. The definition of a subscription is to purchase shares of a company and subsequently become the shareholders of such a company. Entering into this agreement with an investor is a very convenient method for a company to raise revenues for its business. This agreement is also known as a ‘stock subscription agreement’ or a ‘stock sale agreement.’

Who Takes the Subscription Agreement? – People Involved

A subscription agreement is entered into between the company that wishes to raise capital for its business by selling its shares and the investor who wishes to purchase the shares and invest in the company.

Purpose of the Subscription Agreement – Why Do You Need It?

The purpose of a subscription agreement is to lay down in writing the terms under which the shares will be sold to the investor. The agreement will contain the important particulars of the deal, such as the number of shares that the investor will be subscribing to and the price at which such transaction will take place.

This agreement is needed whenever a company wants to raise capital from private investors. It helps a small company or a startup to raise capital for its business without going public. Such companies may not have the means to make the company public or to collaborate with a venture capitalist. Once the agreement has been created, the details of the transaction cannot be changed. This helps to solidify the intention of the parties, and a party cannot renege on the deal at the last moment.

Contents of the Subscription Agreement

The key terms of a subscription agreement are as follows:

- Subscription of the shares: Under this clause, the company agrees to allow a certain number of shares to the investor.

- Purchase price: The price at which the investor shall purchase the shares shall be clearly laid down.

- Terms of payment: The method by which the payment shall be made by the investor and the number of installments that he shall pay will be mentioned.

- Ownership and title to the shares: The company must transfer ownership of the shares to the investor once the sale has been completed.

- Post-sale obligations: There will be certain obligations needed to be completed, such as updating the books of the company and making the necessary filings.

How to Draft the Subscription Agreement?

While drafting a subscription agreement follows these steps:

The company and the investor must decide all the important terms that relate to the subscription of shares, such as the purchase price, when the transaction will be completed, etc.

- All such details that have been mutually decided by the parties must be laid down in the agreement itself. The terms of the deal cannot be changed later on if the parties change their minds.

- The agreement must be signed by both parties. This will ensure that the agreement is binding in nature.

Negotiation Strategy

- The negotiation strategy to follow is to ensure that the agreement is balanced equally between both parties.

- The investor must get an adequate return on his investment, and the company can raise revenues in an easy manner.

Benefits and Drawbacks of the Subscription Agreement

The following are the benefits and drawbacks of having a subscription contract:

- When there is a written agreement in place, the parties can lay down the details that they have agreed to, and once the agreement has been drafted, neither party can back out from the transaction. Thus it helps to make the deal a binding one.

- A benefit of this agreement is that the investor only has to make a one-time investment, and hence, it will not take up too much time or effort on the part of the investor.

- As the investor will be a limited partner in the company, his exposure to risk will also be limited. He will not be held liable for any act or misconduct on the part of the company.

- One disadvantage is that the investor will not have any voting rights, and hence, he cannot help take any company decisions. The investor will be a silent partner and has no influence over how the company will be run.

What Happens in Case of Violation?

In case the investor does not perform its obligations under this agreement, the company may have a number of options available. The company has the right to rescind the contract, and hence, the ownership of the shares shall not be transferred to the investor. If there is a breach on the part of the investor, the company may be able to recover damages or any other relief that may be deemed to be equitable.

In conclusion, a subscription agreement is a necessary agreement whenever an investor decides to invest in a particular company. This agreement is needed to cover the specifics of the entire deal. Early-stage companies use this agreement as a mode of raising capital. It is a relatively easier process than approaching venture capitalists.

You can download a subscription agreement template here.

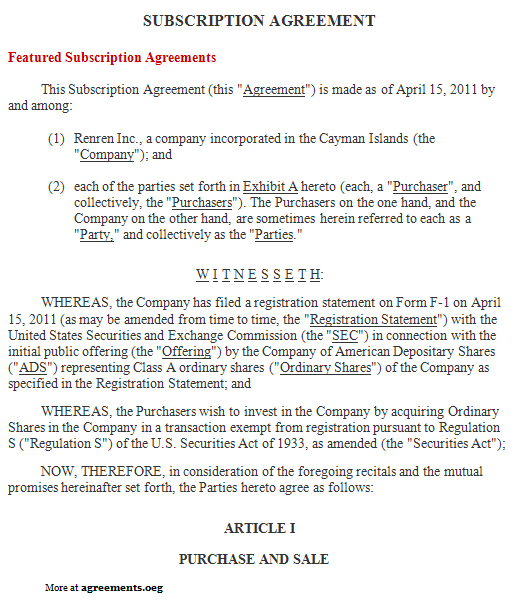

Sample Subscription Agreement