A Brief Introduction About the Subordination Agreement

A subordination agreement definition is a lawful document that founds solitary debt as a position behindhand additional in urgency for gathering payment from a borrower. The importance of debts could develop tremendously significant when a borrower evasions on expenditures or state insolvency. This contract admits that one party’s entitlement or attention is larger than that of the new party on occasion.

Who Takes the Subordination Agreement?: People Involved

According to the subordination clause, the present-day entitlement on all of the debts would take priority over any other claims formed in other agreements made in the future. In a subordination agreement, it has been agreed that its lien would be junior to a consequently verified lien. There are mostly two parties included in an agreement: the promisor, promisee and, even the 3rd party beneficiary may be named. Every person involved has a dissimilar responsibility to the agreement terms.

Purpose of the Subordination Agreement

The main purpose of the subordination is when the process of ranking home loans (mortgage, or home equity loan) by order of importance. The creditor of the first loan refinancing would, at present, need that this agreement will be retained by the next mortgage lender to move it in highest priority for obligation payment. The importance of the benefits of every creditor is altered by the contract from what they will then have developed. The agreement is important when the lender wishes to lend money to the borrower and, in return, wants assurance.

Contents of the Subordination Agreement

A debt subordination agreement will occur in 2 ways in which. Like the equity line, your original loaner could lend from a junior position. Refinancing your home comes with its fair proportion of work. If you’ve got a home equity loan or line of credit, one document could feel notably daunting: the subordination agreement. Subordination agreements a traditional part of the refinancing method. Subordinated agreements typically contain identical info.

How to Draft the Subordination Agreement?

In case the party is a money lending corporation or a separate firm money lender. You that party may have come across with few of the borrowers who may have lent loans from numerous organizations or moneylenders. In case you feel that a specific individual may be a nonpayer in the payment of the loan, you might use a subordination agreement examples. The person needs to draft all in detail.

Points to Draft While Preparing the Subordination Agreement

- Write an outline. Your outline must declaim the deal in some of the transitory verdicts.

- Describe the transaction. It is an important section that would define the sale deal in detail.

- Contain concluding circumstances. These circumstances tell what is required to be done so that the transaction is finished in a proper manner.

- Sign the document. Your sale contract requires to have a page that includes signatures and the right spelling of both the parties and along with the authorized heading.

Negotiation Strategy

Subordination agreements helpfully provide suppleness to creditors and consequently permit enhanced access to credit for debtors. The adaptability of the subordination agreement presents difficult legal problems, the most important of which relates to the characterization of their legal nature.

Benefits and Drawbacks of the Subordination Agreement

Pros:

If a moneylender decides to give the lien situation, this will be seen as it decides to be remunerated second or later from the proceeds of the asset’s sale. For example, in a mortgage, a home equity loan is subordinate to the first remortgage; this means that the first mortgage gets paid first. Though the contract could be a danger, it could also be profitable for the correct parties.

Cons :

The main danger of this agreement is the advance is that the purchaser would default on the expenditures. Uncertainty in case this happens, and at the same time it is not cured, the possessions might be foreclosed. After foreclosure, the lien with priority is paid first. Though few of the agreements let a secondary lien receptacle to prosecute the debtor for the lacking loan balance, numerous states don’t license it.

[Also Read: Subordinated Loan Agreement]

What Happens in Case of Violation?

Throughout insolvency reports, creditors are typically exposed to an involuntary break that stops them from foremost group doings though the borrower is getting their property in order. An executor subordination agreement is a contract under which the subordinating party, like the seller of land, agrees to implement the following tool subordinating anybody’s safety attention to a different safety interest, such as the lien of a structured mortgage.

The rule nearby subordination agreements is complex, and there are numerous details that a knowledgeable lawyer would be capable to examine. An n profitable subordination real estate is also vital in regards to the real estate money and tenancy agreements. Subordinate contract efficiently creates the present entitlement in the arrangement oldest to slightly different other contracts that go along with the exclusive contract.

You can Download the Subordination Agreement, customize it according to your needs and Print. Subordination Agreement Template is either in MS Word, Excel, or in PDF.

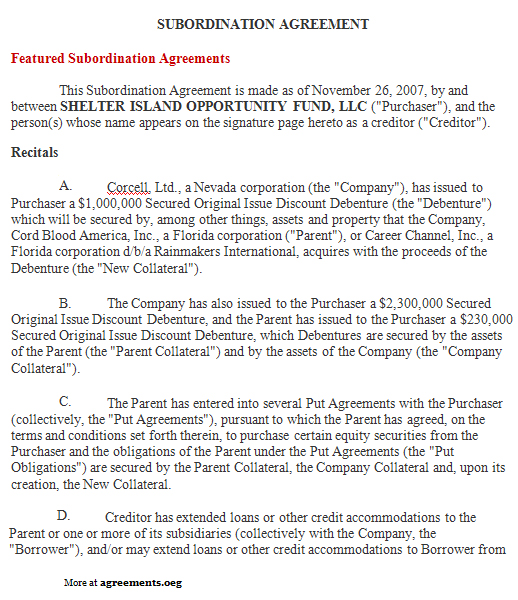

Sample Subordination Agreement