As the name suggests, the subordinated loan agreement is a legal document that ranks debts in priority for collecting repayment from a debtor. Priority becomes crucial in case of bankruptcy or default on payments. These agreements are usually most demanded in the arena of mortgage on real estate properties.

Once entered into this agreement, a secondary lender can only collect the money (in case of liquefaction), if and when the primary lender’s debts are payed off.

This loan agreement is generally used by individuals or businesses in order to increase their net capital at a moment of time, without risking several assets in the process.

When Do You Need Subordinated Loan Agreement?

Lenders need this agreement if the borrower needs more money than loaned by them. A subordinated loan agreement helps them in securing a priority position in case of debt repayment. Borrowers need the same agreement in case their primary lenders are asking for a guarantee that their loan repayment will take precedence over any secondary lender.

The purpose of a subordinated loan agreement is to safeguard the rights of a primary lender in case a business faces foreclosure.

This agreement is also used by secondary lenders to invite primary lenders with a promise that they will be repaid first, thus giving them an extra layer of protection against financial risks.

Inclusions in Subordinated Loan Agreement

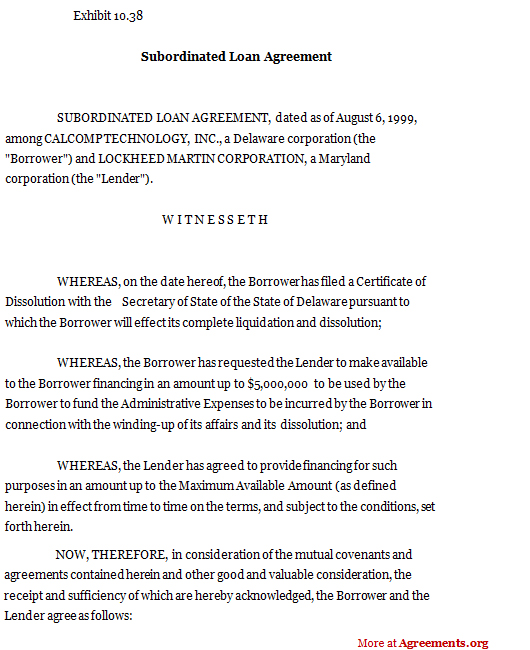

To create the subordinated loan agreement, at least three parties need to be acknowledged: primary lender, secondary lender and the borrower. A collateral against which these loans are being allotted need to be mentioned in the document as well.

A date from when this agreement is effective needs to be mentioned. Place of agreement, monetary value of funds allocated and full legal disclosure regarding this loan from the secondary lender is needed.

How to Draft a Subordinated Loan Agreement?

Confused about how to go ahead with drafting of a subordinated loan agreement? We will tell you when and how you need to get the draft made, read below:

- Primary and secondary lenders need to declare the exact funds they are lending to the borrower.

- Borrower needs to declare a real estate asset in order to get the funds from either of the lenders. A detailed letter with borrower and guarantee’s signatures is required with all information for both lenders to look over.

- A legal document declaring funds, priority ranks, specific rules in case of bankruptcy and liquefaction is clearly stated.

- All parties agree to the rules and accept the terms.

- An overseer for the document (state or federal law) is needed to ensure legal enforcement of the agreement.

Benefits of Subordinated Loan Agreement

An agreement that puts one party in prior position then other tends to have pros and cons. Read below:

- Subordinated loan agreement saves a lender from risk in case the borrower decides to take out a second loan on the same asset.

- The agreement allows a borrower to get a second loan on one asset if the primary loan did not cover their total funding requirements.

- It allows the borrower to have a system in place in case for some reason they have to declare bankruptcy.

- For Subordinated lender, the pro is interest rates. The interest rate on the second loan is always much higher than the primary loan. In case of a repayment, the lender will recover a lot more money.

- Allows the primary lender to have complete knowledge regarding the secondary loan which in term helps them to assess financial risks involved.

Keys Terms in Subordinated Loan Agreement

Like any other legal document, there is a standard list of key terms of subordinated loan agreement. Following are the most important terms that need to be included:

- Primary lender – the party that will be repaid first

- Secondary lender– the party that will be repaid after the primary lender

- Borrower– the borrower of funds

- Funds allocated – value of funds allocated by both lenders

- Subordination of payment– a declaration of subordination between two parties

- Payments held in trust– if the secondary lender gets any repayment before primary lender, the former holds that amount in trust towards the latter.

- Restrictions on actions against the borrower

- Bankruptcy & Receivership– rules in place for a scenario where the borrower declares bankruptcy and the assets held in mortgage is liquified.

[Also Read: Loan Agreement]

Download Subordinate Loan Agreement

Involved parties can get a template of the agreement and use it to create various drafts of the agreement on their own instead of going back and forth to law firms.

Subordinated loan agreement template can be downloaded here.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.