A Brief Introduction About the Stock Purchase Agreement?

A stock purchase agreement is created when there are purchase and sale of the shares of a particular company between two parties. The agreement lays down in writing the terms that concern the purchase of the shares. All important details, such as the number of shares being purchased, the purchase price of the same, and other particulars, will be included in the agreement to make the various elements of the sale crystal clear. This agreement is also known as a “share purchase agreement” or a “stock transfer agreement.” Through this agreement, the rights that are attached to the shares are transferred from the seller to the buyer.

A stock purchase is different from an asset purchase in that under a stock purchase, only the shares of the company are sold, whereas, in an asset purchase, the assets of the company are sold.

Who Takes the Stock Purchase Agreement? People Involved

This agreement is entered into between a person who wishes to sell shares of a company (known as the seller) and a person who wishes to purchase such shares (known as the buyer). The seller may be the company itself or a shareholder of the company.

Purpose of the Stock Purchase Agreement: Why Do You Need It?

The purpose of a stock purchase agreement is to make the entire transaction official and legally binding. It is recommended to enter into this agreement whenever a person wants to sell his shares to another person or when a person invests in the shares of a particular company. The agreement is important as the seller provides proof of the fact that he is the owner of the shares that he wishes to sell. It also helps the buyer to have evidence of the purchase and the fact that the ownership of the shares was transferred to him as per the agreement.

Contents of the Stock Purchase Agreement

The following are the key terms of a stock purchase agreement:

- Purchase and sale of the shares: Through this clause, the seller agrees to sell his shares, and the buyer agrees to purchase the shares. The number of shares being sold and the purchase price must be stated.

- Conditions precedent and conditions subsequent: This will include a list of conditions that need to be performed before the closing of the transaction and after the deal is completed. Among other things, it will include regulatory approvals that are required to complete the sale.

- Termination of the agreement: The circumstances under which either party will have the right to terminate the agreement must be listed out in the agreement.

- Dispute resolution and arbitration: This clause mentions the manner in which any dispute regarding the clauses of the agreement shall be dealt with.

[Also Read: Arbitration Agreement]

How to Draft the Stock Purchase Agreement?

The following are the steps to follow while drafting a stock purchase agreement:

- The first step is that the parties should create a letter of intent that explains the terms of the transaction and brings forth the intent of the parties.

- After this, the agreement will be drafted, and care must be taken that the clauses of the agreement are in line with the terms mentioned in the letter of intent.

- The seller and the buyer must sign the agreement.

- Once the buyer has made the payment as mentioned in the agreement, the seller should hand over the share certificates to the buyer.

Negotiation Strategy

- While negotiating the agreement, care must be taken to make sure that both parties have equal rights under the agreement.

- The contract must be negotiated such that both parties get a fair deal.

Benefits and Drawbacks of the Stock Purchase Agreement

The following are the benefits and drawbacks of having an agreement:

- A huge benefit of this agreement is that it puts all the conditions of the sale and purchase into writing and thus ensures that the entire transaction is transparent and binding.

- If there is a signed agreement in place, the purchase will be a legally binding one that will hold in a court of law.

- Without this agreement, it will be possible for a shareholder to sell his shares to a complete outsider. This agreement can be used to create a “right of first refusal,” which will enable existing shareholders to buy the shares before they are offered to an outsider.

What Happens in Case of Violation?

Every stock purchase agreement will provide a method for resolving any dispute that may arise with regard to the terms of the agreement. Many parties prefer to incorporate a mandatory arbitration clause into their agreement. This clause requires the parties to resolve any conflict that may arise in the future through the means of arbitration. This is an effective solution as the parties can choose the arbitrators and their manner of appointment. The arbitrators will make every attempt possible to reach a solution that is acceptable to both parties.

In conclusion, a stock purchase agreement is needed whenever there are purchase and sale of shares of a company. The agreement will provide a complete outline of the entire transaction and serve as proof that the sale has taken place. There are regulatory and legal issues that must be complied with whenever shares are to be transferred to another person, and having this agreement in place helps to ensure that all such conditions have been met.

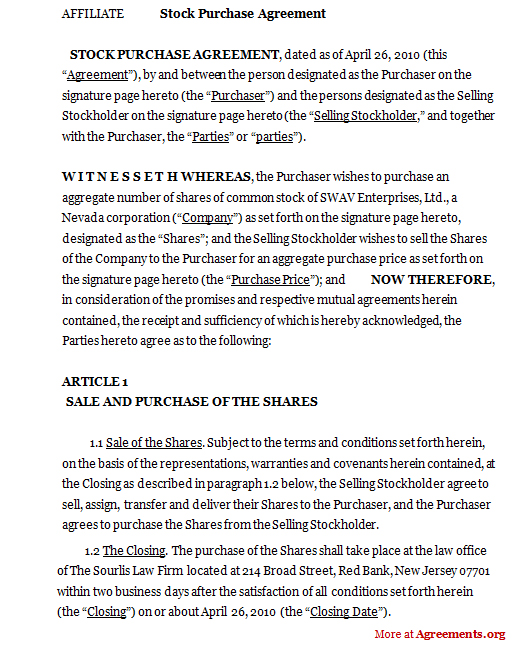

Sample for Stock Purchase Agreement

You can download a stock purchase agreement template here.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.