Insurance policies can be a really expensive deal for some people who can’t afford to bear the entire cost. A Split Dollar Agreement works as a huge relief for such people. This agreement is a life insurance agreement that allows the division of insurance cost and benefit between two people or more. Through this policy, both the parties stand insured without bearing the full cost.

Both the parties involved need to specify how much amount they can contribute and how much returns they are going to receive to avoid any future conflict and confusion

Split Dollar Agreement also helps the insurance companies as they are able to sell large policies to people who otherwise wouldn’t have afforded them.

When Is Split Dollar Agreement Needed?

When two or more people can’t afford the premium cost of a permanent life insurance policy, they get into a Split Dollar Agreement to divide the cost and benefit. This agreement allows everyone to be able to participate in an insurance policy irrespective of their financial status.

This agreement can be between two individuals but mostly, it is between the employees or between the employer and the employees. Former can also be referred to as private split-dollar policy.

Purpose of the Split Dollar Agreement:

- To enable the insurance companies for selling more policies

- To make permanent policies affordable for more people

- To make it possible for the employer to provide good benefits to its employees

- To make retention of high-value employees possible

- To give employer’s an option to use performance metrics in exchange insurance

Inclusions in Split Dollar Agreement

In the case of private split-dollar, both the parties need to mention, very carefully, about their contribution and their return. Such clarity helps both the parties in the long run and avoids conflicts. In the case of employee-employer, the agreement will include how the cost of the life insurance premium will be shared between them, and who is eligible to cash in on the benefits of the policy.

In addition, in both the cases, the agreement will include other basic terms and total benefits of the policy. The Split Dollar Agreement should also comply with applicable legal and tax regulations. Taxation is a very crucial aspect of these agreements and it is suggested that one should get a full understanding of it from an expert before getting into an agreement.

How to Draft Split Dollar Agreement?

As mentioned above, the Split Dollar Agreement is a simple yet very important piece of document, so before drafting it or signing it, certain things must be taken care of.

- Get clarity if the employer is going to pay for the plan because in some case, employer does pay for their employees

- Know about taxation policy and learn if the employer is going to take charge of that

- Know about the time period of policy and details of the circumstances in which it can be used

- Be informed about the conditions the employee must meet to remain eligible for the plan, such as performance metrics

- Know how and when the plan can be terminated

[Also Read: Insurance Agreement]

Benefits of Split Dollar Agreement

This agreement is beneficiary for all parties involved. Even the insurance companies are benefited by it so much that their policies are reaching to more people. In the case of employee-employer Split Dollar, both of them gain some advantage.

Here are a few –

- Shared cost of insurance

- More people are enabled to use insurance policies

- Reduces certain life risks such as health

- Minimum tax cost

- Assists in buy-sell agreements

- Allows more flexibility

- Possible access to cash values

- For employers, it attracts and retains high-value employees

Key Clauses in Split Dollar Agreement

Apart from all crucial inclusions and terms, there are some important clauses in the agreement that all parties should pay attention to.

- Termination

- Failure to purchase

- Liability of insurance company

- Governing law

- Amendments

The agreement must also include terms that give answers for “What happens after the employee leaves the job”? In most cases, the employer wouldn’t want to continue split-dollar in such a case. However, the employee can maintain the plan at their cost, depending on the insurance provider and terms of the policy.

Other important terms are “limits & beneficiaries”. As we know the beneficiaries are significant for all the insurance policies.

What Happens When You Violate the Split Dollar Agreement?

Tax law violations are the most common violation in the Split Dollar Agreement. In case of any late payment, the insurance company can also levy a fine on the customers. These details will be included in the agreement too. Both the parties are well within their rights to approach the court in case of any breach.

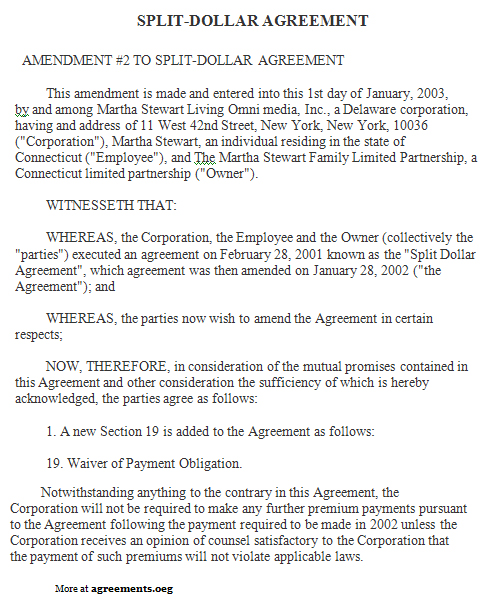

Sample Split Dollar Agreement

Irrespective of the type of Split Dollar Agreement you plan on getting into or your employer put you into, it is suggested that you consult an expert for drafting this agreement. Here is a sample created by an expert attorney. You can download it, customize it and print it.