A security agreement is a contract that creates a security interest in a property or asset, which is kept as collateral with the lender for the purpose of availing loan by the borrower. A security agreement refers to the main loan agreement and includes the description of security, the conditions, and terms which govern such security, etc. Typically, this agreement is made part of the original loan agreement and can be appended to the same. A security agreement sample may be a bipartite or tripartite contract. Typically, holding companies and not the actual company availing loans can become a guarantor and furnish security to enable the subsidiary to avail the loan. Hence, the borrowing company, the guarantor, and the creditor, all three can become parties to this agreement.

Purpose of a Security Agreement

A security agreement serves the purpose of having well-defined security, acting as a guarantee or collateral to the loan advanced. This helps in assuring the creditor that his money would be returned, one way or the other, and at the same time, it also helps in the borrower availing loan in lieu of the security.

Inclusions in a Security Agreement

A security agreement typically includes the names of the parties, effective date, description of security, the value of the security, the money advanced, the redemption procedure, the ways in which the security can be used, etc. Apart from the commercial and operational terms, it also includes standard boilerplate clauses such as a waiver, notices, severability, remedies, choice of law, and dispute resolution.

Key Terms in a Security Agreement

A sample agreement would typically contain the following key clauses:

- Recitals: If a separate security agreement is entered into, then recitals reflecting the existence of and referring to the original loan agreements must be included in the contract.

- Definition and description of security: The security being furnished should be defined and aptly described. For example, if a house is furnished as security, then its name (if any), address, square area, etc. should be mentioned.

- Rights and obligations of the creditor and the borrower: What rights both the parties have over the security should be clearly laid down. Similarly, any obligations pertaining to the property should also be captured in the contract.

- Utilization: Sometimes, security agreements also provide for the investment of security furnished and who would be entitled to the benefits accruing out of such investments.

- Redemption of security: The process of how security can be redeemed by the borrower should be included.

Drafting a Security Agreement

Following guidelines should be followed in order to draft an effective security agreement template:

- Know the number of parties there are and define and describe them accordingly.

- Coordinate the commencement date of the agreement with that of the original loan agreement.

- This agreement, if being executed as a separate document, should contain references to the original loan agreement.

- Remedies such as interim injunction should be listed down under the remedies clause. This will prevent the borrower from disposing of the security in order to evade payment.

- A statement to the effect that beneficial ownership lies with the creditor till redemption should also be included.

- The redemption process should be clearly outlined in the contract.

- A termination date/option to the security agreement should be provided.

Types of a Security Agreement

A security agreement can contain the following types of collateral:

- Tangible goods: Houses, vehicles, inventory, fixtures, etc.

- Intangible: Shares, stock, investment bonds, etc.

Pros of a Security Agreement

Following are the pros of a security agreement:

- Well-documented terms and conditions prevent the rise of disputes.

- Assurance is provided to the creditors that they will be able to get their money back.

- Having security to furnish makes it easier for the borrower to get loans.

- Remedies preventing the disposal of the security by the borrower or its illegal possession by the creditor helps in the preservation of the same for the purposes of repayment of the loan.

- Having legal standing, this agreement helps in manifesting the true intention of the parties.

A security agreement enables a creditor and a borrower to safely and securely enter into a loan agreement. By making the creditor a secured creditor it protects its interests. Despite, the terms and conditions being well-documented, a security agreement’s breach has many serious implications, including the creditor losing his options of getting repaid. Arbitration and litigation both should be set out as methods of dispute resolution in the contract.

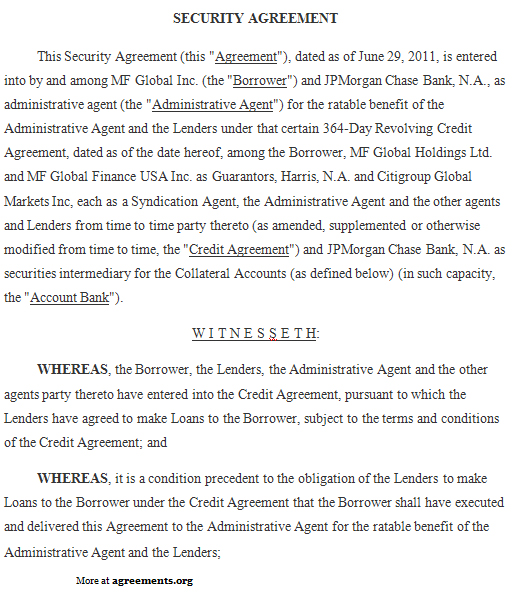

Sample Security Agreement