The requirement of a second loan modification arises in case the borrower is unable to repay the loan amount within the terms and conditions of the existing loan and wants to extend the duration of the loan tenure to repay the same.

What Is the Second Loan Modification Agreement?

A second Loan Modification Agreement includes changes made in the original loan document by a lender. This modification may include interest rate reduction, an extension of the duration of time for repayment of the loan, converting it to a different loan or combination of the mentioned three modifications.

Who Takes the Second Loan Modification Agreement?

A Second Loan Modification Agreement is taken by a borrower who is suffering from some kind of financial burden or crisis and is unable to repay the loan taken by him under the actual terms and conditions.

What Is the Purpose of the Second Loan Modification Agreement?

The main purpose of this agreement is to provide an extension of the duration for repayment of the loan by the borrower who is facing any sort of financial crisis. The aforesaid agreement can be termed as a long term solution for a financially weak borrower.

Contents of a Second Loan Modification Agreement

The following are some of the contents of a Second Loan Modification Agreement;

- Name and Address of the Parties i.e., Lender and Borrower

- Durations of Modification

- Modifications of the Terms

- Conditions of Modifications

- Representations and Warranties

- Covenants of Borrower

- Counterparts

- Incorporation of Recitals

- Authorizations

- Name of the Witnesses

How to Draft a Second Loan Modification Agreement?

The following is the process to draft a Second Loan Modification Agreement;

- Mention the details of the parties such as Name and Address of the Parties i.e., Lender and Borrower

- Mention the details of Durations of Modification

- Mention the details of Modifications of the Terms

- Mention the details of Conditions of Modifications

- Mention the details of Representations and Warranties

- Mention the details of Authorizations

- Mention the details of Name of the Witnesses

There are two ways to seek professional assistance while negotiating a second loan modification agreement. The professionals

- Companies who are dealing in settlement for the profits of the firm that work for the borrowers for the reduction of debt with the setting with the relevant creditors

- Modification of mortgage legal experts who has specialization in negotiation for the mortgage owners who are at the default and near to foreclosure.

- The federal government also helps while negotiating some of the borrowers.

However, it is to be noted that the most successful loan modification process can only be negotiated by a successful and experiences legal attorney.

Second Loan Modification Programs

Mortgage loan modifications are considered as one of the common things as a large amount of money is involved in this. Considering the foreclosure crisis that happened back in the year 2007 and 2010, various governments are establishing second loan modifications programs for the borrowers, which provide them assistance and sponsorship.

Benefits of a Second Loan Modification Agreement

One of the most important advantages is that it provides a short term permanent relief to the borrower as it can reduce the rate of interest. On the other hand, it creates a burden for the borrower when we consider it for a longer-term as it can affect the credit score of the borrower.

What Happens in Case of Violations?

The violations of a Second Loan Modification Agreement depend on the terms and conditions of the agreement. If in case the borrower fails to comply with the terms and conditions of the agreement, he can be sued by the lender for breach of contract.

A second loan modification agreement can be regarded as a short term relief for the borrower as it aids to tackle the financial problem temporarily. However, it is up to the lender whether he wants to modify the loan during the process of settlement. A loan modification agreement is granted to successful applicants who are represented by legal experts and also have some access to government programs.

[Also Read: Modification and Consolidation Agreement]

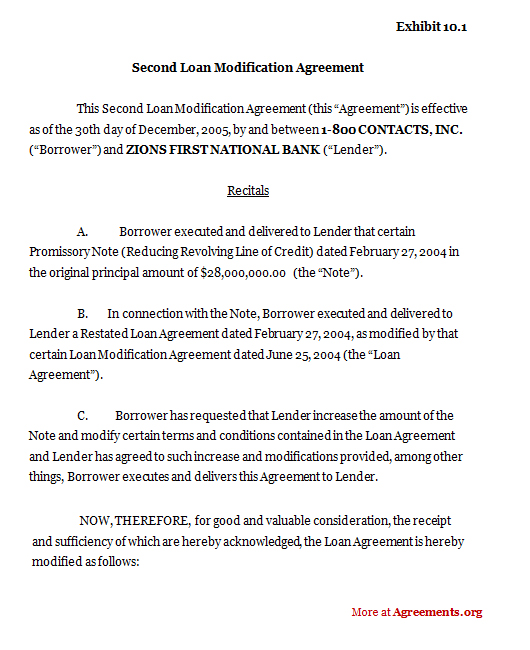

Sample for Second Loan Modification Agreement

A sample of the agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.