Brief Introduction About a Retirement Agreement

It is a formal legal document between the employer and an employee who will be retiring soon. It lists the rights and obligations of both parties. Also known as an employee retirement plan, it states the fact of the employee’s retirement from work and also explains the retirement package that he will be getting. All provisions of the agreement must comply with the Employee Retirement Income Security Act (ERISA) and other relevant state and federal laws.

Purpose of a Retirement Agreement

Since it is a legal document, it guarantees the rights of both the employer and the retiring employee. As it is a written contract, both parties are aware of their obligations. It lists down general information about the employee, his retirement work, and the benefits he will get post-retirement. This ensures that he is aware of the benefits that he is entitled to.

As for the employer, it is protected against further claims from the employee. It can also put him under an obligation not to disclose confidential information and not solicit employees and clients of the employer. This ensures that both parties are protected against potential risks. Therefore, an employer needs to have this agreement in place when one of its employees is nearing retirement.

Key Terms of a retirement agreement

A retirement agreement template typically includes the following terms:

- Names of the employer and the employee

- Date of the agreement

- Retirement of the employee- the position he retires from and the effective date

- Retirement benefits the employee will receive

- Obligations of the employee

- Negative covenants- non-disclosure, non-solicitation and non-competition

- Release of claims

- Notice requirement

- Governing law

- Dispute settlement

- Definition of terms

- Signature of the parties

All the provisions in the agreement have to comply with the applicable state and federal laws.

Drafting a Retirement Agreement

Consider the following points when drafting the agreement:

- State the names of parties clearly. They must be identified by their legal names. The employer’s name should include its registered business address.

- State in clear terms the position from which the employee is retiring and the date of retirement. This term should include that the employee will be relieved of his duties from all the positions that he held at the time of his retirement. This term should be as clear as possible so that there is no misunderstanding if the employee still holds any position or not.

- One of the most important clauses of the agreement is the retirement benefits clause. It must state all the amounts due to the employee as part of his retirement plan. The term should mention how and when these amounts will be paid. The benefits can be a lump-sum payment or long-term incentives. All of this must be clearly mentioned in the clause.

- The agreement must mention all the obligations that the employee has to undertake. These include observing confidentiality about the company’s work, returning all the property of the employer such as laptops, cell phones, other devices, not soliciting the employer’s clients or employees, and not setting up a rival business for a certain time.

- State the method of dispute settlement. This allows the parties to address any issues between them. Also, mention the place of the jurisdiction where a claim can be filed.

Benefits and Drawbacks of a Retirement Agreement

Benefits:

- The employer can receive certain tax benefits under the law if it offers retirement benefits under this agreement.

- A good agreement allows the employer to compensate for the remuneration package if it does not have enough cash in the initial stages.

A drawback of this agreement is the amount of time and money that goes into formulating a suitable retirement plan.

Types of Retirement Agreement

- Phased retirement programs: This is an agreement between the employer and the employee, whereby they agree to slowly retire the employee from his services rather than stop them all at once. The employee’s workload is slowly reduced. After the retirement date, he works part-time at the organization and then gradually retires. This helps both parties- the employee does not have to stop working suddenly, and the employer gets time to find a suitable replacement. They can choose between different phased retirement options. But it must comply with all applicable laws.

- Early optional retirement plan: It is offered to employees to retire them earlier than their time. This is usually done when the employer is undergoing a major reorganization. The employees are offered certain benefits for retiring their services before time.

- Voluntary early retirement incentive plan: If the employee fulfills the given criteria, he can opt for early retirement. Employees that opt for such schemes have completed a certain number of years in the job and have reached a particular age. It also helps the employer to get the organization to the right size without having to lay-off employees.

What Happens When You Violation?

In case the Retirement agreement is violated, the suffering party can opt for remedies given in the agreement. It will state the reliefs available to the parties if there is a breach of any condition. Usually, most agreements will mention a particular mode of dispute settlement. This mode is to be followed in case the parties have any issues under the agreement. But if the party wants to file a claim, it can do so under the agreement. A good agreement will always mention the governing law and place where a claim can be filed. This avoids unnecessary problems with respect to jurisdiction.

Firms that are based on partnership must have this agreement A partner’s retirement from the partnership causes adjustments in the firm’s capital-sharing model and will change the partnership arrangement. This agreement makes sure that the retiring partner gets his fair share according to the partnership agreement.

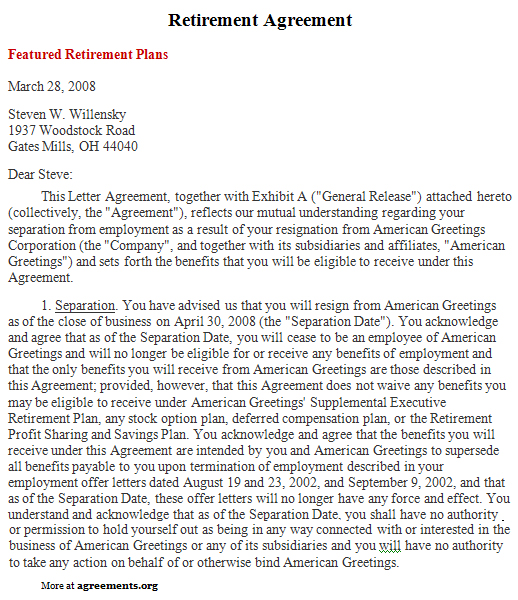

Sample Retirement Agreement

A Sample retirement agreement can be downloaded from below.