A Restructuring Plan Support Agreement, also commonly referred to as a lock-up agreement, is used by a company and its key constituents to contractually bind each other to the material terms of a restructuring proposal. It is intended as a general drafting aid and will require modification according to the particular circumstances and the intentions of the parties.

Generally, plan support agreements frame the material terms of the proposed restructuring, and by executing a plan support agreement, a creditor agrees to vote for and support the terms of a restructuring plan that will be circulated to all creditors in the future. Creditors are often induced to sign on to a PSA in return for an enhanced recovery under the proposed plan of reorganization.

Purpose of a Restructuring Plan Support Agreement?

Plan Support agreements may help reduce the cost, length, and negative publicity associated with a bankruptcy filing by assuring the market, including prospective lenders or investors, that the debtor will exit bankruptcy without causing too much disruption to employees, customers or partners of the debtor. At the same time, if a debtor enters into a plan support agreement with less than all of its significant stakeholders, it could be a recipe for litigation.

Inclusions in a Restructuring Plan Support Agreement?

A plan support agreement apart from commercial terms should include the following information: Names of parties, the effective date of implementation, dispute resolution, waiver, remedies, notices, entire agreement, and severability clauses.

Key Terms of a Restructuring Plan Support Agreement?

Following are the key terms of a plan support agreement;

- Claim Holder Representations: All Plan support agreements include representations and warranties from each signing creditor that it owns and has the right to vote a specified amount and type of claims. These representations are fundamental because a contract will have no purpose unless the creditors supporting the debtor’s plan have the right to the vote for that plan.

- Fiduciary Out: The obligations under a plan support agreement could in theory limit or restrict the debtor’s ability to maximize the value of the debtor’s estate for all creditors, in violation of its fiduciary duties under applicable law.

- Claim Transfer Restrictions: A plan support agreement should include transfer restrictions that prohibit the transfer or sale of a supporting creditor’s claims.

- Creditor Termination Provisions: Creditors have the right to terminate the plan support agreements upon the occurrence of certain events.

Drafting of a Restructuring Plan Support Agreement?

Following guidelines need to be followed for drafting a restructuring plan support agreement:

- Default events entitling creditors to terminate a plan support agreement should be included. Such events typically include bankruptcy proceedings, material breach of the contract, non-compliance with applicable law, etc.

- The effective date needs to be mentioned in the agreement.

- The interpretation of technical terms needs to be included in the agreement.

- An agreement to vote clause among consenting shareholders need to be included.

- Prohibition on transfers during the course of the agreement.

- Forbearance to sue may be included depending upon the negotiations.

Benefits of a Restructuring Plan Support Agreement?

Following are the benefits of a plan support agreement:

- It ensures that

- the creditors will not delay confirmation of a plan,

- are required to support and vote in favor of a plan that is consistent with the terms of the PSA, and

- may not assign claims that are subject to the plan support agreement.

- A fiduciary out ensures that a debtor is able to terminate the contract and propose a different plan if the debtor determines that the agreement is no longer in the best interests of its estate.

- Approval of post-petition financing, approval of a disclosure statement or confirmation of a plan

- favorable payment terms, interest rates or payment schedules

- debt-to-equity conversions, and

- liability releases, as well as more certainty regarding a restructuring timeline and outcome.

Cons of a Restructuring Plan Support Agreement?

Plan support agreements, however, enhance the powers of senior creditors. Senior creditors have learned to exploit restructuring support agreements to gain an additional level of control over the debtor. To this effect, the debtor promises not to bring any avoidance actions against parties to the agreement and to oppose the appointment of a trustee or an examiner with expanded powers. The enhanced ability to form coalitions may offset to some extent the ability of individual creditor groups to extract value.

Further, there exist a lot of issues which need to be addressed such as banks’ inability to address asset quality issues owing to lack of infrastructure, misuse of Corporate Debt Recovery (CDR) provisions by companies by offering preference shares with limited voting rights to banks in the debt-equity swap mechanism, lack of clarity as to the opinion of the smaller banks in the consortium of banks approving a CDR package, among other issues.

Plan Support Agreements have become a mainstay restructuring process, and it is therefore vital for distressed investors and other creditors to have a clear understanding of the legal terms of a contemplated Plan support agreement. Distressed investors and other creditors will be well advised to become more familiar with how certain provisions in a Plan support agreement can be addressed, and how such provisions have been addressed by debtors and creditors in other bankruptcy proceedings.

[ Also Read: Restructuring Agreement]

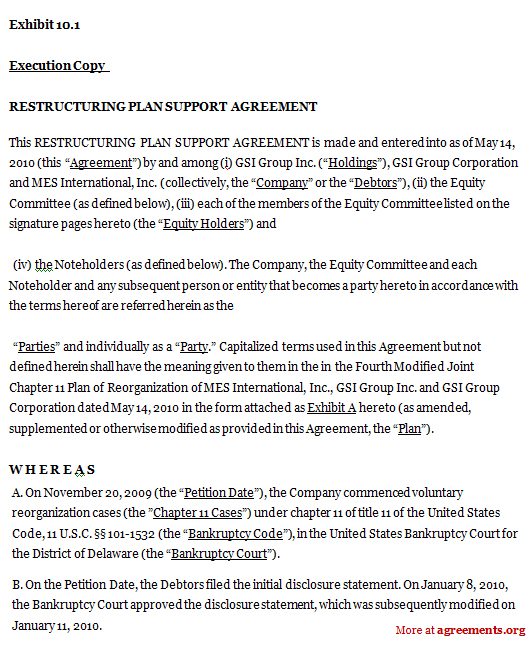

Sample for Restructuring Plan Support Agreement

A sample of the agreement can be downloaded from below.