A redemption agreement is a legal contract between a company that wants to buy back its shares and the shareholders who intend to sell the shares. Since there are two parties to the agreement, it is known as a bipartite agreement. It is usually related to the redemption of stocks and the shares so bought are entered into the treasury stock account. This is considered a better way to return cash to shareholders compared to a dividend.

Another reason for share buybacks is there is a reduction of shares held by the public. The shareholders who don’t sell the shares gain as with the same profits and lesser stocks, the earnings per share increases. The redemption agreement facilitates the buyback of shares and the shareholders are paid at the price offered by the company.

When Do You Need a Redemption Agreement

A redemption agreement is drafted when a company wants to repurchase its outstanding shares from the shareholders. The purpose of the redemption agreement is to enable the shareholders to sell their shares at a mutually agreed price. The company gets into a buyback agreement when the shares are undervalued and this is beneficial for the remaining shareholders. The earnings per share for the remaining shareholders go up. For the company, repurchase of its own shares is a more profitable option compared to paying out dividends. In case of such agreements, it is important that the shareholder is willing to sell the share in the first place.

Inclusions in Redemption Agreement

As the redemption agreement is a bipartite agreement, the name of the company and the shareholder who has agreed to sell the shares has to be included. The agreement should also contain the effective date of the agreement, the price at which the share is being bought back, the number of shares being bought back, the reason behind the buyback, the applicable taxes to be paid by the shareholder, the rights and liabilities of the company and the shareholders, the documents to be submitted by the shareholder, and the payment method by which the shareholder will be paid. The indemnity clause will specify that the company cannot be held liable if there is any misrepresentation on behalf of the shareholder.

How to Draft a Redemption Agreement

While drafting a redemption agreement, the following points need to be kept in mind:

- It is extremely important that the names of the parties to the agreement and their relationship needs to be included

- The events which lead to the revocation of the agreement should be mentioned

- The price at which the share is bought back must be clearly stated

- The last date within which the redemption must be made by the shareholder has to be included

- Compliance with the laws of the state under whose jurisdiction the agreement is being drafted

- The rights and liabilities of the shareholder and the company must be mentioned

- The closing costs and expenses of the transactions

- The details of the documents which need to be executed by the company and the shareholder

Benefits of Redemption Agreement

The benefits of having a redemption agreement are as under:

- The shareholder will get a fair price for the share and is assured of the price mentioned in the agreement. Payment will also be made on time

- The company will benefit from this agreement as it is more profitable to buy back shares as compared to using the profits to pay out dividends to the shareholders. These agreements for buying back shares are normally drafted when the company feels that the shares are undervalued. This is beneficial for the remaining shareholders as there is a rise in earnings per share

- The interests of both the shareholders and the company are protected by this agreement. The company has to pay the agreed price and the shareholder has to deliver the required shares. As both the company and the shareholders have agreed to the price, hence there is no dispute.

Key Terms in Redemption Agreement

The key terms in a redemption agreement are:

- Aggregate purchase price: This refers to the price at which the shares are bought back by the company. This is a mutually agreed price between the company and the shareholder

- Closing date: This means the date before which the shares for buyback need to be delivered

- Damages: This means any losses, cost or expenses borne by any of the parties due to breach of contract by the other party

- Indemnifying party: This refers to the person from whom indemnification is sought.

- Purchase and sale agreement: Purchase and sale agreement refer to the buyback agreement

- Representation and warranties: This cover the authority and enforceability, existence and good standing and partnership interest

Types of Redemption Agreement

The types of redemption agreement are as under:

- Cross-purchase contracts: In such agreements, the shares of a partner or shareholder who dies or retires, is purchased by the remaining partners of the company. There is a life insurance policy in the name of the deceased shareholder’s name which is used to purchase the shares.

- Hybrid agreement: This agreement combines cross-purchase agreements and stock redemption agreements. Here both the company and the remaining shareholders buy the stocks being repurchased.

- Redemption agreements: Types of stock redemption agreement Under this agreement, the company offers a buyback price to the existing shareholders of the company. If they agree, they sell the shares at the buyback price offered by the company.

[Also Read: Stock Purchase Agreement]

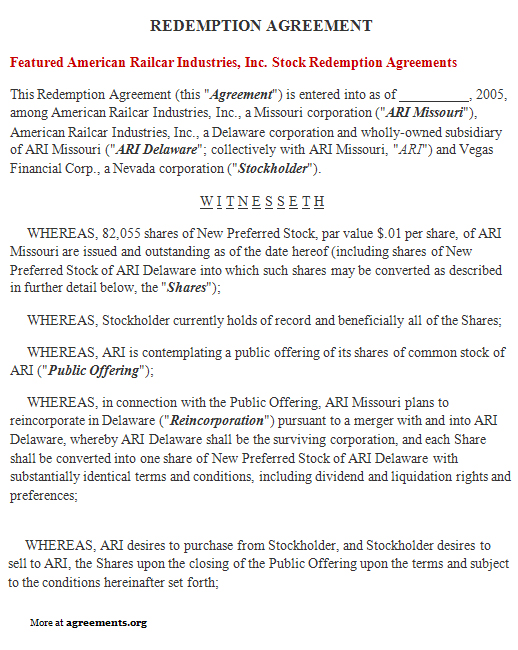

Sample Redemption Agreement

A sample of the agreement can be downloaded from below.