Brief Introduction About Recapitalization Agreement

What Is Recapitalization?

Recapitalization is a process used by a company to change its financial structure. Every company has some capital. It can be in the form of debt (bonds, debentures, etc.) or equity (common stock, preferred stock). When a company faces financial trouble or wants to stabilize its capital structure, it opts for recapitalization. This means that it changes the portion of its debt or equity capital by exchanging one form of capital for another (debt for equity or vice versa). This changes its capital structure. It is brought about by a recapitalization agreement.

This agreement highlights the terms and conditions of recapitalization between the company and the stockholders. It states the capital held by the stockholders, how and when it will be recapitalized, and the obligations of the parties.

Purpose of a Recapitalization Agreement

It is an important instrument for a company to manage its capital structure. When its stock prices fall, the company can use this agreement to issue debt and buy back some of its common stock. This will prevent the prices from falling further. It has to account for this repurchase of its common stock (called recapitalization accounting). The stock so purchased can either be retired or reissued later.

It is also used when the company wants to reduce its debt. This can be illustrated with the following recapitalization example- Suppose Company A has 60% of its capital as debt. Since debt comes with strict obligations to repay the interest and the amount, the company can recapitalize its capital structure and bring the debt down to 50%. This will reduce its financial burden. On the other hand, a company may want to reduce its equity so that it is not targeted by other companies for acquisition.

Key Terms of a Recapitalization Agreement

It generally includes the following key terms:

- Names of the parties

- Date of the agreement

- Definition of terms used in the agreement

- Recapitalization- this clause includes details about the capital held by the parties and the manner of its recapitalization and date when it will take effect (called closing).

- Changes made to existing agreements and documents

- Representation and warranties by the parties

- Obligations of the parties

- Notice requirements

- Governing law of the agreement

- Termination

- Signature of the parties

- Approval of the shareholders conducted through general meetings

- Approval of the federal authorities

- Approval of the creditors and the people holding charges in the form of liens or assignments

- Waivers of liability

- Warranties and Representations

- Jurisdiction

- The method of recapitalization

- The amount of recapitalization and the new structure that is approved

- Audited reports showing the previous financial records as an addendum

- Acknowledgments and notices

How to Draft a Recapitalization Agreement?

Since it is a complex legal document, it is advisable to have lawyers draft it for the company. The following points should be kept in mind during the drafting stage:

- Since it involves multiple parties, their legal names must be correctly mentioned along with their registered business address.

- All the terms, as well as other documents and agreements referred to in the agreement, must be clearly defined. There should be no confusion about the meaning of a term.

- Under the recapitalization clause, the current position of the capital, as well as its recapitalization method, must be explained. It should state any transfer of stock and the new capital held by the respective parties and the date when this recapitalization will take effect.

- If the process alters any existing agreement, it should be mentioned precisely. For example, if recapitalization changes the amount of preferred stock, the necessary change has to be reflected in the company’s certificate of incorporation. The agreement should mention this, and any other amendment to pre-existing agreements.

- All parties should submit the necessary representations and warranties. These include statements declaring that they are complying with all applicable federal and state laws and the issuance under the agreement is valid.

- The obligations of all the parties should be stated clearly. Each party should know what it is required to do under the agreement. This ensures the smooth execution of the recapitalization plan.

- The ‘Notice’ clause should mention the time within which notice has to be served. The address where each party will be served a notice under the agreement should be mentioned. This ensures that any notice issued is communicated effectively to all the parties.

- A clause stating which law will govern the agreement must be mentioned. For example, if the governing law is that of Delaware, then all the internal laws and regulations of the state of Delaware will be used to interpret the terms of the agreement. This avoids issues about jurisdiction.

Benefits and Drawbacks of a Recapitalization Agreement

Benefits:

- It allows a company to raise additional funds by restructuring its capital.

- It lays out a clear plan for restructuring the capital and thereby avoids legal and regulatory disputes.

- It allows the companies to reduce their burden

- It creates a greater ROI for the company

- It improves the company’s profitability and therefore investors’ trust in the long run

- It is better than filing for bankruptcy

- Its cost of equity and cost of debt decreases

Drawbacks:

- This agreement may not be beneficial to creditors when they have to exchange their debt for equity, which is a less secure option.

- Drafting the agreement is a complex and time-consuming process. It may involve a high cost towards attorney fees.

- It might not be agreed upon by all the shareholders

Types of Recapitalization Agreements

- Debt recapitalization agreement: Under this agreement, a company can increase its debt to equity ratio. It can issue debt and use that finance to buy back it’s stock or issue dividends.

- Equity recapitalization agreement: This agreement is used to issue equity stocks to raise funds. These funds are then used to buy back the company’s debt securities. It increases the company’s equity and reduces its debt.

What Happens in Case of Violation?

Normally, the agreement contains a provision that states what relief a party can seek if any term is violated. It can seek relief from the local court of the state whose law governs the agreement. Relief can vary from injunction to specific performance, or any other relief agreed between the parties. Besides, violation of recapitalization would mean that the company chose to recapitalize in a way that the shareholders did not agree for. That means that the original shareholder powers will remain intact including their claims and liens which they might move the court to repossess

This agreement also helps prevent bankruptcy. If the agreement satisfies all the stakeholders, the company can continue to function and avoid going bankrupt. Thus, the terms should be vitally be included in the agreement while being drafted to ensure security.

[Also Read: Restructuring Agreement]

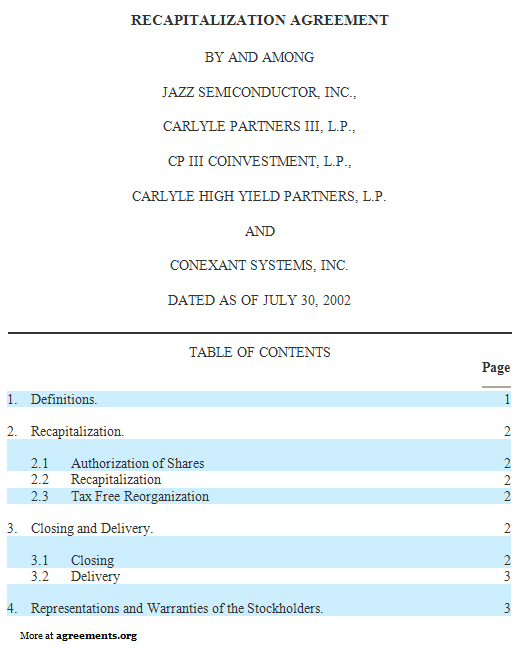

Sample Recapitalization Agreement

A sample of the agreement can be downloaded from below.