A rate lock agreement is an agreement between a borrower and a lender drawn in good faith in the interest of protecting the borrower from the volatility of interest rate movements by agreeing on a fixed interest rate. This saves the borrower a lot of money in the long run because interest rates can be very volatile. The borrower works towards paying off the loan in exchange for this bonafide gesture by the lender. It is also called an interest rate lock agreement.

What is Rate Lock in Mortage and When Do You Need It?

This agreement is used for a mortgage loan rate lock of interest at the current market rate in order to protect the borrower from the volatility of interest rates. It is commonly used in the case of mortgages and hence the name. You will need such an agreement if you are a borrower looking to take out a loan or mortgage from a lender and want to be protected from the effects of volatile interest rates.

You may be able to discuss engaging in an agreement to lock the interest rate with your lender, whereby the lender fixes the interest rate for a particular period of time and if some amount of the loan is repaid in the stipulated time, the interest for the period remains fixed and unaffected by the effects of volatile interest rate fluctuations.

Inclusions in Rate Lock Agreement

A rate lock agreement must mention the effective date, the identities of the borrower and the lender, also establishing a lender-borrower relationship between them. It should mention the principal amount, the interest rate as per the current market rate, and the lender’s intent to fix the rate of interest at the current market rate for a specific duration of time known as the rate lock period. Some lenders may require the borrower to make a rate lock deposit amounting to a certain percentage of the anticipated loan amount in order to finalize the locking of the interest rate.

Additionally, there may be clauses that allow the extension of the rate lock period. The loan must be funded as per the terms of the agreement in order to sustain the rate lock, and if it is not funded during the specified rate lock period, the lock may lapse, or penalties may accumulate.

How to Draft Rate Lock Agreement

The procedure for drafting this agreement:

- Mention the effective date of the agreement.

- Identify the parties to the agreement and establish their relationship as that of a lender and borrower.

- Mention the principal amount and the current market rate of interest.

- Express the willingness and intent of the lender to lock the rate of interest at the current market rate subject to whatever terms might have been mutually agreed upon by the parties.

- Make provisions for rate lock deposits.

- Clearly and expressly mention the terms governing the locked interest rates and the rate lock period.

- Make provisions for extensions, if necessary.

- Mention the terms for the termination of such a rate lock.

- Mention the formulas for the calculation of any penalties or losses and how they will be recovered.

- Finalize the rate lock using a Form of Rate Lock Confirmation and have both parties sign it.

Benefits of Rate Lock Agreement

The benefits of having this agreement:

- It protects the borrower from the volatility of interest rates by locking the interest rate for a definite period of time that may or may not be extendible. This saves the borrower a lot of money that he might have otherwise lost to volatile interest rates.

- The borrower works towards paying the loan in order to sustain the locked interest rate.

[Also Read: Loan Agreement]

Key Terms/Clauses in Rate Lock Agreement

The following key terms must be included:

- Relationship: This establishes the relationship between the parties as that of the lender-borrower.

- Principal: This is the amount borrowed and serves as the basis for the calculation of interest and other payments that might accumulate.

- Current Interest Rate: This is the current market rate of interest which the lender will lock.

- Rate Lock Duration: A certain amount, as per the terms of the agreement, must be paid during this duration in order to sustain the agreement.

- Termination: This clause deals with the termination of the interest rate lock agreement and details the circumstances under which it would be okay to do so and the liabilities of the parties, in case of such termination must be detailed.

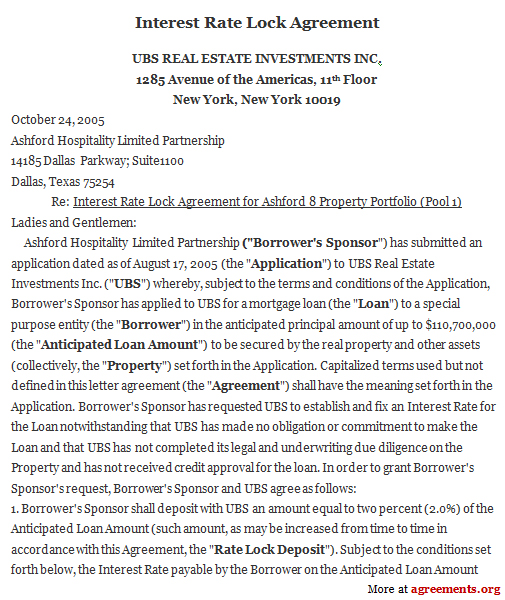

Sample Interest Rate Lock Agreement

A sample of the agreement can be downloaded from below.