What Is a Promissory Note and Security Agreement?

A Promissory Note is a binding legal document in which the borrower of funds promises to repay them under specific terms. It usually states the date when payment is due and includes specific terms affecting repayment, such as interest rate. A promissory note can either be secured or unsecured.

A secured promissory note and security agreement refers to a document that provides the lender of funds, security interest in the form of collateral. It is used in conjunction with a secured promissory note and is used to specify what action the lender can take to seize the collateral in case the borrower defaults in making the payment.

In financial transactions, it is good practice to sign a Security Agreement while agreeing upon a Promissory Note.

When Do You Need a Promissory Note and Security Agreement?

When a predetermined sum of money is borrowed by one person, he or she is required to make a promise to repay it within a fixed amount of time. A security agreement and Promissory Note is used to formalize a loan and agree upon the terms of its repayment in writing. It is used to create a legal obligation upon the borrower to repay the loan.

In transactions other than those involving unsecured loans, a Promissory Note or Loan Contract is often supported by a Security Agreement. A security agreement provides security interest to the lender and assures him a lien on the assigned assets or property in case the borrower fails to repay the loan amount as promised.

Inclusions in a Promissory Note and Security Agreement

A Promissory Note and Pledge Agreement should set out all the terms and conditions of a loan and its repayment. It should provide details of the collateral pledged and how it can be seized by the lender in case of default.

The important elements to be included in a Promissory Note and Security Agreement are as follows:

- The names and addresses of the lender and borrower

- The amount of money being borrowed, and the collateral being used if any

- The schedule for repayment, including the number of installments due along with the date of repayment

- Interest payable

- Signatures of both parties, for the Promissory Note and Security Agreement, to be enforceable

- Types of payments – whether it is with instalments, no instalments, or just interest payments

- The successors and assigns to the note

- The responsibility of payment in case of death or incapacity of the borrower

- The governing law

- Collection costs and attorney’s fees

- Termination of the agreement

How to Draft a Promissory Note and Security Agreement?

When drafting a promissory note and Pledge agreement form, the following things should be kept in mind:

- The creditworthiness of the borrower

- The deferment of payment terms

- Interest paid at simple interest or compound interest

- Repayment schedule

- Early or late payments

- Collection costs

- Rights to delay enforcing any provisions of the agreement

- Default and repossession

- The risk of default

- The credit period that can be offered to the borrower.

- The interest component that would be charged at the end of the period

- The early repayment benefit that can be offered to the buyer

- Any discounts or reduction in principal that can offered to the borrower

- Extending due date upon request and penalties charge for such extension

- Assignment and the final payee to whom the borrower would make the payment

- The details of the types of loan that is extended to the borrower

- Other rights of the lender

Benefits of a Promissory Note and Security Agreement

Some benefits of the promissory note and pledge agreement are

- It provides the borrower with additional time to make the payment

- The lender can get additional money in the form of interest

- The borrower does not have to block his working capital

- The borrower generated additional benefit by getting the goods and retaining the money

- The seller can discount the note for immediate money

- There are no complex legal requirements. It expedites the loan transactions process

- The note is a proof of the financial transaction. No elaborate documentation is needed

- It protects the lender in the event of default

Some of the drawbacks are:

- The buyer could default on the loan given to him

- The lender does not have any security with him to protect him against default

- The only recourse the lender has is legal process which would take a lot of time and expenses

- If the lender discounts it and the buyer defaults it, then the lender will have to pay additional penalties

Key Terms/ Clauses of a Promissory Note and Security Agreement

A Promissory Note and PledgeAgreement is a simple document that obligates the borrower to pay back a loan and covers the lender in case of any default. The key terms to be covered in the document are as follows:

- The amount of the loan and Interest

- Date(s) on which interest and principal are payable

- Where payments are to be sent and how they are to be made

- Particulars of Late Payment Fee

- Whether the note is secured and if so, by what collateral

- Whether the note is guaranteed and if so, by whom

- Governing law and legal remedies in case of default

- Insurance requirements and other miscellaneous provisions

A Promissory Note and Security Agreement is one of the most common types of agreement in case of loan transactions. The purpose of a Promissory Note is to bind the borrower in repaying the sums borrowed whereas the Security Agreement helps in securing the lender by tying collateral in case of default in payments from the buyer’s end. Generally, a Promissory note and Pledge Agreement are signed in conjunction with one another.

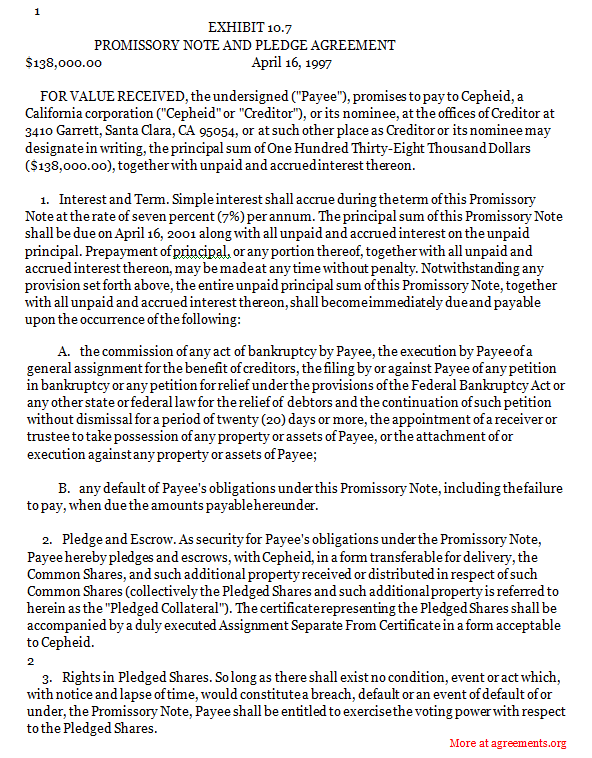

Sample Promissory Note and Pledge Agreement

Download the Promissory Note and Security Agreement Template below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.