What Is a Private Placement Agreement?

Many of the business companies sell corporate bonds to the investors without any open market sale. If you also want to expand your business, then you can do it by raising funds. Selling corporate bonds can also help you to gain long term stability, but it requires you to sign an agreement with the investor’s company. You will be allowed to keep your business private in this agreement.

When Do You Need a Private Placement Agreement?

A private placement loan agreement is taken by the companies and their investors. The public sale offering is included under a private placement memorandum when it isn’t considered during the sale of bonds. The investors can include insurance companies, mutual funds, and banks.

Purpose of a Private Placement Agreement

The purpose of the agreement is to make sure that the company is able to speed up with raising finance. Since only a little amount is spent on getting the work done, most businesses prefer private placement. If any company wants a small amount to be raised, then it can sign a private placement agent agreement with the investor company.

How to Draft a Private Placement Agreement?

To draft this agreement, you can take the help of the reputed attorney. Since you might be unaware of a lot of these agreements, it is advised that you focus on learning more about the rules and guidelines of the agreement.

You can also take the help of the templates with which it can be easier for you to make such an agreement.

Benefits of Private Placement Agreement

Benefits

This agreement helps to avoid any fraudulent activities or issues with the payments. When the investors buy your securities, then this agreement helps you to tie a legal contract with the party.

Drawbacks

There aren’t any drawbacks to having an agreement that will protect your rights.

Key Terms/Clauses in Private Placement Agreement Sample

A standard private placement agreement template

- The contents of the agreement should involve all the obligations which should be followed by the investor’s company and the company selling securities.

- All the rules should be mentioned along with the names of both the parties.

- The date of sale and purchase should also be mentioned in this agreement clearly.

- The terms at which the loan would be offered by the investors, and the purpose for which the loan shall be used

- The lien and assignments for the loan and any securities attached as collateral to the loan

- The risk factors associated with the use of funds in the project for which the loan is being asked for.

- Method and content of the notice that should be given to the investors including the advance notice that should be given to them

If you wish to negotiate with the party, it is best to do it before signing the contract. Any negotiations made at a later stage could fetch a little or no help.

What Happens in Case of Violation?

Violation of any rules or regulations stated in the contract could call for a penalty. The party will have liable to pay. The agreement explicitly includes certain sections on violation of rules.

Now that you know almost every basic thing about this agreement, you can look forward to drafting one and taking your business to the best level.

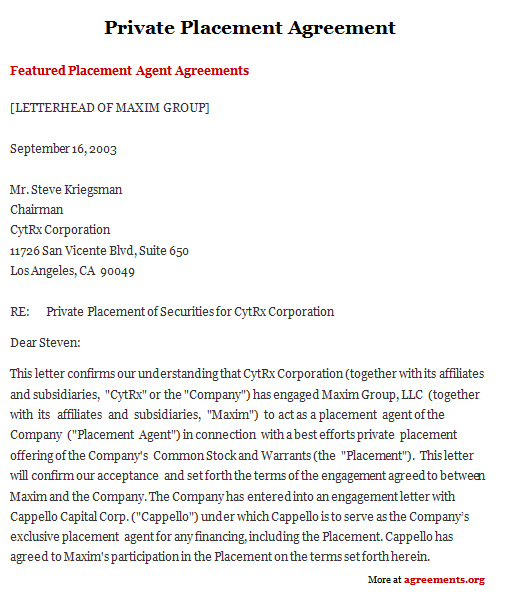

Sample Private Placement Agreement

A private placement agreement template can be downloaded from below.