A Pledge Agreement is an agreement drawn between a borrower and a lender, whereby the borrower pledges some personal property to guarantee the loan. In the event that the borrower defaults and is unable to repay the loan, the title of the pledged property will be forfeited to the lender.

The lender might be more enticed to make a loan if it is guaranteed. If you’re the borrower, make sure you can repay the loan off in time to avoid forfeiture of the pledged property.

Before the establishment of the Uniform Commercial Code (UCC), pledge agreements involved transferring physical possession of the property to the lender. Under the UCC, a pledge agreement is a security agreement which is used to create a security interest (UCC § 9-102(73)). They are also called security agreements, collateral agreements and security agreement forms.

When Do You Need Pledge Agreement?

A pledge agreement gives the definition to the terms of the loan taken. You will require a security agreement if:

- You are a borrower looking to get a loan from a lender who is asking for security.

- You are a lender who wants collateral to make sure the borrower is able to repay the loan he is taking out.

- You are a large corporation or sovereignty borrowing a syndicated loan from one or more financial institutions.

The purpose of such an agreement is to help create collateral as a security interest in order to secure the loan. It is common practice to use such an agreement when the borrower is taking out large sums of money, which is often the case with corporations and governments.

Inclusions in Pledge Agreement

A security agreement must contain the names of the parties, the date on which the agreement will become effective, clauses to create the security interest, description of the collateral, warrants and covenants, consequences of defaults, waiver and the governing jurisdiction. The agreement’s terms must be looked over to ensure that the interests of all contracting parties are safeguarded and are mutually agreeable so that no conflict or dispute arises in the future.

The agreement should be clear, concise and lack ambiguity or an element of vagueness; often, agreements that are verbose don’t effectively communicate the intentions of it. Making agreements complicated and convoluted often lead to miscommunication and can result in lengthy legal disputes that can be time and resource consuming.

How to Draft Pledge Agreement?

Procedure to draft a security agreement:

- Decide the effective date of the agreement.

- Identify the borrower and lender(s) with their names and addresses.

- Mention the total principal amount of debt before interest as is in the original agreement.

- List and describe the items or property being offered as collateral.

- Mention the address where the collateral is kept.

- Decide whether or not the borrower grants a security interest in all rights and interests the borrower has and will have in the foreseeable future. Typically, only businesses grant security interests over all of its interests.

- Include standard clauses including provisions for waiver, consequences of default, and dispute resolution.

- Have the concerned parties and their witnesses read and sign the security agreement to make it enforceable.

Benefits of Pledge Agreements

Security agreements can be beneficial to both, the borrower and lender.

- It provides the lender with the assurance that even if the borrower defaults and fails to repay the loan, he will be able to recover the principal through the collateral.

- This assurance entices the lender to give the borrower the loan.

- Individuals with poor credit histories may also be eligible for loans by offering a security interest.

- Banks and financial institutions would be more inclined to giving out large loans if they are secured. More often than not, banks will only give out a large loan to an individual or business if they secure the loan with some valuable property.

Key Terms/Clauses in Pledge Agreements

Important clauses in a standard pledge agreement format include:

- Creation of Security Interest: This clause makes the purpose of the agreement clear by mentioning that the debtor will secure the lender by granting a security interest in the Collateral.

- Define Pledge: Collateral clause specifies the details of the property which is being offered as security interest to the lender.

- Security Interest: This clause fulfils the intention as described in the Creation of Security Interest clause by granting a security interest in the Collateral. It must mention the address where the property is located.

- Warrants and Covenants: This clause prevents the debtor from moving the collateral from the address outside of the ordinary course of business. It also mentions that the debtor is to keep the collateral free of any unpaid charges, taxes or overheads and must keep it insured against any risks that may damage the property.

Download a Pledge Agreement Sample Now!

You can download the pledge agreement template here.

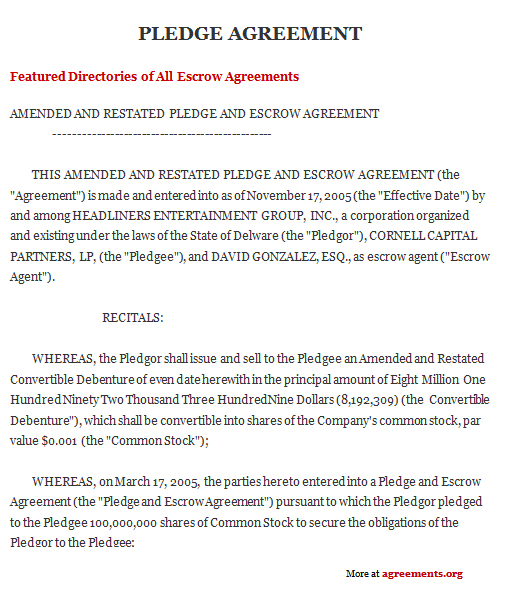

Sample Pledge Agreement