Raising capital can be difficult for a private company since there are various restrictions placed by law as to who can invest in them. In such a scenario, it cannot seek investors by itself as that would involve spending a lot of money and time. It can instead hire a placement agent through the Placement Agent Agreement.

A placement agent can either be an organization, an investment bank, or an individual working independently. It acts as an intermediary between the company raising funds and investors who would be willing to invest in the company. It is essentially a broker-dealer and connects potential investors to fund seekers. A placement agent in the United States of America must be registered with the Financial Industry Regulatory Authority (FINRA), Securities and Exchange Commission (SEC), and any other relevant state authority.

What Is a Placement Agent Agreement?

A placement agent agreement, also known as a placement agency agreement, sets the terms between the agent and the company engaging its services. It states the company’s intention to appoint the agent, how it intends to raise funds, how the agent will help with its services, and other such conditions. The agreement must adhere to all the federal and relevant state laws.

Purpose of a Placement Agent Agreement

Since the placement agent agreement sets the conditions between the company and the placement agent, it helps to avoid any confusion between the parties. It clearly explains the payment process and the duration of the agreement. These are some issues that may give rise to disputes. Clarifying them with the help of the agreement prevents any potential litigation. If parties do not wish to go for litigation, they can prescribe any other mode of dispute resolution, such as arbitration. The agreement gives them the freedom to decide the conditions of their arrangement. But they must ensure that all these conditions abide by the law.

Key Terms of Placement Agent Agreement

Below are some of the key terms of the agreement:

- Description of the parties

- Appointment of placement agent

- Duration of the agreement

- Nature of the agreement: Whether exclusive or non-exclusive

- Sale of units to raise funds

- Representations and warranties by both parties

- Obligations of the parties

- Payment structure

- Indemnification

- Grounds for termination

- Confidentiality

- Governing law

- Signature of the parties

How to Draft the Placement Agent Agreement

When drafting this agreement, there are some points to be kept in mind.

- When stating the appointment of the placement agent, clearly define the duration for which the agreement will be valid. Include the dates of the beginning and end of the agreement.

- Nature of the agreement: This can either be exclusive or non-exclusive. If the company agrees that it will engage the services of only one placement agent for the particular fundraise, the agreement will be exclusive. But sometimes, the company appoints multiple agents for the same fundraising. Then the agreement is non-exclusive. In this case, it is important to keep a record of which agent is bringing which investor.

- Sale of units: If you are a company engaging a placement agent, state the process of how you intend to raise funds. If you are issuing shares, mention the price of the share and the dates of opening and closing of the issue. Clearly mention the steps on how the placement agent can sell the units to potential investors.

- List the representations and warranties by both parties. These are statements that reflect the bona fides of a party. For example, the company should represent that it has the authority to issue the units to raise capital. The placement agent should represent that it is registered with the SEC and FINRA.

- Clearly set forth the obligations of each party so that there is no scope for ambiguity. Depending on initial negotiations, include relevant provisions if the placement agent also has to manage the fundraiser.

- Payment: One of the most important clauses is the payments clause. It is a common business practice to charge a commission on the total amount of investment as placement agent fees. The rate of commission is open to negotiation. This clause should also include the time when the fee is to be paid.

- Include an indemnification clause where the company agrees to bear any indemnify any loss that the placement agent might suffer due to the company’s error.

- State the grounds for termination of the agreement. If you are a placement agent, you may negotiate for a ‘tail provision.’ It states that if the agreement is terminated before finalizing the deal with the investor brought by the agent, the agent will still be paid compensation if the deal is finalized within a particular time after such termination. This is called the tail period and usually ranges from twelve to twenty-four months. This clause protects the placement agent from companies who engage their services only to make contacts with big investors and then terminate the agreement.

- Include a confidentiality provision to ensure that parties do not divulge any sensitive information.

- Mention which state’s law will govern the agreement. This avoids jurisdictional issues.

Types of Placement Agent Agreement

- Exclusive: This type of agreement engages only one placement agent for the entire fundraising process.

- Non-exclusive: under this agreement, the company appoints more than one placement agent to handle the fundraising.

- Private: Under this agreement, the company appoints private placement agents who help raise funds from a select group of investors. The securities used to raise funds are not available to the public.

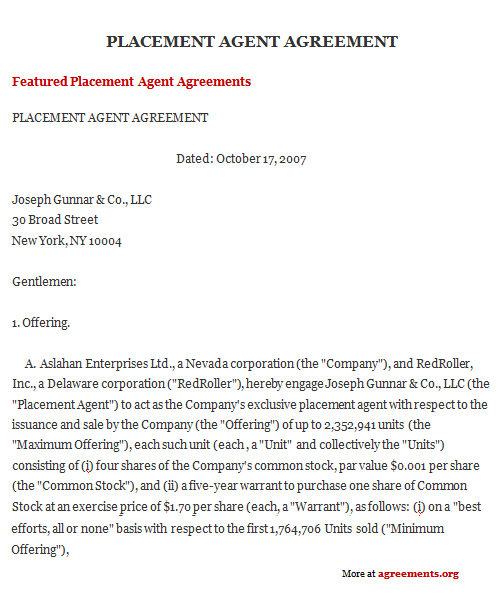

Sample Placement Agent Agreement

A sample of the agreement can be downloaded from below.