A Notification of disposition of collateral is an agreement whereby a secured creditor sends a notice to the debtor informing him of the disposition of the security being held as collateral. In the US, section 9 of the Uniform Commercial Code (UCC) mandates the sending of such notice prior to disposition of the collateral. It is also called the UCC notice of the disposition of collateral. Section 9 states that reasonable prior notice should be given to the debtor, however, a fixed timeline is not set. Typically, a 10-day notice is considered to be reasonable. Before one sits down to draft such a notification, one should have information pertaining to the original agreement whereby security was pledged as collateral.

Purpose of Notification of Disposition of Collateral

A notice for disposition of collateral serves the purpose of intimating the debtor that in view of the non-repayment of the debt borrowed, his collateral which stands as security is being disposed of. It gives the debtor time and the last chance to repay the loan. A notification also systemizes things and neither party feels wronged on account of a consequent disposition. Apart from protecting the parties’ interests, a notification also protects the interests of third parties who may have an interest in the security pledged.

Inclusions in Notification of Disposition of Collateral

A notice for disposition of collateral essentially includes names of parties, effective date, time and place of disposition, the reason behind disposition, etc. As it is in the format of a letter, it does not contain boilerplate clauses. However, it should be made a part of the original loan agreement. This would make dispute resolution easier in the event of a challenge.

Key Terms of Notification of Disposition of Collateral

Following are the key terms of notification of disposition:

- Description of the parties: A notification is statutorily required to describe both the parties.

- Description of the collateral: Section 9 requires the notification to contain a description of the collateral intended to be disposed off.

- Method of disposition: The notification inter alia should also contain the method and means whereby the collateral is sought to be disposed off.

- The time and place of disposition: The notification should also mention the time and place of disposition.

- The reason behind notification: The notification should also contain the reason behind the disposition. For example, a statement to the effect that disposition is happening on account of non-payment.

- Effect of disposition: The effect of disposition on the loan taken should also be captured.

Drafting of Notification of Disposition of Collateral

The following drafting guidelines must be followed while drafting a notice of disposition:

- Follow the directions given under section 9 of the Uniform Commercial Code.

- Put the time, place, date and name of parties accurately.

- Do not give a vague but a comprehensive description of the security to be disposed off.

- The time, place and date of disposition should also be mentioned.

- References to the security agreement which governs the creditor-debtor relationship must be made.

- Caution be taken that the notification should be given at least 10 days prior to the disposition.

- What will happen to the proceeds of the sale should also be mentioned.

Benefits of Notification of Disposition of Collateral

Following are the benefits of notification of disposition:

- The debtor gets an advance notification which helps him in understanding the consequences of no-payment.

- The debtor gets time to make the repayment.

- Third-parties whose interests are intertwined with the property pledged as security also get time to protect their interests. For example, if A is an investor in B whose properties are pledged as collateral for a loan, he might sell off his stake and exit before disposition occurs.

- The creditor’s risk of the disposition being challenged as unlawful is mitigated.

- A proper format of the same and the requirement for the notification to be given within a reasonable period of time prior to disposition helps streamline the process.

- References to the original loan agreement must be included for contextual purposes.

Cons of Notification of Disposition of Collateral

The following are the cons of notification of disposition:

- It places an additional burden on the creditor to notify the debtor prior to disposition.

- It gives the debtor time to unlawfully sell off the collateral before the creditor may take charge of it.

- It unnecessarily delays the recovery process.

- It is a technical requirement and the disposition in the absence of the same may be challenged.

A notification of disposition is a mandatory statutory requirement. The information to be contained is also provided under the law. It helps streamline the process of disposition of the collateral. A non-compliance with the same may lead to statutory penalties and the disposition getting challenged. It is preferable to make this document subject to the dispute resolution clause of the original agreement.

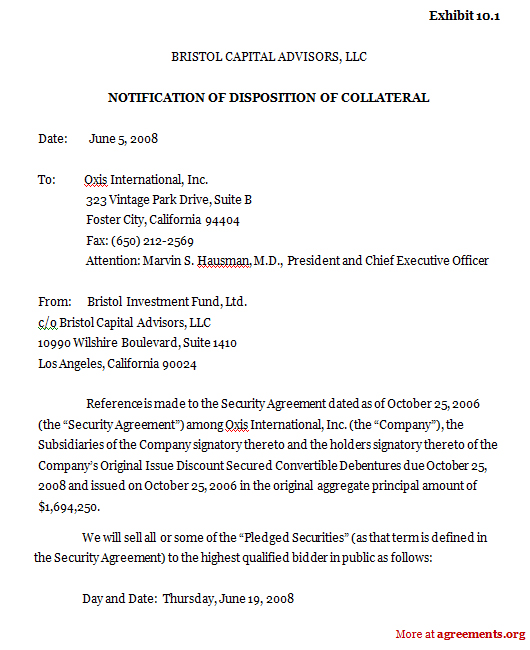

Sample for Notification of Disposition of Collateral Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.