A Note Purchase Agreement is an agreement that a company acting as a seller, enters into with another party acting as the buyer to sell promissory notes, in order to raise capital for the funding of general corporate functions or any other purpose. The seller must fulfil certain conditions, make representations and comply with warranties and covenants as drafted in the agreement. It includes the maturity date, upon which the buyers may return their notes in order to receive the principal and accrued interest at the rate described in the agreement.

When Do You Need a Note Purchase Agreement?

You would require such an agreement if:

- You are a corporation that is looking to use promissory note sales as a funding mechanism to fund any corporate functions, acquisitions, or other purposes.

- You are an investor looking to invest your money in promissory notes of any kind.

- You are an investor or corporation in possession of a promissory note of another company and would like to sell the note back to them.

- You are a corporation looking to buy back a promissory note that was previously sold to an investor.

Inclusions in Note Purchase Agreement

A standard agreement of this sort will include:

- The effective date of the agreement, which is the date on which the agreement comes into force.

- The names and descriptions of the contracting parties, that is, the buyer and the seller.

- Background details that establish the circumstances of the agreement.

- Purpose of the agreement, which will establish the intention to contract.

- Conditions of waiver which will limit the liability of the contracting parties.

- The principal amount and the maturity date upon which the note can be returned in exchange for payment as per the terms in the payment’s clause.

- A payments clause that will detail the terms of payment including the amount and mode of payment among others.

- Failure of conditions clause that mention the consequences of non-performance of any conditions mentioned in the agreement.

- Representations of the seller’s assets.

As would be the case with any agreement, it must be drafted clearly and with as much detail as possible.

How to Draft Note Purchase Agreement?

The procedure to draft a note purchase agreement is as follows:

- Mention the effective date of the agreement.

- Mention the parties to the agreement and identify them as the buyer and the seller, respectively.

- Mention the background and circumstances of the agreement and establish the seller-buyer relationship and make the intention to contract explicit.

- Establish what would constitute a failure of conditions and its consequences.

- Create a security interest or collateral if needed.

- Make representations of the assets of the company acting as the seller.

- Make provisions for payments that will provide all terms and conditions of payment in detail.

- Establish the closing conditions and make provisions for dispute resolution.

- Make an interpretation clause that would assist the reader in interpreting the agreement as was intended by the drafters. It must include a clause that expressly mentions the governing jurisdiction.

- Have the parties, their guarantors and witnesses sign the agreement.

Benefits of Note Purchase Agreement

The benefits of an agreement for the purchase and sale of notes include:

- It secures the investors’ money as it ensures that the company or the seller will pay them back. The agreement makes their claims legally enforceable; this limits their risk.

- It makes the investment more appealing to prospective investors as they agreement secures their investment.

- It lays down the terms of non-performance and default clearly, so any party contravening these terms would be penalized under the governing law for breach of terms of contract. This secures the interests of both the parties.

- It makes the transaction legally recognizable. The tangibility of a physical document makes the existence of the agreement easy to prove in court, in case a dispute arises.

- The clearly written terms and conditions make the agreement less susceptible to miscommunication.

Key Terms/Clauses in Note Purchase Agreement

Key clauses to include while drafting a note purchase agreement are:

- Payment: This clause should discuss, as many details as possible, the amount and terms of payment. It must also include the rate of interest, mode of payment and other important information. In cases of convertible notes, it must mention that the consideration will be converted to equity.

- Principal: This clause is very important as it mentions the details of the principal amount that was invested into the company by the investor. This figure must be accurate as the interest would be calculated on this.

- Waiver: Waiver clause determines the maximum extent of liability of both parties.

- Default: This clause establishes what actions (or the lack of them, thereof) would constitute an event of default. It should also mention the implications this would have on the party that contravenes the terms of the agreement.

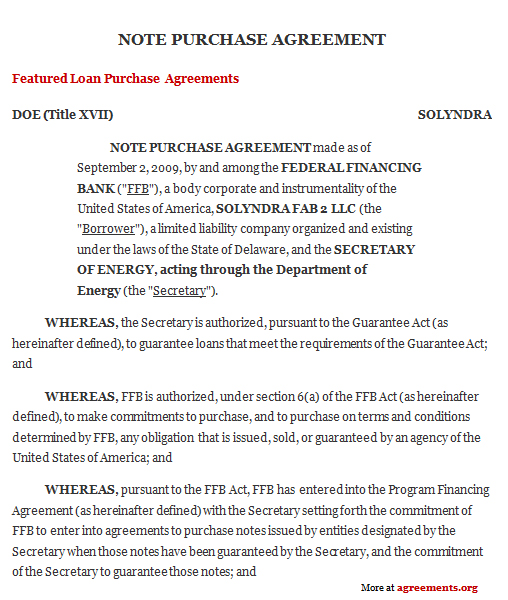

Sample Note Purchase Agreement

A sample of the agreement can be downloaded from below.