A non-employee directors benefit plans trust agreement is a legal contract between the trustor or the company, the trustee, and the beneficiary, the non-employee directors of the company. The non-employee director has the same responsibilities as any other director on the company’s payroll and is expected to provide value-added services like ensuring meeting the obligations to shareholders, assessing management performance, or appointment of directors. The trustee ensures that all the clauses with regard to benefits accruing to the non-employee directors are complied with including benefits payable to nominees in case of death of the non-employee director. The clause relating to termination of services of the non-employee directors are also clearly mentioned.

When Do You Need Non-Employee Directors Benefit Plans Trust Agreement

A non-employee directors benefit plans trust agreement is required when a company wishes to appoint an experienced individual as a director of the company who will not be on the company’s payroll. A non-employee benefits trust is created for this purpose. The purpose of non- employee directors benefit plans trust agreement is to ensure that the rights, responsibilities, and liabilities of the trustor, trustee, and beneficiary are clearly laid out to avoid any disputes related to of any promise. The trustor or company needs to ensure that payments are made on time. The trustee has the responsibility of protecting the interest of the beneficiary, the non-employee director, and ensure payments are made as per the agreement.

Inclusions in Non-Employee Directors Benefit Plans Trust Agreement

A non-employee directors benefit plans trust agreement has three parties which must be included in the agreement namely the trustor or company, the trustee and the beneficiary or the non-employee director. The agreement needs to incorporate the effective date of the agreement, the administrator, affiliate, authorized officer, the legislation governing the trust agreement, the payment schedule, and the beneficiary. The powers and duties of the trustee, the investment directions and guidelines, the compensation payable to a trustee, limitation of liability, resignation, and removal of a trustee also need to be clearly defined in the agreement. The agreement should also contain the accounting followed by the trust fund and contributions by the company.

How to Draft Non-Employee Directors Benefit Plans Trust Agreement

The following few pointers need to be kept in mind while drafting a non- employee directors benefit plans trust agreement:

- The agreement must contain the names of the parties to the agreement and the relationship between them

- The rights, responsibilities, and liabilities of all those who are parties to the agreement must be clearly defined

- The fees payable to the trustees and the compensation payable to the beneficiaries must be stated clearly

- Provisions regarding change of control should be clearly mentioned

- The events leading to the termination of the services of the beneficiary or trustee has to be clearly laid out

Benefits of Non-Employee Directors Benefit Plans Trust Agreement

Here are some of the benefits of having this agreement:

- The payment schedule for the non-employee directors’ compensation is clearly defined in this agreement which ensures that there is no dispute regarding compensation.

- The performance evaluation parameters for the non-employee director are clearly laid and the termination criteria are also mentioned.

- The trustee ensures that the beneficiary gets the stated remuneration during their lifetime and any benefits due to the nominees after the death of the beneficiary.

Drawbacks of Non-Employee Directors Benefit Plans Trust Agreement

These are the drawbacks of an agreement:

- The non-employee director is not on the payroll of the company or trustor and this is merely a contractual service. The renewal of the contract is at the discretion of the company.

- The agreement is null and void in the event of non-compliance with regulations.

Key Clauses of Non-Employee Directors Benefit Plans Trust Agreement

The key clauses are:

- Detailed payment schedule regarding the remuneration payable to the beneficiary

- The fees payable to the trustee and the responsibilities of the trustee

- The accounting of the contribution made by the company to the trust fund and expenses of the trust fund

- The law which governs this trust agreement and the jurisdiction

- The conditions of the amendment, revocability, and termination of the trust

- The purpose of the trust must be clearly stated

- There must be acceptance from all the parties to the terms and conditions

[Also Read: Director Designation Agreement]

Download a Non-Employee Directors Benefit Plans Trust Agreement

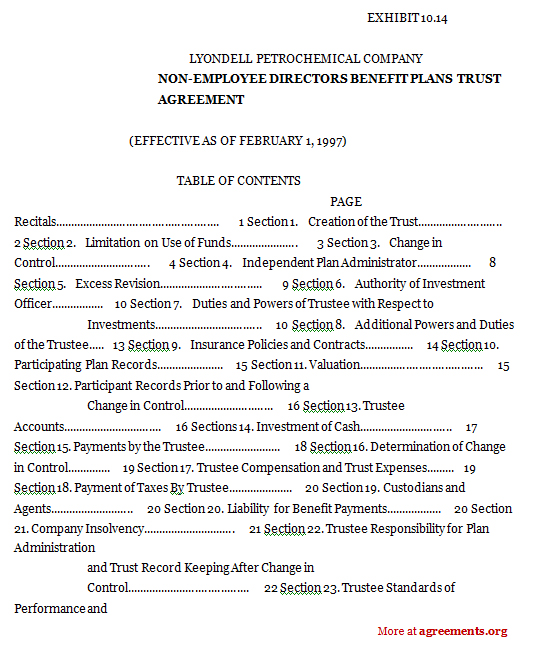

A sample of the agreement can be downloaded from below.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.