What Is a Multi Currency Credit Agreement?

A multi currency credit agreement is a form of a loan agreement that lays down the terms of a multi currency loan that is given by a bank to a particular organization. A multi currency credit is when the borrower can receive the loan in multiple currencies. This is useful for organizations that carry out operations in more than one country. The organization also has the option of repaying the loan in different currencies.

When Do You Need a Multi Currency Credit Agreement?

The contract is important to serve as proof of the various details that have been agreed to by the parties. This agreement must be created whenever such a credit facility is given. It is imperative to lay down in writing the terms and conditions of the loan. It is also essential that the obligations of both parties are clarified in the contract itself.

Inclusions in the Multi Currency Credit Agreement

This agreement includes

- The names of the parties involved, i.e. the bank and the organization.

- The details relating to the multi currency credit such as the amount of the loan.

- The purpose for which such loan may be used

- The date by which the organization must repay the loan

- The conditions that have to be fulfilled by the organization prior to the disbursement of the loan

- The base currency and the optional currencies that are part of the loan will also have to be included.

- Prepayment and cancellation of the loan

- Interest amount and the interest payment schedules

- Changes to the calculation of interest rates

- Fees and taxes

- Increased costs and other indemnities

- Security and advances including collaterals

- Guarantee and Indemnity

- Representations and Warranties

- Financial covenants

- Information and general undertakings

- Changes to the lenders and obligors

- Roles of agents and arrangers

- Payment mechanics including set off

- Notices

- Partial invalidity

- Remedies, amendments, and waivers

- Governing law and enforcement

- Confidentiality and counterparts

The agreement must also state the procedure for repayment of the loan and terms of prepayment, if applicable. The rate of interest, the manner in which such interest will be calculated are all essential to the contract.

How to Draft a Multi Currency Credit Agreement?

While drafting an agreement;

- The parties will have to negotiate amongst themselves regarding all the details that are essential to a loan transaction such as the loan amount, base currency, interest rate, etc.

- Once these terms have been finalized, they should be laid down in a written contract to make the position of both parties clear.

- Mention the currency types and optional currencies like USD, EUR, GBP, JPY, and HKD.

- Mention the interest rate, whether it is a floating type or fixed one.

- The agreement must state that all the fees concerning the foreign currency will be charged as per the agreement.

- Target audience

- Charges

- Application qualification

- Required documents

- Process

- Notices to be issued.

- Defaults, Remedies, and Waivers

The application for such a loan requires that the funds must be used in a legal, reasonable, and profitable area and that the borrower should have a foreign currency funds source. If not, it should have a certificate of foreign exchange purchase for loan repayment, approved by the foreign exchange administration department.

Benefits and Drawbacks of the Multi Currency Credit Agreement

The following are the benefits and drawbacks of this agreement:

- A benefit of this agreement is that it lays down in writing all the important details of the loan, which in turn can serve as evidence of all the terms that have been agreed to between the parties.

- It protects the rights and interests of both parties in case there is any violation of the terms of the contract.

- There will be remedies available under the agreement to the aggrieved party.

- It hedges the person using the loan against volatility in the currencies

- It provides a continuous line of credit to be used when the need arises

- It helps in hedging against sudden exigencies in the business requirements

Key Terms in the Multi Currency Credit Agreement

The key terms in a the agreement are as follows:

- Term of the agreement

- Purpose and application

- Conditions of use

- Optional currencies

- Repayment schedule

- Interest

- Security

- Conditions precedent

- Guarantee and indemnity

- Costs and expenses

- Events of default

- Representations and warranties

- Covenants

- General undertakings

- Security and advances, or collaterals.

What Happens in Case of Violation?

The agreement will talk about the situations that amount to a breach of the agreement and will detail the events of default. In such an event, the remedies or actions that will follow will also usually be listed out. It may lead to early termination of the agreement and/or damages to the aggrieved party. For any loss caused as a result of the breach, the parties may seek an injunctive relief or specific performance. If there is a loss of profit then the parties may seek restitution to recover damages or seek compensatory damages.

Through a Multi Currency Credit Agreement, a buyer Loans in which the borrower, at his/her discretion, may receive the funds from the loans in multiple currencies. While a few multi currency loans facilitate only two currencies, others give the borrower a choice of multiple currencies. This agreement is particularly useful to corporations that aim to reduce the foreign exchange risk s involved in financing.

[ Also Read: Credit Agreement ]

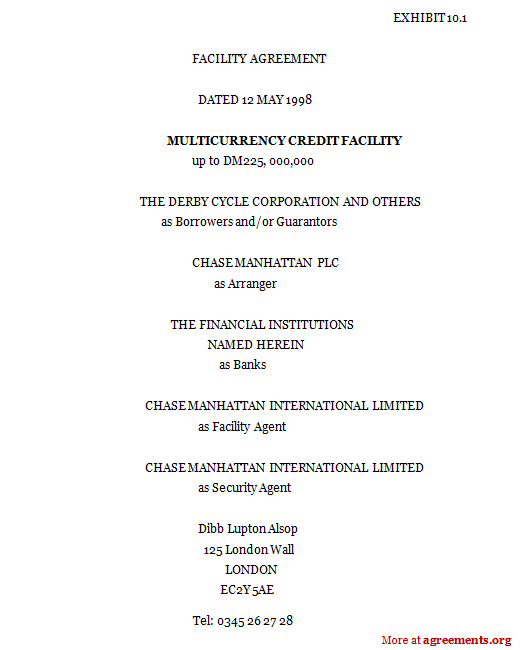

Sample for Multi Currency Credit Agreements

You can download a Multi Currency Credit Agreement Template here.