A Mortgage Financing Agreement sets the terms for everything that stays associated with the contract between the lender and the borrower. Once signed, the borrower gains access to the money and the lender, to the property for future takeover if the loan does not get paid back in full.

To explain the features of mortgage financing agreement, one can say that it is a piece of legal document that speaks about the different terms and conditions you must comply with to obtain a mortgage loan against one or more properties. It refers to the process of getting the credit against the collateral – which is typically a particular real estate property – which secures the loan amount which the bank is disbursing, and the loan amount is either equivalent or lower than the value of the property.

When Do You Need Mortgage Financing Agreement?

A mortgage financing agreement is a complex document that can catch you off-guard if not studied and understood correctly. It should contain the most essential points that are integral to borrowing, which is the interest rates, type and amount; fee rates (whether fixed or floating or both); the default interest amount; Prepayment terms and conditions; steps to be taken by the lender in events of default, cross default, non-payment and insolvency.

A mortgage financing agreement is for everyone taking a mortgage loan, to ensure it serves as a document for:

- Reduced retirement expenses.

- Saved costs of interests.

- Tax Deductible interest payments.

Inclusions in Mortgage Financing Agreement

The mortgage, being a long-term loan, the borrower needs to make payments of equal, specific amounts through instalments (which includes the interest and a part of the capital) to the lending financial institution through a certain length of time (20 to 30 years) as mentioned in the Mortgage Financing Agreement. Both the parties, therefore, fix the tenure of the loan and the interest rates, it helps in building equity in that property.

Mortgage Financing Agreement clearly states that the borrower can use the property, but he/she will not technically own it anymore till the loan gets paid in full. In this case, the title gets transferred to the borrower’s name for the tenure of the loan. The lender takes the property in case the borrower can’t pay back the mortgage.

How to Draft Mortgage Financing Agreement?

- Always remember not to change your job without bringing it under the notice of the lender. It might hamper the entire mortgage financing agreement process, and you might require to start all over even if it doesn’t get cancelled. The lender might accuse you of not being able to show him a consistent income source.

- Making any major purchase is discouraged before looking for a mortgage loan. Spending on stylish furniture and modern appliances for the new place are tempting, but it results in a cash shortage and might highly defer your payment plans.

- Don’t apply for a new credit card when you are halfway through a mortgage financing agreement process. It might affect directly to your credit score and this might put your lender off, since applying for a credit card affects credit score; more so if you are in the habit of frequently opening and closing credit accounts.

- And as always, make sure to pay the lender on time; if possible, a couple of days earlier than the fixed date. Late payments show up on credit reports and might affect your next mortgage, especially if you are trying to build up or increase your property.

Benefits of Mortgage Financing Agreement

- Mortgage, being the easiest way to use a property as your own, requires you to come into terms with the person or institution providing capital for the possession of the property. However, you do not technically own this property unless you return the full loan amount to the lender for which, you need to follow specific rules and regulations the lender will be devising.

- Since you both agree to the terms and conditions related to the purchase of the property, it automatically becomes a contract, and both the parties can legally get prosecuted if there is a violation of the terms and conditions agreed upon when signing the agreement at the beginning.

- Any Private Mortgage Loan Agreement will require you to read carefully between the lines While it is not possible to point out every pitfall it might carry, certain features of mortgage financing stay common. You need to act according to these and make the best out of any given mortgage financing agreement process.

Key Terms/Clauses in Mortgage Financing Agreement

- Prior disbursing any mortgage loan amount, it’s a must for a borrower to sign and execute the related loan agreement, which states and regulates every term and condition associated with the loan thereby creating a mortgage on a particular property.

- This agreement always gets established in favour of the bank with clauses that are entirely against the interests of the borrower, which he or she must ensure them to be applicable only when they provide written consent.

- The bank has the power to alter any of the terms present in the Mortgage Financing Agreement, but if you are smart enough, you can use the same document to understand and look after your rights and liabilities as a borrower.

[Also Read: Collateral Mortgage and Modification and Consolidation Agreement]

You can download a mortgage financing agreement sample PDF files from the internet and can customize as per your requirements.

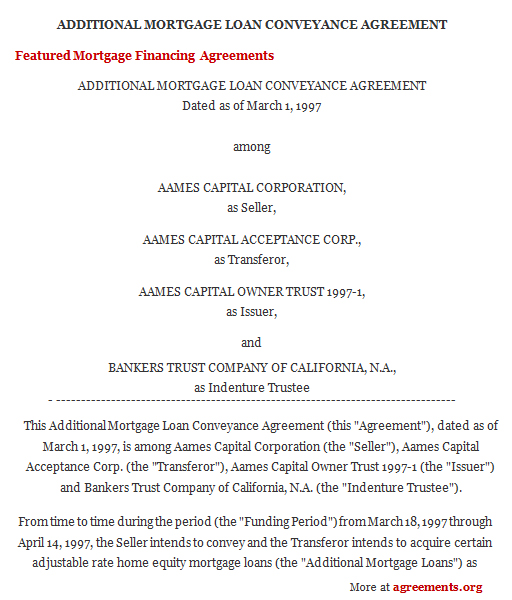

Sample Mortgage Financing Agreement