What is CEMA?

Modification and Consolidation Agreement, also known as the New York Consolidation Extension and Modification Agreement (CEMA), is a legal document for combining old mortgages with a new one in the state of New York. It modifies terms of an existing mortgage and merges it with a new mortgage for the same property. In short, it is basically an agreement between an existing lender and a new lender.

When Is a Modification and Consolidation Agreement Required?

In the state of New York, homebuyers who borrow loans have to pay a mortgage tax to document the transaction. By taking a loan under the New York Consolidation Extension and Modification Agreement for a mortgage refinance, homeowners can avoid paying full mortgage tax on the second loan.

The document is valid only if the homeowner is planning to refinance his existing first mortgage and has previously paid the New York State mortgage tax. Thus, the main purpose of CEMA is to avoid paying full New York State mortgage tax on a to refinance transaction. It is often used by homeowners looking to refinance their mortgages, though in rare cases homebuyers use it too.

The agreement contains details such as the current outstanding amount, new rate of interest, new principal amount, maturity date, and covenants. A point to be noted is that the CEMA is available only in the state of New York.

Inclusions in Modification and Consolidation Agreement

The critical parties involved in this agreement are the new lender, current lender, and the attorneys of both buyer and seller.

The agreement process is lengthy as it involves the legal counsel of both parties. So, it is advisable to start the process immediately at the beginning of the loan process as it takes anywhere between 60 to 90 days to process a loan in New York. It also depends on how much the bank attorney and original lender and or their attorney are willing to cooperate.

How to Draft Modification and Consolidation Agreement

Procedure for drafting CEMA:

- First, contact the original bank and request for an assignment of the mortgage to a second bank. The documents will be ready within three to six weeks of advance notice.

- Documents from the original bank should be given to the second bank. All mortgages, promissory notes, prior mortgage assignments, and a payoff letter showing all balances due should be included.

- Get a confirmation from the original bank and exchange all original documents upon the new banks’ disbursal of the loan.

- The new bank issues a fresh mortgage for additional money being borrowed, over and above what is due to the original bank.

- The new bank prepares the CEMA which merges both the mortgages into one.

Benefits of Having a Modification and Consolidation Agreement

The following are the benefits of taking a CEMA, available to both buyer and seller:

- Buyers have an advantage wherein they have to pay the mortgage recording tax on the new mortgage borrowing from the new bank minus remaining loan balance taken from the seller.

- The seller has the benefit of saving money on transfer taxes, that is paying taxes on sales price of the property minus remaining mortgage debt that is transferred to the buyer.

Downside of Modification and Consolidation Agreement

- Modification and consolidation agreement loans / CEMA loan have additional fees involved that can make them less attractive. These fees include assignment fees, closing fees, and processing fees.

- CEMA is not an automatic process. The previous lender may not agree to assign the loans as there is no requirement in New York that they must do so.

- It is a lengthy process and requires the state of New York and any previous lender to do a special signing off on the order to start processing the loan.

Types of Modification and Consolidation Agreement

- The most common type of modification and consolidation agreement loan is for a mortgage refinance.

- ‘Splitter’ or Purchase CEMA is the other type of mortgage in which a seller still paying off his or her mortgage can transfer it to a buyer who wants to take a new mortgage.

Key Clauses in the Agreement

- Borrower’s agreement about obligation under the notes and mortgages.

- Agreement to combine notes and mortgages.

- Agreement to change terms of the consolidated note.

- Agreement to change terms of the consolidated mortgage.

- No set-off, defenses.

- Borrower’s interest in the property.

- Written termination or change of this agreement.

- Obligations of borrowers and of persons taking over borrower’s or lender’s rights or obligations.

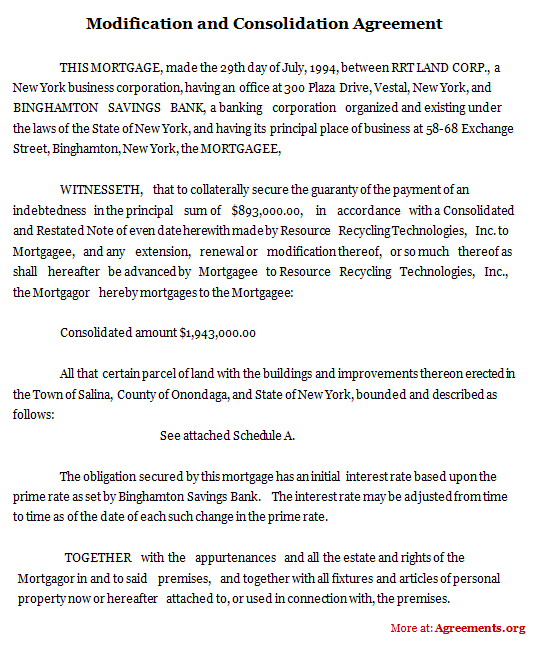

Sample Modification and Consolidation Agreement

If you are considering a new mortgage on your existing New York home, do consider the CEMA and see if it can save some money for you.

You can download a sample Modification and Consolidation Agreement below

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.