What Is the Lockheed Corporation 1992 Employee Stock Option Program?

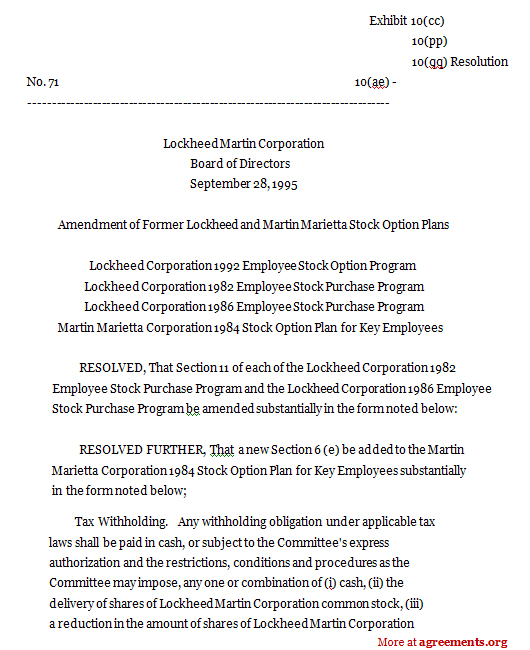

The Lockheed corporation 1992 employee stock option program is a scheme that was formulated after the meeting of the Board of Directors in March 1992. The objective of the program is to benefit the employees of the organization.

As a component of the incentive program, the Lockheed corporation launched the alternative of purchasing the share options of the organization at a price that is more subsidized as compared to the market price. This step was taken to encourage better performance for the employees. This program was subjected to significant adjustments to usher in a host of advantages for all the eligible employees.

A few amendments were made for the removal of the provision of the consent of the board of directors. These amendments also make provision for the alternative of vesting for all the employees beyond the period of lock-in. Besides, the program underwent another modification for the imposition of restrictions upon the employee who avails these share options only once in the financial year.

When Do You Need the Lockheed Corporation 1992 Employee Stock Option Program?

Similar to other employee stock option programs, this employee stock option program is needed to:

- Make investments in the shares of the employer or company that is sponsoring the program.

- Bring the employees and employer into the employee stock option program with a variety of tax benefits

- Double up the investment with the increase in the corporate finance strategy of the company seeks for the alignment of the interests of the employee with the importance of the regular stockholders of the company.

Inclusions in Lockheed Corporation 1992 Employee Stock Option Program

This employee stock option program includes the following provisions:

- The effective date on which the agreement comes into existence between the employer and the eligible employee

- The share percentage on the stock

- The principal amount, rate of interest, and duration of the interest

- The market price of the shares

- The cost of the shares at a subsidized rate as offered by the company

- No rights of assignment, waiver, and delegation

- Specification of the regulations, laws, and jurisdiction of the state

- Details of the utilization of the share proceeds

How to Draft the Lockheed Corporation 1992 Employee Stock Option Program?

Drafting this agreement should only be done by an authorized attorney.

Benefits of the Lockheed corporation 1992 employee stock option program

The Lockheed Corporation 1992 Employee Stock Option Program is a component of the organization’s employee compensation package. It is a way that the organization adopts to pay the incentive to the employees. This compensation package takes the form of stocks, shares, salaries, rewards, and wages. It gets determined as per the principles expressed by the organization relating to worker execution and income produced by the organization through that representative.

The advantage of this is to help the representative and the organization by and large. It likewise keeps the members in the arrangement centered upon corporate execution, and along these lines, they raise the organization’s offer value appreciation. This gratefulness legitimately reduces the stock execution profiting the workers over the long haul alongside the organization.

Plan members can see the organization’s stocks performing great, which urges members to do what’s best for investors, for the members are themselves investors of the organization. It likewise improves the trust factor and dependability of the workers towards the organization. The workers, accordingly, perform well to raise the offer costs and, subsequently, similarly get exposed to different prizes contrived by the organization. These prizes can be in any for running from impetuses, reward to a relative climb in the pay, etc. Their endeavors help them yield twofold outcomes.

Besides, the responsibility for the business’ stocks get offered at no direct costs; it’s merely that the organization holds those offers in trust for a definite period to guarantee wellbeing and development. At the point when a representative resigns or leaves from the organization, the stocks are repurchased by the organization from the resigning or leaving worker. This cash goes to the worker in a singular amount or as equal occasional installments.

However, the arrangement got contrived. For terminated workers, just the sum they have vested in the venture are paid back. They are not at risk for the fluctuating rates or the upgraded costs that their piece of offers comes to over the period. In any case, Lockheed ESOP turns into a decent plan of retirement for workers.

Key terms/clauses in the Lockheed Corporation 1992 Employee Stock Option Program

The objective of purchasing the shares from the company

- Schedule of payment to be made by the employees

- The Employee Stock Option Plan or ESOP of the company

- The event in the default of payment

- The liabilities of the employee to the company

- The specifications of the shares of the company

Download a sample agreement and customize it as per your choices and needs with an effective date as decided by the contracting of specific articles and sections that lay down the key terms, clauses, and guidelines regarding the program.

Sample for Lockheed Corporation 1992 Employee Stock Option Program

Download this USA Attorney made an original agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.