What Is a Loan and Security Agreement?

Loan and Security Agreement is a type of a loan agreement where a lender creates security for the amount lent to the borrower. Without this Agreement, it becomes difficult to borrow money due to the restrictions on credit, high interest rates, and high chances of default. Security agreements allow for the free flow of credit and capital by assuring lenders that they will be repaid on the loans they make. A loan agreement with collateral is a compulsory accompaniment when drafting this contract.

Who Takes the Agreement?

This agreement is signed between a borrower and a lender and is used where large sums of money have to be lent over a long period of time. A mortgage and security agreement sets the terms for issuing the loan so that the chance of payment default is reduced. When parties enter into this agreement, the borrower has to provide suitable security to cover the exposure on the loan borrowed.

When Do You Need Loan and Security Agreement

In this form of agreement, the borrower either provides particular security as collateral for the loan or creates charge on any business assets. This charge can a first lien, floating charge or an assignment for asset values equivalent to the amount of loan borrowed. There is no specific context when this agreement is important. Every time a loan is issued, a security agreement should be drafted to cover the exposure the lender suffers by lending the loan.

Contents of the Loan and Security Agreement

A standard loan and security agreement template contains the following terms:

- A description of the loan issued, the monetary value of the loan and the security offered, and whether such security matches the exposure on the loan – for a loan security and pledge agreement.

- Details of all the documents that have been drafted as part of issuing the loan, including loan contracts, securities already offered such as promissory notes, assignments, and subordination agreements

- Lien rights of the lender and any other charge that the lender holds on the security offered.

- The rate of interest charged on the loan and the repayment cycle along with the breakup of principal and interest.

- Any rights of the lender in getting rid of the security to minimize his exposure

- Remedies and grievance redressal mechanisms in case of any default pertaining to the charges on the assets.

- Any miscellaneous terms that the parties might agree upon to offer sufficient collateral for the loan

Drafting a Loan and Security Agreement

Drafting a loan and security agreement requires due care so that the interests of both the parties are represented in the loan agreement. Some of the points to keep in mind are:

- The nature of the subsidiary mortgage and security agreement to cover the risk of loan.

- Payment of any fees or expenses as part of the loan

- The rate at which the interest shall be calculated for each payment and the cut-off date for considering such a rate.

- Payment of interest on delayed repayments of the loan

- The breakup of the principal and interest components in the loan

- Mode of repayment for the loan

- Grievance redressal mechanisms.

Benefits and Drawbacks of the Loan and Security Agreement

Advantages of Secured Loans

- Because the loan’s exposure is suitably covered, the lender would consider offering a lower rate of interest to the buyer.

- It protects the interests of the lender and provides an avenue in case the buyer defaults on payment

- Secured loans can be issued for a wider array of purposes beyond just a handful of avenues.

Disadvantages of Secured Loans:

- The uncertainty of collateralization of security would still attract higher rates of interest compared to a mortgage.

- Valuation and arrangement fees can increase the initial cost of the loan

- Lien on the assets could restrict their use in business operations.

What Happens in Case of Violation?

The agreement would include clauses that deal with breach of contract. After waiting the stipulated amount of time, and giving due notice, the lender could sell the asset and recover the amount of loan. Any excess on the loan, after deducting the selling expenses, would be remitted to the buyer. That’s why, in most cases, the security required is more than the amount of the loan.

However, not every activity constitutes a breach of contract. Simple defaults and delayed payments might not receive the same treatment as a breach of contract. In case of any disputes, the contract would specify the legal recourse available to both parties. The seller would not be allowed to exercise his lien if the buyer offers a deferred payment or other alternatives and the contract allows the buyer to exercise that right.

A loan and security agreement is required to ensure that the loan is suitably covered and the lender is protected in case of bad debts or insolvency of the buyer. How the security would be treated is not only governed by the relevant laws but also by the contractual provisions. Every loan offered should be accompanied by this agreement to reduce the risk a lender faces.

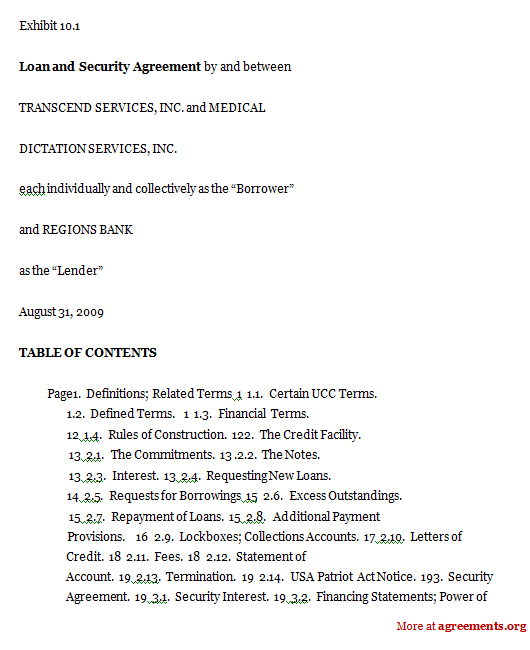

Sample for Loan and Security Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.