A Brief Introduction About the Loan Agreement?

A loan agreement is a binding contract between two or more persons to document the giving of a loan from one person to another. It documents the promises of both the parties – the promise by the lender to lend the money and the promise by the borrower to repay the money along with interest applicable. The agreement is necessary to lay down the terms under which the loan has been given, and it provides various details regarding the repayment of the loan.

Types of Loan Agreements

There are various types of loan agreements that may be created between parties depending on the purpose for which the loan is given. These include personal loans, auto loans, mortgages, term loans, business loans, etc.

Who Take the Loan Agreement? – People Involved

A loan agreement is entered into the person who is giving the loan (known as the lender or the creditor) and the person who is borrowing the loan (known as the borrower or the debtor). The guarantor also may be made a party to the agreement.

Purpose of the Loan Agreement- Why Do You Need It?

The purpose of a loan agreement is to formally lay down what the parties have agreed to, what their responsibilities are, and what the duration of the agreement will be. The purpose for which the loan has been given should also be clearly mentioned. If the loan amount is used for a purpose other than what is stated in the loan agreement, the lender can ask for a loan to be repaid immediately.

The agreement lays down in writing the terms and conditions under which the loan is being provided to the borrower. When such an agreement is in place, it helps the parties have a complete understanding of the entire transaction and leaves no room for any error or misunderstanding.

The purpose of the agreement is to protect the rights and interests of the parties in case of a violation of the terms agreed to by the other party. This agreement helps to have written proof of the specific details agreed to by the parties. Additionally, the contract will also provide for remedies to make sure that each party can protect their rights under this agreement.

The various acts that can be deemed to be a breach of the agreed terms will be listed out, and a remedy will be provided for each one of them. If the matter goes to the court, the loan agreement also helps the court determine whether the terms and conditions of the agreement are being carried out and whether an event of default has occurred.

Contents of the Loan Agreement

The key terms of a loan agreement:

- Loan Amount: This clause will mention the amount that is being provided by the lender to the borrower.

- Duration of the loan: This clause will specify the length of time for which the loan is being provided.

- Rate of interest: The rate of interest that will be payable by the borrower must be included in the agreement itself.

- Schedule for repayment: A detailed schedule regarding how the loan amount shall be repaid by the borrower must be given

- Prepayment penalties: The agreement must mention if there is any penalty that will be applicable in case the borrower repays the money before the term of the loan is over.

- Collateral: The collateral that has been provided by the borrower also must be mentioned.

- Default and events of default: The various acts and circumstances that will amount to an event of default must be laid down in detail. This is a very important clause.

- Remedies for events of default: The remedies that a party has when the opposite party commits an event of default must be specified so as to protect the rights of both parties.

- Representations and warranties of the lender: The lender will provide warranties and representations that he has the capacity to enter into this agreement and that there is no litigation pending against him etc.

- Representations and warranties of the borrower: The borrower will provide warranties and representations that he has the capacity to enter into this agreement and that he will use the loan for the purpose mentioned in the agreement etc.

- Modification of the agreement: This clause will state the manner in which the agreement may be modified by the parties.

- Termination of the agreement: Termination of the agreement is an important clause. It will lay down in what circumstances the agreement is to be terminated by the parties.

How to Draft the Loan Agreement?

Steps to follow while drafting a loan agreement:

- The parties between whom the contract is being created must be identified clearly. It must be mentioned whether the parties are individuals or companies.

- All the details surrounding the transaction must be negotiated between the parties – the loan amount, the frequency of payments, the date for repayment, the rate of interest, etc.

- All the decided terms must be laid down in the agreement itself, and there must be no room for any doubt regarding the intentions of the parties.

- The details regarding the collateral provided by the borrower must be stated clearly.

- The parties should take into account all the possible events of default and provide remedies for them.

- A strong dispute resolution mechanism must be in place.

- Once the agreement is drafted, it should be reviewed by both parties to ensure that their rights and interests are adequately protected under the agreement.

- The agreement requires to be signed by both parties and also notarized by a notary. This will help to validate the agreement and make it binding in nature.

Negotiation Strategy

- The basic strategy is to assure that the agreement is reasonable to both parties and that their interests are secured.

- It must be negotiated in a way that the agreement is unbiased and balanced and benefits both parties while providing for adequate remedies for both parties.

Benefits and Drawbacks of the Loan Agreement

The benefits and drawbacks of having a loan agreement:

- Having a written loan agreement is solid evidence of the fact that a loan has been provided to the borrower and that it is not a gift.

- This agreement helps both parties to reach a consensus on the various specific details that are involved in the loan transaction and avoids any confusion or misunderstanding in the matter.

- An agreement will distinctly lay out the terms and conditions of repayment of the loan along with the rate of interest that is applicable. This avoids any conflict between the parties.

- The agreement will also have a dispute resolution process in place as well as remedies in case of an event of default. This helps to protect the interests of both parties and will help the parties reach a solution if a dispute arises with respect to the terms of the agreement.

- In case the matter goes before a court, the loan agreement will help the court determine whether an event of default has occurred.

- If such an agreement is not in place, both parties may have limited or no remedies available in case there is a breach of the clauses of the agreement by the opposite party.

What Happens in Case of Violation?

Generally, loan agreements have a clause that talks about the actions to be taken when a party to the agreement breaches the clauses of the said agreement. Every agreement should have a detailed list of what acts or what omissions will amount to a breach of the agreement. It should have clauses detailing the actions to be taken by the lender when the borrower defaults on repayment of the loan or when either party disregards a covenant under the agreement.

When the borrower defects an installment, there might be remedies accessible to the lender. These might include the complete loan amount being due and payable on the date of default or the lender taking possession of or foreclosing the collateral provided under the agreement. The borrower would also be liable to pay the penalty for delayed payments.

A mandatory arbitration clause is present in many loan agreements and states that if a clause of the agreement is breached or if any dispute arises with respect to the terms of the agreement, the matter will be resolved by arbitration. The clause includes where the arbitration proceedings will take place, i.e., the seat of arbitration, the language in which the proceedings shall be conducted, and the manner in which the arbitrator shall be appointed. Parties prefer arbitration as it is a faster and cheaper process than going to the courts.

Alternatively, any other form of dispute resolution, such as mediation or negotiation, may also be mentioned in the agreement.

The agreement can also include that all disputes arising out of the agreement will be subject to the exclusive jurisdiction of a specified court.

In conclusion, a loan contract is essential to evidence the giving of a loan. This agreement helps to lay down the terms and various details relating to the loan transaction. It documents the amount that is being given as a loan and the amount that is to be paid back along with interest.

You can download a loan agreement template here.

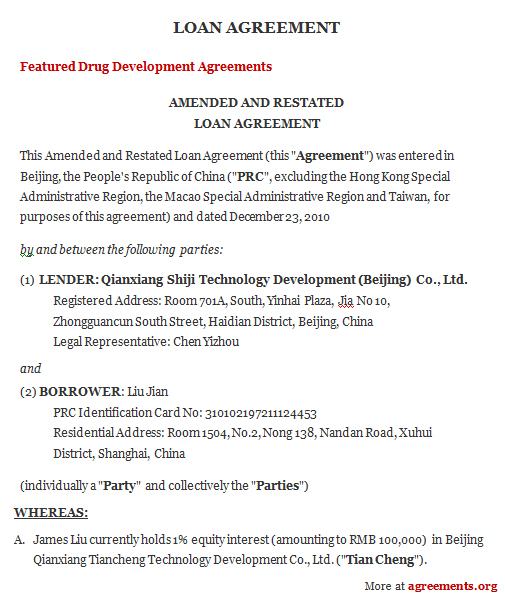

Sample Loan Agreement