Introduction to Liquidating Trust Agreement

Liquidating Trust Agreement is a contract for the creation of liquidating trust whose primary purpose is the liquidation of assets transferred to them for distribution to trust beneficiary. This Agreement is entered to effectuate the establishment of the Liquidation Trust and to effectively carry out the purpose for which the trust was established.

The Liquidation Trust is established to collect, administer, distributing, and liquidating the Liquidation Trust Assets. One such example of a liquidating trust is Recap liquidating trust. There should be a Liquidating Plan or a liquidating distribution which provides the manner and ways of disposal of assets. Liquidating Trust Agreement is created to give effect to such Liquidating Plan.

Parties Involved in the Liquidating Trust Agreement

Following parties are involved in the Agreement:

- Affiliated Persons: It means a Person

- who in his capacity as a director, trustee, officer, partner or employee of the Manager or of a person who controls, is controlled by or is under common control with the Manager or

- who controls, is controlled by, or is under common control with the Manager.

- Beneficiaries: A person who derives an advantage from the liquidation of trust.

- Liquidating Trustees: A person carrying out a winding-up process of the company.

Purpose of Liquidating Trust Agreement

Liquidation Agreement is entered into for the following purposes:

- A liquidating trust or a liquidation trust is created for efficient succession planning. Its sole purpose is to manage the assets on behalf of a third person who is the beneficiary. A liquidating trust typically does not enter into any business activity until and unless the same is essential for the management of the trust.

- Assets to be held, especially on behalf of a minor, may become susceptible to fraud or misuse. Liquidating trust prevents the same.

- A liquidation agreement acts as a framework within which the liquidation trust functions. It lays down in writing the terms and conditions which govern the trust, provisions for its termination, and when the assets vested in the trust would be conferred upon the beneficiary on whose behalf they are held.

Contents of Liquidating Trust Agreement

This Agreement includes the following:

- Definition: It contains the definition of various terms used in the trust agreement. Typically, technical terms used throughout should be defined here.

- Purpose of Liquidation Trust: This contains the purpose for which the Liquidation Trust is created. It is always for the benefit of a third party.

- Appointment of Liquidating Trustee: This clause provides for the manner, qualification, etc. for the appointment of liquidation trustee.

- Rights of Liquidating Trustee: This clause provides for the rights and liabilities of a liquidation trustee.

- Rights of Liquidating Trust Beneficiaries: This clause provides for rights available to beneficiaries of such trust.

How to Draft Liquidating Trust Agreements?

Following points are to be considered while drafting the Liquidation Trust Agreement:

- Disposal of Property: The Liquidating Trust Agreement should specify the complete way in which property needs to be disposed of for the purpose of Trust.

- Rights Powers and Duties: The Agreement should specify the rights, powers, and duties of the Trustees and beneficiaries to the Trust. This will help to prevent future conflicts or confusion that arose in the process of carrying out the purpose of Trust.

- Duration and Termination: The Agreement should provide for the duration of the Trust and mode of termination of the Trust.

Benefits and Drawbacks of Liquidating Trust Agreement

Following are the Advantages of the Liquidating Trust Agreement:

- Confidentiality: It helps to maintain the confidentiality of reports and other relevant data while Trust is engaged in liquidation of the Asset.

- Protection of weak: The creation of trust helps in the protection of interests of the weaker section and to prevent the oppression of minorities.

- Tax Planning: Since assets no longer belong to settlers and hence no tax can be levied as per the ownership of settlers. It helps in tax planning.

Following are the Disadvantages of the Liquidating Trust Agreement:

- Complexity: There is complexity in maintaining the structure of Trust.

- Distribution of Profits only: Liquidating Trust created with respect to Liquidating Trust Agreement distributes on profits and does not take into consideration loss distribution.

What Happens in Case of Violation?

Remedies available in case of violation of the Liquidating Trust Agreement:

- Mandatory Injunctions: The parties are also entitled to sue for mandatory injunctions for the breach of provisions of the trust.

- Damages

- Recession: Court can also order a recession of trust in case of violation of provisions of the creation of Trust.

- Restitution: Court can also order restitution for consideration paid by the parties in case the parties violate the terms of the Trust.

Liquidating Trust Agreement is an Agreement created for the purpose of liquidation of the assets. It is entered upon to provide a comprehensive mechanism and way for disposal of the asset. It also clearly specifies the rights, duties, and liabilities of both beneficiary and the Trustee to the Liquidating Trust. Although, the creation of the trust is a costly affair due to the complexity in carrying out the process of trust. However, such creation of Trust by laying down each and every detail in the well-written format will ensure the effective working of the Trust.

Liquidating distribution partnership also ensures that the weak group is also represented and gets their due share in case of liquidation of the Trust. It helps is providing due representation to the minority group and prevents any oppression faced by the weaker section.

Liquidating Trust also helps in Tax planning and ensures asset disposal in an effective manner.

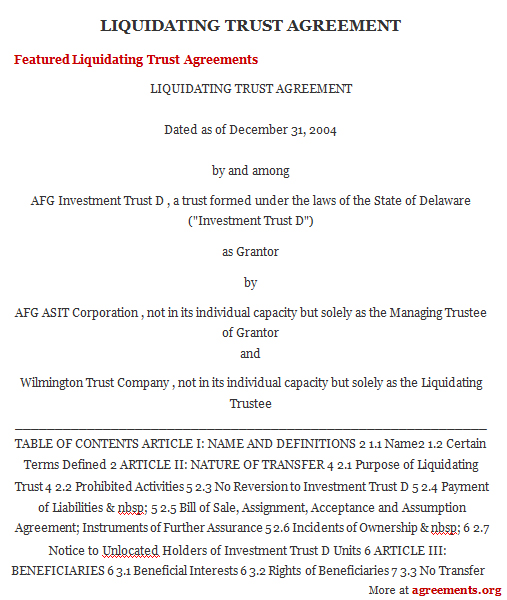

Sample Liquidating Trust Agreement

A sample of the Agreement can be downloaded from below.