An investment agreement is entered into between a company that requires funding and an investor who is willing to provide such funding. Typically, investors in lieu of their funding are granted equity shares or other such rights. An investment contract contains the terms and conditions governing such a relationship between the parties. For example, invested in a startup and, in return was granted 49% of the shareholding. Such shareholding would entitle A for voting rights and would enable him to participate in the functioning of the company. He would also be able to earn returns on the shareholding if the startup does well. An investment agreement outlines how this relationship will get manifested, what would A’s rights and obligations be, what rights will accrue to him, etc.

Purpose of an Investment Agreement

An Investment Agreement is entered into in order to document the terms and conditions of an investment arrangement or transaction. It enables companies in need of funds to raise them without any hassle. It also enables investors with surplus finance to invest such money in profitable ventures. An investment contract is entered into in order to match needs with the requirement. These are widely entered into the corporate world and hence need to be drafted carefully.

Inclusions in an Investment Agreement

An investment agreement typically includes the names of the parties, the effective date, the rights and obligations of the parties, the quantum of investment made, the shareholding or any other right granted to the investor and standard boilerplate clauses such as a waiver, notice, remedies, severability, dispute resolution and choice of law.

Key Terms in an Investment Agreement

Following are the key terms of an investment agreement:

- Number of Shares and nature of Shareholding: An investment contract should ideally contain the number of shares being allotted to the investor along with the paid up capital and the corresponding percentage of shareholding.

- Representations: Representations to the effect that shares are unencumbered, the promoter of the company holds the right to transfer the same and that the allotment of shares is occurring in compliance with laws that need to be made.

- Price: The price at which shares are allotted also needs to be included in the agreement.

- Conditions precedent: Any conditions which are required to be followed by the promoter or the investor prior to the vesting of obligations in them need to be mentioned in the agreement.

- Closing: This clause contains the date and venue when the closing of the transaction will take place and will be dependent on the conditions precedent being fulfilled.

Drafting an Investment Agreement

Following guidelines should be followed for drafting an effective investment agreement:

- The percentage of shareholding and the number of shares should be calculated properly. The nature of shareholding (equity/preference) should also be indicated.

- Recitals stating the purpose behind the investment should also be mentioned.

- The amount being invested or the consideration in lieu of shares should be included.

- Tax implications if any should be adequately captured in the contract.

- Compliance with applicable laws should be included in the condition precedents.

- The price of shares should be arrived at by following the applicable law.

- The total equity share capital of the company should also be mentioned.

- Risk mitigation clauses such as indemnity and limitation of liability should be included.

- The distribution of profits/losses, which right is conferred on the investor and how would it be exercised should be included in the contract.

Types of an Investment Agreement

There are two types of key investment agreements:

- Equity purchase agreement: In Equity purchase agreement, equity shares are allotted in lieu of investment.

- Convertible Debt Agreement: A convertible debt is also classified as equity; however, the option to convert is with the allottee. It needs to be converted within a stipulated time period.

Some other forms of investment agreements are:

Pros of an Investment Agreement

Following are the benefits of an investment agreement:

- No regular payments required for financing. The investors look for lucrative and higher returns of interest.

- Equity investors are also known as angel investors who are typically seasoned professionals who can offer expert advice and guidance to promoters of the company.

- It is beneficial for the investor as there is the potential to earn a lot more than traditional investments.

- It enables the promoter of a company in need of finance to avail of the same in lieu of its shares, hence making financing easy.

Cons of an Investment Agreement

An investment agreement has the following cons:

- The risk for the investor is higher, as the prices of equity shares are dependent on a number of factors, not all within the control of the promoters.

- The promoters in their bid to get finance also end up losing control over their company. Sometimes, the investors demand a majority stake, and the promoters remain as mere puppets in their hands.

- Promoters also have to deal with undue and unnecessary interference by investors.

- Finding the right investor is time-taking and may cause the business to suffer.

An investment contract is a commonly used document to capture the terms and conditions governing the relationship between the promoters of a company and the investor. Disputes as to ownership and control, returns on equity, etc. may arise. Typically, mediation and arbitration should be preferred over litigation as a method of dispute resolution.

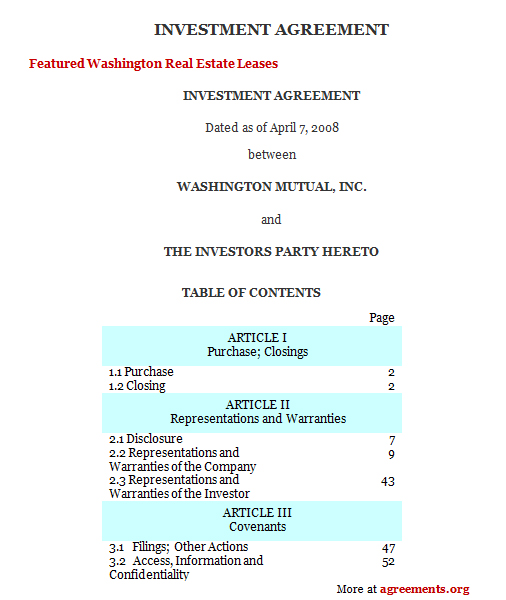

Sample Investment Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.

—————–