An insurance contract is an agreement to provide insurance. It can be defined as a legal document that highlights the responsibilities of both- the insurance company and the insured. It also specifies the policy terms and conditions of coverage. The contract specifies the risks that can be covered for a limited period of time.

What Is an Insurance Contract?

The insurance agreement is a legally enforceable agreement made between an insurance company and consumer for the financial protection of life or property of the consumer or ensures a reimbursement that the consumer will get in case of potential damages or losses in the future. This, however, differs from a temporary insurance agreement that confers a potential risk to the insurer at risk as the policy is not yet approved or issued.

These contracts are regulated by the state of law, and as such, they should be in a legal form. These contracts must comply with the requirements stated in the legal form and they should also be approved by the state insurance department.

Who Takes an Insurance Contract?

An insurance agreement is made between an insurance company or insurer and a consumer or insured for the protection of life or property from potential risk in monetary terms.

Purpose of an Insurance Contract

One of the purposes of the contract is the reduction of unidentified and potential risks involved in business exposure. It ensures reimbursement to consumers or insurers.

To enter into a contract, both parties must deliver what is promised. The insured should be of a sound mind and of legal age. On the other hand, the insurance provider must conform to any licensing requirements of the state.

Contents of an Insurance Contract

A well-drafted agreement to furnish insurance policy would require the below-mentioned inclusions.

- Name and address of the insurance company and insurer or consumer

- Date of the contract

- Duration of the contract

- Date of maturity

- Total policy amount

- Policy name

- Amount of premium to be paid

- Mode of payment

- Duration of payment i.e., monthly or quarterly or yearly

- Late fee charges if any

- Renewal date

- Grace period for the deposit of premium

- Terms and Conditions

- Details of termination of the contract

- Details of the nominee/legal heir

- Details of medical records of the insurer

- Accidental benefits applicable if any

How to Draft an Insurance Contract?

The process of drafting a contract is given below;

- First, mention the Name and address of the insurance company and insurer or consumer

- Then, the date of the duration of the ContractContract along with the date of Maturity

- Mention the total Policy Amount and Policy Name

- Mention the details of premium amount and payment mode, i.e., cash, cheque, online transfer, etc.

- Mention the duration of Payment, i.e., monthly or quarterly or yearly, late fee charges if any and Grace Period for the deposit of Premium if any

- Mentions the date of renewal along with other terms and conditions

- Details of termination of Contract

- Details of the nominee/legal heir

- Details of medical records of the insurer

- Accidental benefits applicable if any

The Insurance Agreement must explicitly state if the insurance company shall fund a buy sell agreement insurance, that will help the insured against sudden departures, or deaths.

The following are some of the negotiation strategies that can be applied in a contract;

- First, know the terms and conditions of the Contract

- Analysis of the main point and need for investment

- Calculation of break-even points and weighted averages

- Analysis of the provided data

- Assessment of market leverage

- Consideration of legal requirement

Benefits and Drawbacks of an Insurance Contract

The following are some of the main benefits of a contract;

- Protects against liabilities

- Replaces income

- Covers business property

The following are some of the drawbacks of a contract;

- Denies claims or pays slowly

- Adds additional expense

What Happens in Case of Violation?

The violation of an insurance agreement completely varies depending on serval cases. For example, at times, consumers fake the death of the insured to get the total policy amount, which may lead to civil as well as criminal action by the insurance company against the insured. Likewise, an insurance company can also reject a claim asserting a breach to the terms and conditions of the contract, in this case, the insured can sue the insurance company and claim damages and losses in the court of law.

An insurance contract isn’t a new concept as it has been providing financial protection for the consumers in case of loss of property or death of the consumer. The need for insurance agreement is unavoidable and is legally enforceable for all the insurance companies across the globe.

[Also Read: Insurance Plans Agreement]

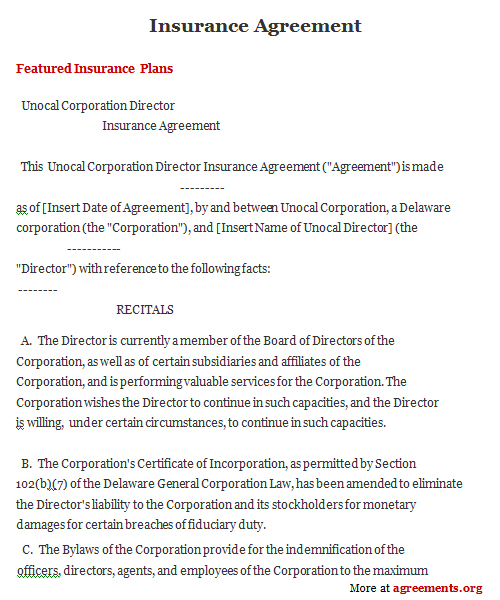

Sample Insurance Agreement