An Installment purchase agreement is a contract entered into by the buyer and seller wherein the former pays the consideration of the purchase in tranches or installments on a regular basis, until the total amount has been paid. Such an agreement is agreed upon on occasions when goods to be purchased are expensive and the buyer is unable to pay the amount in lump sum during the purchase.

With an increase in the complexities and well as the exponential rise in the number of transactions that relate to sale and purchase of goods and services among parties, Installment purchase agreements have soon become one of the widely and extensively used type of agreements in businesses all over the world.

When Do You Need an Installment Purchase Agreement?

The basic purpose of entering into this agreement is so that the obligation of the buyer to pay the consideration for the goods purchased becomes well defined through the terms and conditions of the agreement. This way, the buyer becomes legally bound to pay the whole amount to the seller on the default of which, he may be liable to pay damages.

An Installment contract frees the seller from any stress that he might incur with respect to receiving his payments since he is sure to receive all installments as per the conditions laid down in the agreement.

Before entering into the Installment purchase contract, you need to consider certain important factors such as mode of payment by the buyer, the duration within which the installments are to be completed, etc.

Inclusions in an Installment Purchase Agreement

The following information should be included while drafting an Installment purchase contract:

- Consideration or the total amount of the sale transaction that is involved in the Installment purchase contract.

- The Installment plan that provides for the time frame and the interest rate of each Installment.

- Warranties, express or implied, that the seller may have made with respect to the goods such as its quality, the condition in which it is to be delivered to the buyer, replacement or repair in case of defect, etc.

- Action in case of default of payment such as penalties, if any.

How to Draft a Instalment Purchase Agreement

The process of drafting an installment purchase agreement template has been explained succinctly in the following points:

- Mention the identity of the parties as well as the date of the agreement. This is important so as to assign rights and obligations of each party.

- Describe the goods or services that are being rendered via the agreement.

- The next step is to mention the terms of payment including the Installment schedule, the mode of payment, etc.

- The agreement should also include the details about the delivery of the goods or services such as the place and mode of delivery, the cost incurred, the liability incurred in case of failure to deliver the correct goods or services, etc.

- Parties can also include the warranties as mentioned in the previous section and provisions dealing with the breach of contract, confidentiality terms, etc.

Benefits of an Installment Purchase Agreement

- It enables buyers to purchase goods that are expensive

- It eliminates middlemen by directly striking a deal between the buyer and the seller, thus stabilizing the price of the commodity or service.

- It widens the market for sellers looking for purchasers to buy their service/goods.

- It helps businesses grow without having to bear a monetary burden with respect to their purchases.

Important Clauses/Key Terms in an Installment Purchase Agreement

It would be most appropriate if you understand and enter the following key terms into the agreement:

- Jurisdiction: it specifies which court would have jurisdiction in case a dispute arises between the parties with respect to the term so the agreement.

- Dispute Resolution: It specifies the remedies available to the parties in case of dispute such as arbitration, mediation, etc.

- Obligations: it specifies the conduct of each party with regards the transaction as specified in the agreement.

- Insurance: It specifies the terms of insurance with regards the goods or services being rendered in the contract.

What happens when the Installment Purchase Agreement is Violated?

In case the agreement is violated by any of the party, the violating party has to suffer the liability as imposed by the terms of the agreement. These may include payment of damages, payment of interest on delayed payments, etc.

In fact, the party suffering from the breach of contract can also approach a court of law so as to initiate civil as well as criminal proceedings against the defaulter and to seek a mandatory injunction from the court with regards receiving his due right as per the terms and conditions of the Installment purchase contract.

These days, most Installment purchase agreements contain an arbitration clause that lets them resolve their dispute by referring the matter to either arbitration or mediation or even conciliation wherein, a third party intervenes to understand the dispute and resolve the same amicably without having to enter into prolonged litigation.

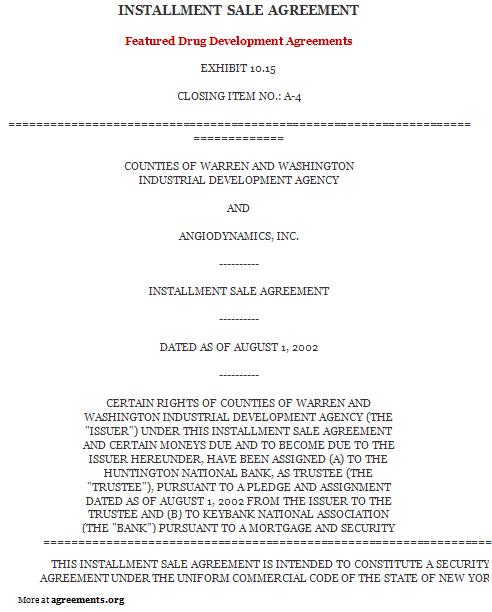

Sample Installment Purchase Agreement

An Installment purchase agreement is a great way of selling goods thus assuring the seller of his payment and helping the buyer purchase without shelling out a huge money at once. You can download a installment purchase agreement form here.