As the name suggests, incentive stock options are an incentive offered to the employees so that they remain in the company for a long time. They are offered as rewards to attract new employees in place of higher salaries. Also known as incentive share options or qualified stock options, they also give tax benefits to the holder.

These options give the employees the right to buy the company’s stock at a pre-decided price at a later date as per the agreement between the employee and the company. However, employees usually have to hold on to the option for a long time before they can exercise it to get a favorable tax cut.

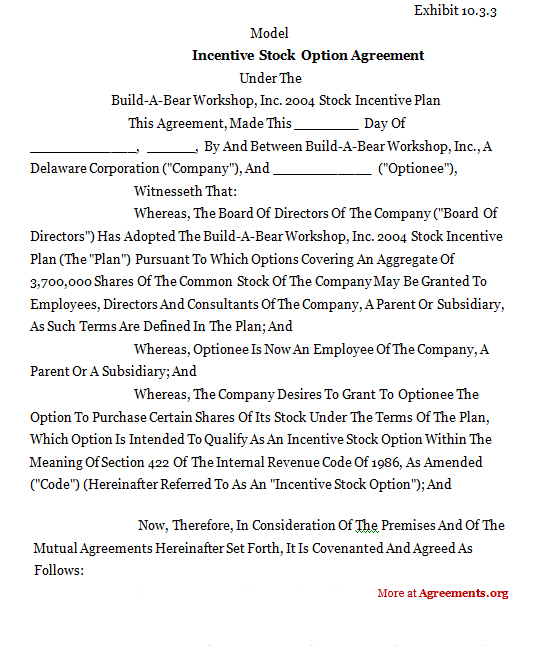

Incentive Stock Options Agreement

Incentive Stock Options is an agreement between a company and the employee to whom the options are offered. It contains conditions such as granting the option, the price at which it is offered, how and when it can be exercised, and any other related term.

There are certain incentive stock options requirements to be met before an option can qualify as one. These are stated in the Internal Revenue Code (Title 26 of the United States Code).

Key Terms of Incentive Stock Options Agreement

The following are some of the important terms to be included in the agreement:

- Names of the parties

- Granting of the option

- Duration of the option

- Vesting Schedule

- Manner of exercising the option

- Rights of the company

- Taxation provision

- Restriction on transfer of shares

- Clawback provision

- Governing law

- Confidentiality

- Signature of the parties

These terms must comply with US security and tax laws.

How to Draft the Incentive Stock Options Agreement

There are some points to understand when drafting an incentive stock option plan agreement.

- Grant of the option: Under this clause, clearly state that the company grants the right and option to the employee to purchase a certain number of shares at a fixed price as per the terms agreed between them. Also, mention the date when the option is granted.

- Mention the duration for which the option is available to the employee. The start and end date of the period must be included. The offer period for such an option is always ten years. However, it may be terminated early if the employer terminates the employee from his employment for reasons stated in the employment contract. This clause should also explain what happens to the option in case of death or disability of the employee.

- Vesting schedule: It has to be followed before an employee can exercise the option. It sets a timeline as to when the employee would be able to exercise his option. For example, an employee may become fully vested after three years of the date of grant. He/she will be able to exercise complete the complete option. Vesting can also be graded- only a certain percentage of the option will vest with the employee after a particular time period. For instance, one-fourth of the options will be vested after two years from the date of the grant. Another one-fifth of the option will be vested at the end of the next year and so on. It depends on the employer what kind of schedule it wants to follow.

- Mode of exercising the option: This clause should clearly state the manner of exercising the option, such as the issue of notice to the company stating the number of stocks with regard to which it is being exercised. It must contain the mode of payment to be made to the company.

- Include a provision giving the company certain rights to buy back the stock from the employee. For instance, if the employee proposes to sell some of the stock received by exercising the option, the company has the right to be offered the stock before anyone else.

- State how the options will be taxed in accordance with the relevant laws.

- To provide greater control to the company, a provision can be included that restricts the employee from transferring shares received under this agreement to any other party for a certain period of time.

- Clawback provision: Clawback provision includes a provision that allows the company to cancel the option under certain circumstances. For instance, if it is not able to meet the financial obligations under the option.

- Mention which state’s law will be the governing law for this agreement. It avoids jurisdictional disputes in case the parties take the matter to court.

- Since the agreement contains sensitive commercial information, including a confidentiality obligation to prevent the spread of such information.

In addition to the above points, a clause can be included that states that the agreement does not obligate the company to continue the employee’s employment and that it shall be governed by the employment contract and not this agreement.

Pros and Cons of Incentive Stock Options Agreement

Pros:

- These incentive stock options provide employees with additional income over and above their salaries. They are more likely to serve the company longer.

- If all conditions are followed, the income from these options is not taxed as regular income but under long-term capital gains.

Cons:

- When an employee sells these options, he/she may end up paying more tax than usual for that year.

- Any transaction related to these options has to be tracked and reported by the employees because the employers cannot withhold any tax with respect to these options.

Sample for Incentive Stock Options

A sample of the Incentive Stock Options agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.