A health realty income trust agreement is a legal contract between the Settlor or Sponsor who invests in healthcare facilities and the beneficiary to whom the income generated from these facilities accrue. There is a trustee in the agreement who has to ensure that the funds invested by the beneficiaries are properly managed. There is a REIT manager providing management services and a property manager providing property management services. Usually, both the manager and property manager are owned by the Sponsor. The income received by the beneficiaries is net of REIT manager fees, property manager fees, trustee fees, and other expenses. The unit holder has the right to remove the REIT manager or trustee.

When Do You Need Health Realty Income Trust Agreement?

This agreement is required when a REIT dealing in health realty needs to be formed. The purpose of the agreement is to ensure that the rights of the investors in commercial real estates which receive income from facilities that provide human services and health care services. The investors are the beneficiaries in the trust and it is the responsibility of the sponsor or the trustor to generate revenues from the properties owned by them. The trustee, one of the parties to the agreement, ensures that the funds invested by the investors or beneficiaries are not misused. A trusted name in the commercial real estate space is health realty income trust agreement.

Inclusions in Health Realty Income Trust Agreement

This agreement has 3 parties to the agreement namely the sponsor or trustor, the trustee, and the beneficiary or investor who need to be included in the agreement. If the REIT manager and property manager are not owned by the trustor, they then need to be separately stated. The health realty trust agreement must include the effective date, duties of the manager, qualification as a REIT, fidelity bond and limitation of liability, the compensation payable to the manager as well as expense limitations, and limitations and termination of services. The responsibility of the trustor, as well as the trustee, should be clearly defined. The terms of appointment and termination of the trustee need to be clearly stated.

[Also Read: Trust Agreement]

How to Draft Health Realty Income Trust Agreement

Here is the procedure for drafting a Health Realty Income Trust Agreements:

- First and foremost, the names of the parties to the agreement as well as their relationship must be clearly stated.

- The rights and responsibilities of all the parties to the agreement must be mentioned.

- The compliance with regard to the relevant state law should be clearly mentioned

- The circumstances under which the services of the trustee or REIT manager can be terminated have to be clearly spelled out.

- The fees to be paid to the property manager, REIT manager and trustee need to be incorporated in the agreement.

Benefits of Health Realty Income Trust Agreement

The benefits of having a Health Realty Income Trust agreements are as under:

- Clearly defined roles of the service providers namely the sponsor, REIT manager, and property manager. This helps in performance evaluation, and remedial action can be taken when required.

- Protection of interest of the beneficiaries or shareholders by the trustee. This will ensure that the investments made by the sponsors and income distribution to the shareholders are done in accordance with the terms and conditions of the agreement.

There are certain drawbacks posed by Health Realty Income Trust agreements

- The beneficiaries may terminate the services of the REIT manager due to the poor performance of the REIT which may be related to general market conditions or other unavoidable situations.

- There are strict compliance issues which if violated results in the dissolution of the trust.

Key clauses in Health Realty Income Trust Agreement

The key terms in a Health Realty Income Trust Agreement are:

- Meeting the statutory requirements required to qualify as a REIT

- Compliance with the state laws in which it is operating

- Duration of the trust

- Title of the properties being invested in through the trust, their geographical location and sector exposures

- Information to be provided to the shareholders or beneficiaries regarding the performance of the REIT

- Other investment information such as dividend policy and fees or charges

- Information regarding the REIT manager such as experience and track record

- Disclaimer with regard to the various risks

Download Health Realty Income Trust Agreement

If you are planning to invest in commercial real estate through a Trust, then a Health Realty Income Trust Agreement is advised to protect the interest of all parties.

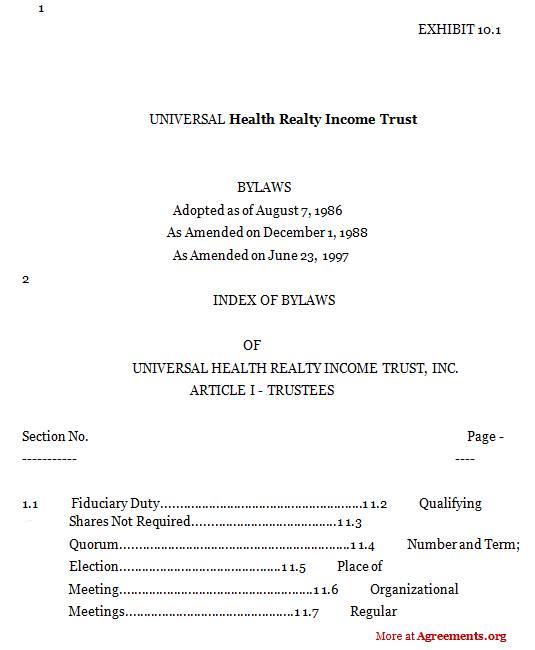

You can download a sample Health Realty Income Trust Agreement below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.