A Guaranty Agreement is a formal document in which one person takes the responsibility of making payments on behalf of another in case the defaulter is unable to make the payments. The person giving the guarantee is called the ‘surety’ or guarantor, and the person to whom the guarantee is given is called the creditor and the person on whose behalf the guarantee is provided, in case he makes a default in payment is called the ‘debtor.’

A guaranty agreement is an agreement that outlines the conditions under which guarantee is extended to the debtor. The legal definition of guarantee is an obligation undertaken by a third party to repay the loan of the debtor, which he owes to the creditor, in case he defaults or fails to pay. The third-party is called a guarantor. The debtor may be a person or a corporation. The agreement is signed only by the guarantor. However, it binds three parties – the creditor, debtor, and the guarantor.

The laws of most states mandated a guarantee agreement to be in writing and delivered to the creditor. It is generally governed by the law of contracts.

Purpose of a Guaranty Agreement

It serves as a security for the loan taken by the debtor. If the debtor fails to pay the amount, the creditor can recover it from the guarantor. A guaranty allows a borrower with a poor credit score to avail of a loan with the help of a guarantor who has good credit. In the absence of a guarantee, the former may not be able to get a loan from a lender. For lenders, it serves as a certainty that they will recover their amount. The guarantor may recover the amount from the debtor, depending on the agreement between them.

Key Terms of a Guaranty Agreement

The following key terms must be incorporated in a Guaranty Agreement:

- Identity of the creditor

- Name of the debtor

- Name of the guarantor

- Description of the guarantee

- Amount to be paid under the guarantee

- Form of payment

- Representation and warranties by the guarantor

- Right of subrogation

- Notices- How and where to be served

- Governing law of the contract

- Signature of the guarantor

Drafting a Guaranty Agreement

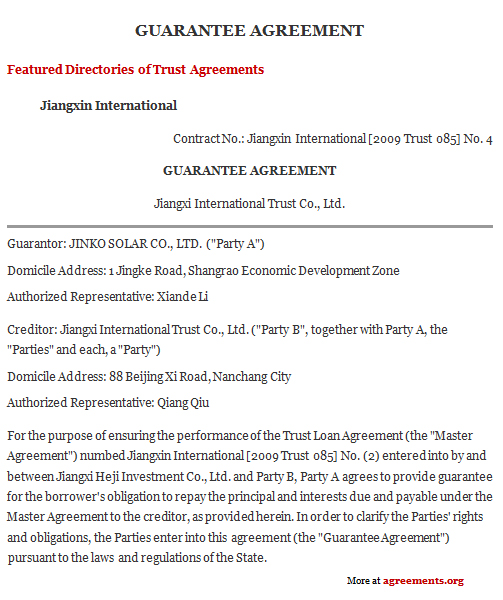

- One of the most important points to remember while drafting an agreement of guarantee is to clearly mention the identities of the creditor, debtor, and the guarantor. Their names and addresses, along with any other specific identification, should be mentioned to avoid any confusion.

- The clause describing the guarantee must state its exact nature- whether it is absolute, conditional, continuing, or a payment guarantee. Any ambiguity in this clause can render the entire agreement open to dispute.

- The nature of the guarantee will determine the amount to be paid under the agreement. The mode of payment should also be clarified in the agreement.

- Representations and warranties should be included so that the beneficiary of the agreement can make an informed decision.

- It is important to include the right of subrogation, which states that the guarantor will step into the shoes of the creditor soon after he has discharged his obligations under this agreement and will be eligible to recover the amount from the debtor. It is as if the creditor has assigned his rights to the guarantor. This allows the guarantor to recover his amount.

- Specify which state’s law will govern the agreement in case of a dispute. Since different states in the United States of America have some differences in the laws regarding the guarantee, this clause helps to eliminate any ambiguity regarding the jurisdiction and related procedures.

- Ensure that the agreement is signed by the guarantor or his authorized person.

Types of Guaranty Agreement

The different types of guaranty agreements are:

- Absolute guaranty: Such a contract has no conditions that restrict the invocation of guarantee agreement by the creditor. If there are no conditions written, the guarantee is assumed to be absolute.

- Conditional guaranty: Under such an agreement, the guarantee is not automatically invoked after the debtor defaults. Some other condition has to be met on the creditor’s part.

- Personal guaranty: Under this agreement, the guarantor is made personally liable if the debt is not repaid. It is done with the help of a carefully drafted personal guarantee form. For example, if a corporation takes a loan, its director can act as a guarantor. He undertakes that if the debtor (his corporation) fails to repay the loan, then he will pay for it in his personal capacity. Such a personal guarantee may or may not be backed by security (for ex- the guarantor’s house).

A personal guaranty clause may be included in a promissory note. In a promissory note with a personal guarantee, the latter acts as security for the former. The note expresses the borrower’s intention to pay the lender as per its conditions. The personal guarantee acts as a security for the lender that it will recover the amount.

- Guarantee bond: Companies and governments issue bonds to raise funds from investors. The principal is repaid after a fixed period of time. During the subsistence of the bond, the issuer (the debtor) pays interest periodically to the investors as a return on their investment. But since bonds have an inherent risk, the issuer seeks an additional guarantee for the bond from a third party, like a bank or an insurance company. They guarantee timely payment of interest and principal, thereby mitigating some of the risks. Such a bond is known as a guaranteed bond.

- Lease guaranty bond: When leasing out a property, landlords in some cities demand a guarantee from the tenants to make sure that they will pay the rent. The resultant agreement between the landlord (the obligee), the tenant (the principal), and the guarantor is called a lease guarantee bond.

- Payment guarantee: This agreement places an obligation on the guarantor to pay the amount due at maturity if the debtor fails to repay it at that time. The creditor does not have to demand payment from the debtor. The obligation is automatically invoked on a fixed date when default occurs.

- Collection guarantee: This agreement states that the creditor shall first seek payment from the debtor and exhaust all remedies available to it. Only if it is unable to recover the amount will the guarantor step in to pay.

- Performance guarantee: Such a contract places an obligation on the guarantor to perform a condition on behalf of the debtor for the advantage of the creditor.

- Continuing guarantee: This agreement extends the guarantee to a series of transactions that may take place in the future.

- Upstream guarantee: This agreement is used to guarantee the obligations of a parent corporation where the subsidiary acts as a guarantor.

- Cross-stream guarantee: This contract is among affiliated corporations whose stock is owned by the same parent company.

[Also Read: Collateral Agreement]

Download Sample Guaranty Agreement

A template of a Guaranty Agreement can be downloaded from below.