A Funding Agreement is a legal contract between a company and a financier. As there are two parties to the contract, hence it is known as a bipartite agreement. The funding is required when the company plans a project. The project planners lack the funding capabilities, so they look for financiers or other entities to fund the project.

Project finance is used in long-term infrastructure and industrial projects. This financier extends the funds depending on the cash flow of the project. The assets, rights, and interests of the project are held as collateral. There are significant risks during the construction phase as there is no revenue stream at this point. Debt servicing begins only in the operational phase of the project.

When Do You Need A Funding Agreement

A funding agreement is required when a company does not have sufficient funds to implement a project and has to take the assistance of a financier.

The purpose of a funding agreement is to enable the company executing the project to get the funding for it through a financier. The financier looks at the project proposal and the background of the company implementing the project before signing the agreement. There is quite a long gestation period between the time the agreement is signed, the funds are disbursed and the project starts generating adequate cash flows. The financier gets their own experts to verify the viability of the project before agreeing to it.

Inclusions In A Funding Agreement

A funding agreement is a bipartite agreement, so the name of the company in charge of executing the project and the financier should be included in the agreement. The agreement should also include the effective date of the agreement, the loan commitment, how the proceeds of the loan will be utilized, penalties for any time and cost overruns, provisions for contingency reserve in the event there is an additional funding requirement by the borrower, quality of work including penalties for defective work that has not been rectified.

There should be a mention of the interest rate for the loan being granted including the method of calculation of the interest rate. There should be a default rate, which would be higher than the normal rate, in the event of any default. The monthly debt service payments also need to be mentioned including the date on which they are due.

How to Draft A Funding Agreement

While drafting a funding agreement, the following points need to be kept in mind:

- The names of the parties to the agreement, the company executing the project and the financier, should be mentioned. The relationship between them also needs to be stated

- The interest rate at which the loan is being given and the calculation thereof also should be mentioned. Any provisions regarding the escalation of interest due to delays needs to be incorporated

- The events which lead to the termination of the agreement need to be stated clearly

- The applicable laws of the state under whose jurisdiction the agreement is being prepared also needs to be mentioned.

- Prepayment clause, including voluntary prepayment if allowed should be mentioned.

- The borrower has the right to voluntarily render the contract null and void

Benefits Of A Funding Agreement

The benefits of a funding agreement are as follows:

- Helps companies to avoid the issuance of corporate repayment guarantee, and this does not appear in the balance sheet

- The risk of the sponsor is shared with other stakeholders. The risk is spread through a network of security arrangements, contractual agreements as well as supplemental credit support to other financially stable entities willing to share the risk.

- The financier has the right to decide how the free cash flow that is left after payment of operational and maintenance expenses, will be deployed.

- The financier is able to maintain the confidentiality of information and gain a competitive edge. If financing is done through the capital market, project related information will have to be shared with the public.

Types Of Funding Agreement

The types of funding agreement are:

- Share capital: Financing a project may be implemented through equity and preference shares of the company. Equity shareholders have the right to vote but are paid dividends after preference share holders.

- Term Loans: Terms loans can be availed of through financial institutions and commercial banks.

- Debentures: Finances for a project may be raised through both convertible and non-convertible debentures. Convertible debentures are converted wholly or partly to equity shares.

- Unsecured loans: Loans for project financing can also be raised through unsecured loans, but this is risky for the lender as they may not get back their loan.

Key Terms In A Funding Agreement

The key terms of a funding agreement are:

- Loan commitment: The lender agrees to extend the loan and the borrower decides to accept it.

- Interest rate: The interest rate on the outstanding principal and the calculation of the interest

- Loan payment: The monthly debt service payments, payment on maturity date and late payment charges

- Prepayments: Voluntary and mandatory prepayments as well as prepayments after default

- Defeasance: If there is no default, the borrower may defease the loan. This means to render the loan null and void

- Release of property: If the borrower decides to defease the loan, this leads to release of lien on property

When a financer is required to fund a project by an organization, then a funding agreement is required.

You can download a funding agreement sample here.

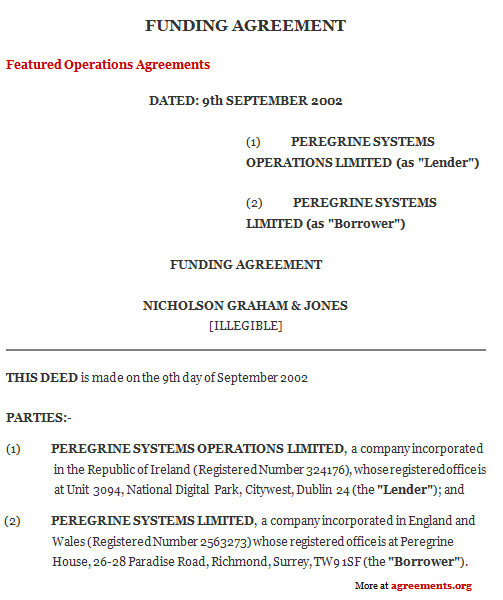

Sample Funding Agreement