A Forbearance and loan restructuring agreement allows the debtor some financial relief by postponing the foreclosure and, at the same time, modifies the loan agreement terms to enable the debtor to pay off the loan. These can also be characterized as two separate agreements. If a temporary hardship causes the delay in payments, then a forbearance agreement would allow the debtor to avoid foreclosure until the situation gets improved. A loan modification or loan restructuring agreement, on the other hand, modifies the basic terms such as interest rates, due dates, and other obligations contained in the loan agreement. However, the two may be clubbed together and constitute a single forbearance and loan restructuring agreement.

A forbearance agreement is also in the nature of a mortgage forbearance agreement, wherein, in lieu of postponing the foreclosure of the loan, the creditor mortgages certain property of the debtor. This may be in the form of forbearance and loan restructuring as well.

Purpose of a Forbearance and Loan Restructuring Agreement

The purpose behind a forbearance agreement is to provide temporary relief to the debtor from paying off his debts. It prevents the invocation of foreclosure against the debtor until his financial situation improves. A loan restructuring is done when the debtor is not able to pay the loan even after the forbearance. Whenever the two are clubbed together, one should precede the other. An unlimited timeline for forbearance should not be provided.

Inclusions in a Forbearance and Loan Restructuring Agreement

The following inclusions should be there in forbearance and loan restructuring agreement:

- Names of parties: If any new creditors are added, that should be reflected.

- Timeline of forbearance.

- Standard boilerplate clauses which inter alia include, dispute resolution, waiver, effective date, and severability.

- References to the earlier loan agreement.

- The stipulation of loan amounts.

- Remedies should be curated with great care, and all possible legal remedies should be included.

- Statements are confirming that apart from the mentioned changes, the rest of the terms remain unchanged.

Key Terms of a Forbearance and Loan Restructuring Agreement

Following key terms need to be included in forbearance and loan restructuring agreement:

- Forbearance/Forbearance Period: A forbearance and loan restructure agreement should contain the timeline up to which the foreclosure would be delayed. An unlimited timeline should never be provided. Typically, 180-240 days may be provided to the debtor to improve his financial situation.

- Additional loans: If, as a part of the loan restructure, any additional loans are being advanced, then those same needs to be captured in the agreement. The purpose behind such loans should also be included. They should be made subject to the original terms of the loan.

- Collateral: If the agreement is in the nature of a mortgage forbearance agreement, then new collaterals may be added. The same should be captured.

- Amendment to definitions: Any new definitions which may be added as a result of the modification of terms should be included.

How to Draft the Forbearance and Loan Restructuring Agreement?

The below guidelines need to be followed in order to draft an effective forbearance and loan restructuring agreement:

- The agreement should always begin with references to the earlier agreement.

- Recitals of the agreement should clearly state the reason behind forbearance and loan modification.

- The loan amounts (earlier and if any freshly advanced), should be mentioned in the agreement.

- If the forbearance is in the nature of mortgage forbearance agreement, then this understanding should be captured.

- The introduction of new collaterals may also lead to an amendment in other terms. Such implications should be taken care of.

- The timeline for forbearance should not be too long and should have certain conditions attached to it.

- Events of default should also be reviewed. If new parties are added, it is better to negotiate the modified terms before inclusion.

- Any varied interest rate should be mentioned.

Benefits of a Forbearance and Loan Restructuring Agreement

The following are the benefits of forbearance and loan restructuring agreement:

- The debtor gets temporary relief and gets more time to arrange for the money.

- Reduction in interest rates and modification of other terms of the agreement facilitates the repayment of the loan.

- It prevents loans from becoming non-performing assets.

- More collaterals or security in favor of creditor keeps assured that their loan will be repaid in due time.

Cons of a Forbearance and Loan Restructuring Agreement

Following are the cons of a forbearance and loan restructuring agreement:

- Extension of time may not lead to repayment.

- The inclusion of more collaterals and additional loans may increase the difficulties of the debtor.

- Many times, interest rates are increased in lieu of forbearance; such modification may not help the debtor in repayment.

- A debtor may routinely request forbearance, and this can pose to be a problem for the creditor.

Forbearance and loan restructure agreement, creates a positive environment for loan repayment and takes into account any hardship which the debtor may have. However, it is a very complex agreement and should be drafted carefully. Owing to the nature of this agreement, it is prone to disputes, and hence, the dispute resolution clause should be drafted carefully. Remedies such as initiation of bankruptcy proceedings against the debtor in the event of non-payment should also be included.

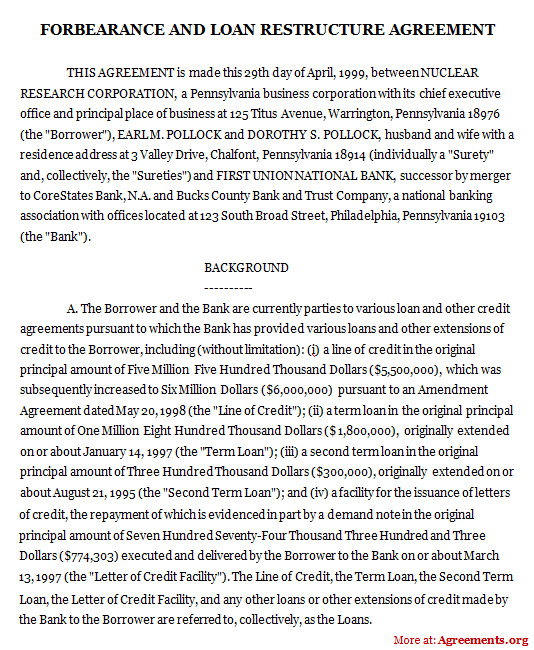

Sample for Forbearance and Loan Restructure Agreement

A sample of the Forbearance and Loan Restructure Agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.