A Brief Introduction About the Forbearance Agreement

A lot of people need loans today. Some take it for their house, some take it for health, and some take it for their kids’ education. There are individual entities as well as organizations that provide mortgage loans to people in need. Both parties share a lender-borrower relationship.

However, there comes a situation sometimes when the borrower is unable to make the payments, or he or she defaults. This could happen for various genuine reasons, too, such as unexpected expenses, unanticipated health issues, etc. In such a situation, if the lender decides not to impose foreclosure and decides to decrease mortgage payment or cancel it for a particular time, this agreement is drafted. Forbearance literally means holding something or refraining from the enforcement.

It then becomes the borrower’s responsibility to give the full payment at the end of the period, including other expenses such as tax, insurance, etc. A borrower must also agree for a Forbearance Agreement. These agreements depend on situations, borrowers, and lenders. Everyone can have their own ways of drafting this agreement. It contains all the information related to the forbearance.

Another name for the Forbearance Agreement is Forbearance Loan Agreement and Forbearance Mortgage Agreement.

Who Takes the Forbearance Agreement? – People Involved

The agreement is signed between two entities. One is known as the lender, and the other is the borrower. The lender can be an individual or an organization. In this agreement, the lender promises not to enforce the legal remedy that it has for default or no payment. The borrower also promises that after a certain period, he will make the full payment. The agreement legally protects both parties and spells out each entity’s responsibilities.

Purpose of the Forbearance Agreement – Why Do You Need It?

This agreement is not a solid solution for all default-related problems in the business of mortgage loan. However, it is a great remedy for borrowers who are unable to pay due to genuine reasons and unforeseeable financial troubles. Borrowers manage to buy more time to make the payments.

Here are some pointwise reasons to sign this agreement –

- It avoids foreclosure

- It ensures that the borrower doesn’t get punished for an unforeseeable situation or poor financial condition

- It gives the borrower more time to arrange the money

- It is also beneficial for the lender who might earn more in the form of interest, insurance, principal, by giving extra time to the borrower

Contents of the Forbearance Agreement – Inclusions

Like most other lease agreements, the Forbearance Agreement also contains the basic details of the involved parties such as names, addresses, phone numbers, etc.

- It will further have details about the loan taken by the borrower and how much of it has already been paid.

- As mentioned above, for each situation and lender, the terms of this agreement can differ. The agreement will have the testimony of the lender where he admits that there won’t be foreclosure until a particular period of time, and he will allow payment skipping until the loan’s balance is stable. Generally, lenders allow borrowers until their financial condition becomes stable.

- Some lenders only charge interest rates while others may ask for interest rates, principal, insurance, and taxes, which should be clearly stated in the agreement.

How to Draft the Forbearance Agreement?

Here are a few things to keep in mind while drafting this agreement –

- Both parties should first discuss the terms and conditions of forbearance in person

- The borrower should be honest about his financial state or abilities

- The borrower should set the expectation right

- The terms should be negotiated by both parties

- Parties should be clear about the applicable clauses of the original loan agreement

- Both parties should sign the agreement only after reading all the provisions and terms

- The borrower should have a good credit history so that the lender can trust him

Negotiation Strategy

Negotiations are one of the most crucial aspects of this agreement. The borrower has to do a lot of negotiations to duck the foreclosure and avoid additional costs such as taxes, insurance, interest rate, etc. A healthy relationship between both parties ensures that the borrower can take time for as long as his financial condition doesn’t allow him to pay the full loan. If the borrower’s credit history is not strong enough, he can convince the lender through negotiations.

Benefits & Drawbacks of the Forbearance Agreement

Here are some benefits of the agreement –

- It gives short term relief to the borrower

- It opens up ways for the lender to earn a little more

- It reduces the pressure of the borrower

- It avoids foreclosure

- It is legally binding

- It protects both parties and lists out their responsibilities

- The underline loan document still stands

Here are some drawbacks of this agreement –

- It can be risky for both the parties

- The terms of the agreement are not standard, and the lender decides them

What Happens in Case of Violation?

The provisions of the original loan agreement hold true even after this agreement is signed. Those provisions would mostly be about dispute resolution, governing laws, the result of defaults, etc. This agreement is also one that is legally binding that protects both parties. If the collateral is involved, upon default, the lender can own it. Both parties can also take the help of the court. Both parties should read the governing laws before signing the agreement to avoid any dispute or misunderstanding.

Key terms of the agreement vary depending on the situation and the lender. Depending on the key term, there can be different types of Forbearance Agreement. There is also Student Loan Forbearance, which is really common among other loan forbearance. This agreement is not a long-run solution, but for borrowers, it is a temporary relief. If drafted well, the agreement can be beneficial for both parties. Thus, it is important to draft the agreement very carefully. You can also take the help of an expert.

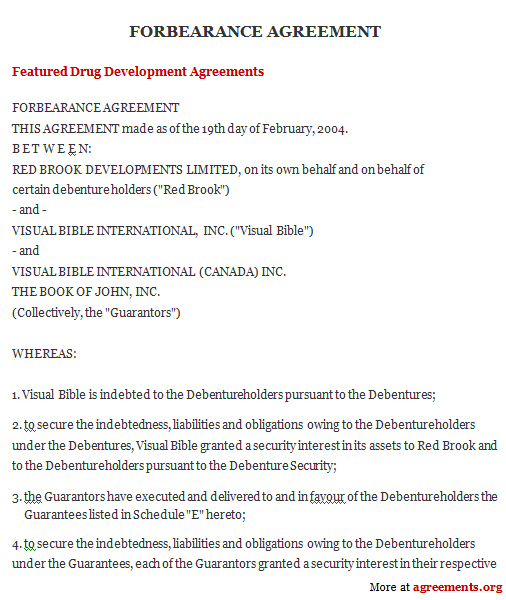

Sample for Forbearance Agreement

A sample of the agreement can be downloaded from below.