What Is a Facility Agreement?

A corporate loan is often called a ‘facility’ provided through the bank to the borrowing company, and so, a corporate loan agreement is also recognized as a facility agreement.

A facility agreement amid the bank and the borrower states the terms laid out in the term sheet in the form of a binding legal agreement. It comprises the details of the loan, the manner in which the loan would operate, and the terms and conditions that are required to be fulfilled by the parties towards the agreement.

When Do You Need a Facility Agreement?

Facility agreement is also recognized as a loan or credit facility agreement or facility letter. An agreement or letter in which a lender (typically a bank or any other financial institution) states the terms and conditions (which include the conditions precedent) on which it is prepared to make a loan facility available towards a borrower.

The loan facility is usually a term loan, revolving facility, or overdraft. A facility agreement might contain more than one loan facility.

Purpose of the Facility Agreement

A facility is an agreement between a corporation and a public or private lender that permits the business to borrow a specific sum of money for diverse purposes for a short period. The loan is for an agreed amount and doesn’t require collateral. The borrower makes monthly or quarterly payments, with interest, until the dues are paid in full.

A facility is particularly important for businesses that want to avoid things, for example, laying off workers, slowing growth, or closing down during seasonal sales cycles when revenue is lower.

Key Terms of Facility Agreement

The key terms a facility agreement would typically include:

- information regarding the parties to the agreement, which includes their names, addresses and company numbers

- provisions dealing with the interpretation of the agreement and a list of definitions used in it

- provisions concerning the facility itself that is its nature and purpose

- mechanics regarding the borrowing and repayment of the facility including any conditions and limitations

- provisions regarding costs, fees, and other payment obligations

- representations as well as warranties

- undertakings (also recognized as covenants)

- events of default

- boilerplate provisions, and

- schedules

A facility agreement might also comprise a guarantee if the borrower or its subsidiaries are to provide this form of credit support as well as the guarantee is not provided in a separate guarantee document or elsewhere.

Inclusions in a Facility Agreement

Parties involved: In the creation of this agreement, there are usually two parties involved; the first being bank and the second is the borrower.

Effective dates: This agreement would state the date when the agreement starts and when the agreement will expire, if applicable

How to Draft the Facility Agreement?

Each facility agreement is different and is drafted, keeping in mind the nature of the facility. Though there are several ways of drafting facility agreements, each of them could be divided into the following key sections—

- Introductory– The title, the exordium, recitals, and the table of contents, which are items that are found at the beginning of most commercial agreements, are put at the beginning of a facility agreement also

- Interpretation – describes some of the terms which would be used elsewhere in the document

- Operational– states the operational terms of the agreement, for example, the amount being borrowed, repayment schedule and interest. This is the section in which the finance director or treasury team of the borrower would pay considerable attention.

- Terms and conditions– comprises the terms and conditions of the agreement which includes what each party should provide, their duties towards one another, what happens if the borrower defaults on the loan as well as the extent to which the parties to the agreement might change. This is the section which the lender, as well as, borrower would spend most time negotiating

- Boilerplate clauses– comparatively standard clauses are setting out the contract details of the parties, the relationship amid the finance parties if there is above one tender and law which governs the agreement.

Types of Facility Agreement

A facility agreement would comprise provisions stating the facility being provided, which includes what type of facility it is. The most common types of loan facilities are:

Overdraft Services: Overdraft services offer a loan towards a company when the company’s cash account is empty. The lender charges interest as well as fees on the borrowed money. Overdraft services cost less than loans, are speedily completed, and do not contain penalties for an early payoff.

Term loans: A term loan is a commercial loan with a set interest rate as well as the maturity date. A corporation usually uses the money to finance a large investment or acquisition. Intermediate-term loans are under three years and are repaid monthly, possibly with balloon payments. Long-term loans could be up to 20 years and are backed by collateral.

Business Lines of Credit: An unsecured business line of credit provides corporations’ access to cash as required at a competitive rate, with flexible payment choices. A traditional line of credit offers check-writing privileges, needs an annual review, and could be called early by the lender. A non-traditional line of credit provides business credit cards with quick access to cash as well as a high credit limit.

Revolving credit: It has a particular limit and no set monthly payments, yet interest accrues and is capitalized. Corporations with low cash balances that require funding their networking capital needs would usually go for a revolving credit facility, which provides access to funds any time the business requirements capital.

Letters of Credit: Domestic and international trade corporations use letters of credit to facilitate transactions and payments. A financial institution assures payment and completion of duties between the applicant (buyer) and the beneficiary (seller).

What Happens of Violation?

There would also be an event of default provisions regarding breaches of the facilities agreement itself. These might allow time for remedy by a borrower, and might, in any case, only apply towards material breaches or breaches of the main agreement provisions. The non-payment default provision would usually contain a grace period to cover administrative or technical difficulties. Insolvency defaults are also required to contain appropriate grace periods and must comprise appropriate waivers for solvent reorganizations with the lender’s consent.

The lender must only have the right to demand repayment of the loan if an event of default has happened and is continuing. If the event of default were remedied or waived, then the lender’s right to accelerate must stop.

[Also Read: Employee Loan Agreement]

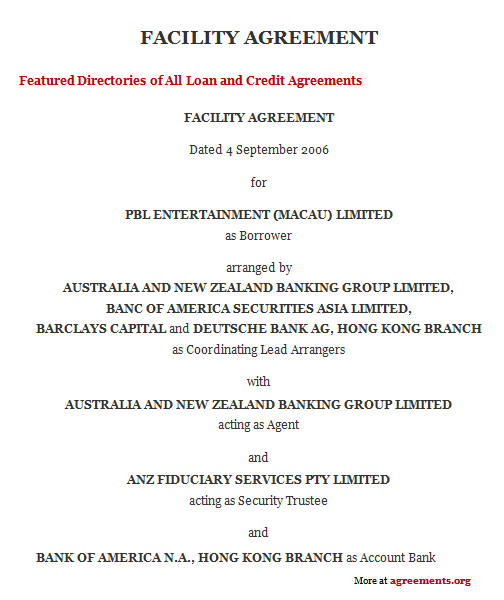

Sample for Facility Agreement

A sample of the Facility Agreement can be downloaded from below.