What Is an Equity Purchase Agreement?

An equity purchase agreement is an agreement to sell the equity shares of the company to the purchaser. Equity purchase agreement results in the transfer of equity shares of the company along with the transfer of the ownership and liabilities of the company (disclosed and undisclosed) proportionate to the equity shares transferred to the buyer. The seller must be the owner/shareholder of the equity shares of the company and may decide to sell the entire or part of its shares. Also, before a party can transfer/sell shares, it must hold shares in that company and must have the authority to transfer the shares — it can not transfers more than it has.

Purpose of an Equity Purchase Agreement?

This agreement is created for the following purposes:

- Equity purchase agreement helps in transferring and selling equity shareholding from sellers to buyers and ensures that the deal occurs as both the parties expect it to.

- Such an agreement helps both parties to protect their own interests before the transfer of shares and as well as after the transfer of shares. It is a very wide-ranging document that covers each and every aspect of the transaction and helps in examining the rights, responsibilities, and duties arising from each and every clause in the agreement.

Contents of an Equity Purchase Agreement

An Equity agreement template consists of the following main components:

- Definitions: Certain definitions, such as the definition of equity, purchase price, etc. should be included in the agreement.

- A number of shares: The agreement must contain the number of shares the seller is holding, and the number of shares buyer is interested in buying.

- Purchase Price: The purchase price of each share and also the aggregate price must also be mentioned.

- Mode of payment: The mode of payment the buyer will use to pay to the seller.

- Closing Mechanism: City, Date, Time, and the duration within which the procedures to be concluded.

- Representation and warranties of the seller/buyer: This component involves warranty by the seller that it is the legal owner of shares, having complete authority to transfer and sell the shares as mentioned in the agreement and to the seller’s knowledge of the company is valid and duly registered and has lawful authority to function. The same applies to the buyer also that he is legally competent to purchase the shares and other statements.

How to Draft an Equity Purchase Agreement?

An effective agreement can be drafted, keeping in mind the following:

- Restrictive Covenants: These may involve a nonsolicitation clause restricting the seller from soliciting the buyer’s customer and non-compete clause prohibiting the seller is engaging in a business that may compete with the buyer; for the set period of time as settled. Restraint of time period for restrictive covenants must be reasonable for both parties.

- Conditions Precedent: This may involve the form of obligations and formalities of the parties and authorizations, permissions, or permits to be obtained by the respective parties to the agreement.

- Conditions Subsequent: The agreement may also involve safeguarding the parties from the future defaults made by either party that if either party fails to abide by the terms as set forth in the agreement, the other party shall have the machinery to turn to and get the terms of the agreement enforced.

- Asset v. equity: Equity essentially means shareholding of the company, whereas, assets are the capital of the company such as buildings, machinery, etc.

- Equity and stock: The difference between equity and stock should also be highlighted in the agreement.

- Modifications and Amendments: The agreement may include the conditions, methods, and ways to modify and amend the equity purchase agreement.

Benefits and Drawbacks of the Equity Purchase Agreement

The benefits of this agreement are:

- There may be a better overall return for the shareholder/seller in an equity purchase transaction, including access to tax concessions.

- Clients, suppliers, contracts, employees remain within the company; hence there is less risk and effort associated with ensuring clients, suppliers, and employees will stay with the company; Therefore, there is no requirement for the assets of the company to be transferred thus not involving any third party.

The drawbacks of this agreement are:

- Seller may be required to provide for a bank guarantee in case of a breach of a warranty.

- The seller may need to comply with any restrictions on share transfers to third parties, such as pre-emptive rights provisions in the company’s constitution or the Shareholders Agreement.

What Happens in Case of Violation?

In the event an equity purchase agreement is violated or breached, the parties can demand damages for such breach or resort to any other legal measure as provided in the agreement or approach the courts, or they can sit together and resolve the issue by mediation, arbitration or other such alternative methods of dispute resolution.

An equity purchase agreement is an agreement where the seller sells his part of equity holdings of the company and thus transfers all the rights, ownership, control, and liability to the buyer. While drafting an equity purchase agreement, due diligence must be paid to the possible interpretation of the words and clauses, ensuring that they are not ambiguous, interest and protection of each party, proper execution, and other factors. It is important to draft and execute the agreement under the supervision of an experienced, skilled legal professional/advisor.

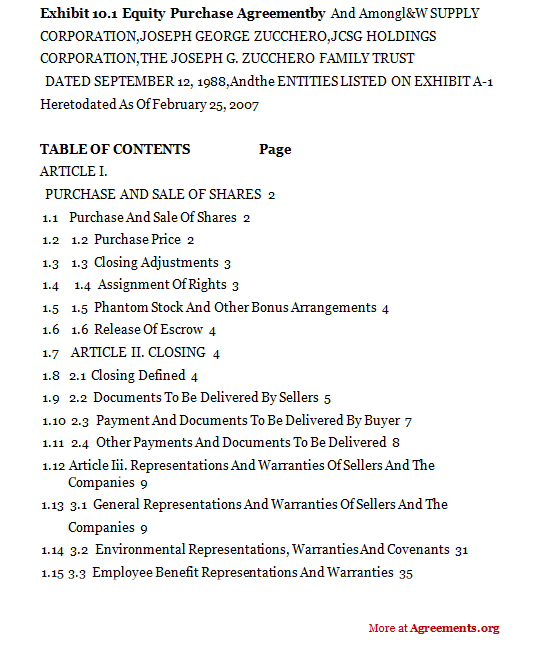

Sample for Equity Purchase Agreement

A template of an Equity Purchase Agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.