An equity funding pledge agreement is a tripartite contract which is entered into by three parties: the lender, the borrower, and the pledger. The main purpose of such an agreement is to raise finance for the company. Furthermore, the finance obtained can be used for carrying out fresh acquisitions, meeting the needs of working capital, funding ventures, etc.

Equity is the value of shares issued by a company. An equity funding agreement allows the promoter to raise finance against the shares held by him. Shares pledged act as collateral to the loan availed. Thus, it is a contract between the equity holder (promoter/investor) and a third party (lender) to pledge the shares in lieu of money.

Purpose of an Equity Funding Pledge Agreement

As stated above, the purpose of an equity funding pledge agreement is that a promoter is enabled to pledge his shares in order to meet various business requirements.

It is considered to be a safe method to raise finance because it is better than selling equity interest. Furthermore, the promoter/investor/pledger still has ownership of the shares and hence control over the company. The agreement plays a vital role by stating terms and conditions of the transaction and facilitating effective transaction.

Inclusions in an Equity Funding Pledge Agreement

An equity fund agreement typically includes the names of the parties, the duration of the pledge, the effective date of the agreement, the redemption clause, details regarding the pledged equity shares, representations and warranties, applicable laws and rights and powers of the beneficiary. It also includes standard boilerplate clauses such as dispute resolution, notices, remedies, waivers and severability.

Key Terms of an Equity Funding Pledge Agreement

The key terms of a private equity funding agreement are:

- Purpose Clause: The purpose clause should mention the purpose behind the pledge being made. It should also reflect the number of shares as well as percentage of total equity share capital.

- Representation and warranties- This clause becomes important in context of equity funding terms and conditions because, the shares being pledged need to be in a certain condition and representations and warranties regarding the same need to be made.

- Invocation/enforcement of pledge: The conditions and the circumstances in which the pledge can be invoked. It also requires that the pledger immediately bring it to beneficiary’s notice by conveying it to beneficiary in case of a default.

- Timeline for redemption: The time for the redemption of shares by the borrower should also be mentioned in the agreement. This clause is negotiable.

- Negative covenants- this clause states what the pledger shall not do during the term of agreement.

Drafting of an Equity Funding Pledge Agreement

Following are the drafting guidelines for this contract:

- Like any other contract, an equity funding pledge agreement begins with the name of the parties. This is of utmost importance due to the fact that these agreements are tripartite in nature.

- Secondly, the date on which the agreement comes into effect has to be mentioned.

- The pledged equity interest clause needs to be included. This reflects the percentage of total equity share capital.

- The term of the pledge is mentioned and the conditions wherein the collateral will be released are also stated.

- Termination events and the timeline for redemption should also be included in the contract.

- The number of days within which the pledger shall enter the pledge in the pledger’s register of charges is also mentioned. This should be in compliance with the applicable law.

Benefits of an Equity Funding Pledge Agreement

- It provides the promoters with a good ground to raise finance for the facilitation of business.

- It states the rights and obligations of the three parties avoiding scope for future conflict.

- It provides a proper timeline for redemption of shares avoiding any sort of confusion.

- There is no interference from the investor as no sale is made unless default occurs.

- By way of representations and warranties in the agreement, security and assurance is provided to the lender.

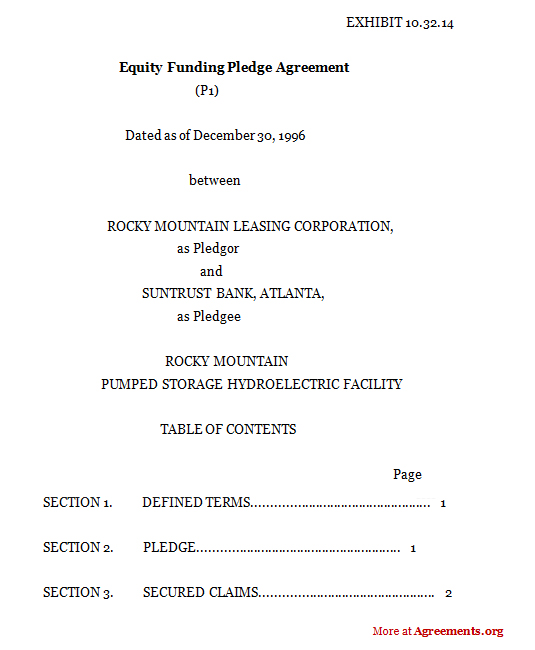

Sample for Equity Funding Pledge Agreement

Sample can be downloaded from below

Conclusion

An equity funding agreement allows promoters to raise funds. Pledging of securities does not put the promoters out of control of the company as ownership is not transferred. As it is a tripartite agreement, disputes are bound to arise. Arbitration would be a preferred method to resolve the same.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.