A Brief Introduction to Employee Stock Ownership Plan

Also referred to as Stock Purchase Plan, an Employee Stock Ownership Plan is an employee benefit plan. It allows the company employees to have an ownership interest in the company. Like any other good employee plan, this plan too makes the employees feel like they are part of the system and attracts new employees. It goes without saying that the retention rate of a company gets much better when they implement plans like these.

As per this plan, the company first chooses those who are eligible for the plan. Every company can set up its own rules for eligibility. Further, the company provides shares to all these eligible employees. The distribution of these shares depends on the position and salary of the employee. This plan has both advantages and disadvantages.

Nowadays, employees check the kind of schemes and additional benefits a company can provide them, thus for companies it has become important to come up with robust plans that can make the employees feel like they are an integral part of an organization and also, motivated.

When Do You Need the Employee Stock Ownership Plan?

An Employee B0nus Plan is needed when a company wants to make its employees involved in the interest of the company. It increases the positive involvement and outcomes for the company. It also ensures that the employees remain in the company for a long time because of the shares they own in the company.

For years, studies and research papers have shown that companies with Employee stock option plan or Employee Stock Ownership Plan grow faster after setting up ESOP. Apart from the usual benefits, this is also helpful in reducing taxes for the employees.

As per the plan, employees are not taxed unless they sell their shares at the time of leaving or retiring. They can sell the share in the market or back to the company. It should be noted that for any organization, these plans are also a corporate finance strategy.

Inclusions in the Employee Stock Ownership Plan

Employee Stock Bonus Plan would include the following terms

- Employees for whom the plan would be applicable

- Types of awards under the plan

- Purpose of the plan

- Structure of the plan

- Administration of the plan

- Eligibility criteria from the selected employees

- The stock under consideration for the plan

- Terms of the options offered

- Grant price

- Terms of exercise of the option

- Effect of termination of service

- Shareholder rights

- First refusal effect

- Repurchase rights

- Limited transferability of options

- Incentives

- Rights of the administration

- Cancellation of the rights

- Miscellaneous

How to Draft the Employee Stock Ownership Plan?

When drafting an employee stock option plan for private companies, or for any company for that matter, you need to consider the following points

- How you would set the people for whom the plan would be applicate

- What is the eligibility criteria out of those employees

- What stock are you going to have for the stock ownership

- What sort of options are you providing and what is the deadline for accepting or refusing the offer

- What is the price for exercising the option

- What are the terms and conditions of those options that you are providing to the employees

- What sort of rights are you giving for repurchase and transferability of the rights

Benefits & Drawbacks of the Employee Stock Ownership Plan

As mentioned above, there are both benefits and drawbacks to the ESOP. Some benefits are

- Without contributing their own money, employees can have shares in the company

- Employees can feel motivated to work hard because they are the shareholders of the company

- ESOP attracts more potential employees and talent

- It is the best way to reward employees

- Tax benefits for the employees

Here are some cases when the ESOP can fail –

- hen the company is too big

- When the company is too small as the ESOP can get expensive for such companies

- If you have a family business that is multigenerational

Key Terms/Clauses in Employee Stock Ownership Plan

Some key terms of this plan are

- The eligible classes of employees

- The eligibility criteria

- Applicable classes of shares

- Option prices

- Period of exercisability of the option

- Repurchase and assignment

- Treatment of the plan after termination of employee services

What Happens in Case of Violation?

This is a legally binding document. So if the employer commits any breach, the employee is well within his or her rights to approach the court.

However, it is suggested that both parties first try to mediate as per the decided terms and conditions. There has to be a dispute resolution method in place that can favor both parties rightfully. Both parties should understand these methods fully before signing on the plan. For employees, specifically, it is important to be on the same page with the employer.

An ESOP is an important piece of document for both the organization and the employees. There are many Employee Bonus Plan examples and ESOP is one of them. Here is an Employee Bonus Plan template drafted by our experts.

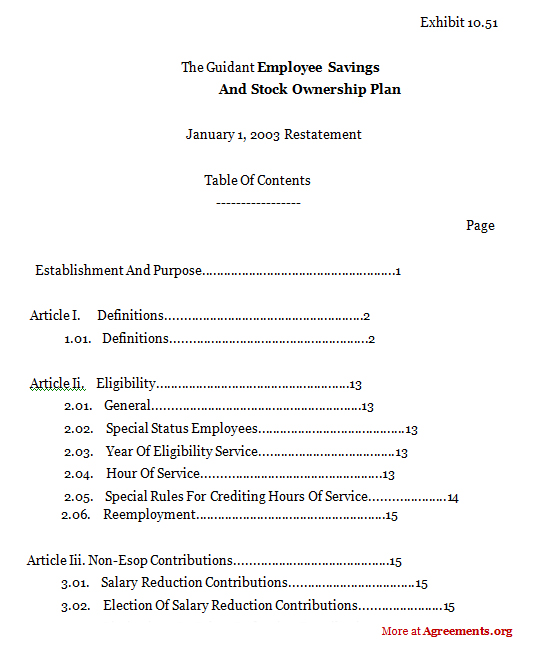

Sample for Employee Stock Ownership Plan

A sample of the agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.