What Is a Director Compensation Plan Agreement?

A director compensation plan agreement is meant for non-executive directors who are not involved in managerial or financial duties of the company. As the name suggests, the executive agrees to the company withholding a certain percentage of their compensation. The portion which is withheld is invested by the company on their behalf, and they can claim this at a certain date in the future.

This applies only to a certain category of executives who are usually part of senior management or those whose earnings are above a certain limit.

When Do You Need a Director Compensation Plan Agreement?

This agreement is required when the company wants to retain or compensate the directors of the company because of their contribution to the growth of the company. The amount of compensation would vary according to the profitability of the company and would be revised accordingly – through revisions in the board of directors agreement. There are provisions in case a director retires. The incentive is to try to ensure that the director does not join a rival company.

Inclusions in the Director Compensation Plan Agreement

The information that should be part of such plans are:

- Names of the parties to the agreement: The company and the director

- The effective date of the agreement

- Compensation payable to the director: The cash component and the deferred component, including the contribution made by the company.

- The notice period for termination of the agreement

- Percentage of compensation being deferred

- Investment schedule for the compensation withheld

- Duties and obligations for eligibility of such withholding

- Lockin period for withholding the compensation

- Responsibility of payment of taxes and other costs

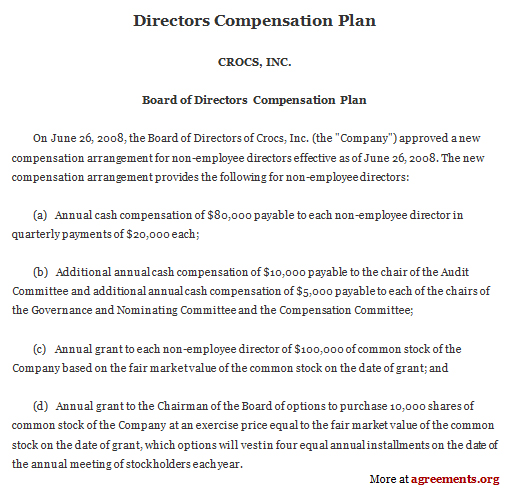

- Type of stock that would be awarded to the directors and increase in their pay

- Payment method and calculation of value of stock to be awarded

- The rights of the shareholders

- Acknowledgement that such granting does not entitle the holder to a contract of employment or director status

- Compliance with all the relevant laws and regulations

- Termination of the agreement

How to Draft Director Compensation Plan Agreement?

When drafting the agreement, you can refer to a director compensation plan sample contract. Here are the points to be kept in mind when drafting a contract:

- Governing laws: The agreement should follow the laws of the state

- Eligibility of both parties

- Detailed breakup of the consideration payable to the director

- Terms of the contract should be fair to both parties

- Confidentiality clause: No disclosure of proprietary information to a third party

- Dispute resolution clause

- Termination of the contract clause

- Signatures of both parties to the contract

- No contract of employment or status as a director

- Eligibility to election of directorship

- Increase in compensation for those that elect payment by company shares

Benefits of a Director Compensation Plan Agreement

- The director compensation plan agreement benefits both parties to the agreement.

- The director will be entitled to the shares of the company and enjoy the profits made by the company.

- The company benefits as they are able to retain a valuable executive who will ensure greater revenues through their knowledge and experience.

- The chances of the director leaving the company are minimized.

- If any party violates the agreement, legal action can be taken.

- It aligns the interests of the directors with those of the shareholders

- Increases investor confidence by showing strong corporate governance

- It fosters director independence

- Serves as best practices for the management

- It complies with the business objectives

- It helps in withstanding shareholder scrutiny

Key Terms/Clauses in a Director Compensation Plan Agreement

The key terms or clauses in the director compensation plan agreement are as under:

- Service as a director: Responsibilities of the director

- Termination of service: Events which lead to termination

- Compensation and expenses: Annual retainer, the initial grant of shares, additional compensation received as committee chair service, expenses reimbursement, other benefits

- Director ownership requirements

- Status of director

- Representations and warranties of the director

- Compliance with all the relevant laws

- Election as a director for payment of compensation through common stock

- No contract of employment or directorship

- Miscellaneous: Entire agreement, successors and assigns, counterparts, amendments and waivers, severability, construction, governing law

What Happens in Case of Violation?

When you violate the director compensation plan agreement, the company will take legal action on you depending on the kind of breach. If there is a total breach of the agreement, the company will claim money damages, including lost profits.

If the company does not want to continue with the agreement, then under restitution, the director has to restore the company to its original position by returning the compensation paid.

If the contract was prepared with a fraudulent intention, then it may be canceled under rescission. Alternatively, a fresh contract can be drawn by the court.

Under specific performance, the director will have to fulfill their contractual obligation, and money damages will not be accepted by the company.

[Also Read: Directors Deferred Stock Plan Agreement]

Sample Director Compensation Plan Agreement

Download Director Compensation Plan Agreement Sample.