A Deed of Trust is an instrument that pledges the property to secure a loan. In a Deed of Trust, the borrower transfers the legal rights over the property in favor of the Trustee, and the Trustee is empowered to sell the property of the borrower in case the borrower defaulted in making payment of loan amount. However, when the borrower repays the loan, then the Trustee reconvenes the ownership of the property in favor of the Trustor or the borrower.

A trust deed sample is usually created with a specified objective mentioned in the deed itself. The Trust Deed is valid till the object stated in the deed is fulfilled.

Purpose of Deed of Trust

The creation of a trust deed agreement helps to secure the loan given by the lender. The Trustee is empowered to sell off the property, which is given as security in cases where the borrower defaults in repaying the loan amount. This contract empowers the Trustee to take care of property till the time the object for the creation of Trust is satisfied.

Inclusion in Deed of Trust

A sample typically includes the name of the Trustee, amount lent, the registered office of the Trustee, the object of Trust, the property of Trust, powers, and qualification of Trustee, etc. Apart from these, This also includes clauses like indemnity, dispute resolution, dissolution of trust, etc.

Key Terms in a Deed of Trust

- Clauses definition: This clause contains the definition and interpretation of the different clauses used throughout the contract.

- Objects: This clause talks about the object for which the Deed of Trust is created. The entire Trust Deed revolves around fulfillment of the object of the trust.

- Appointment of Trustee: This clause lay down how a Trustee will be appointed and in case of any vacancy, how will it be filled.

- Property of Trust: This clause outlines the property which is assigned to the trust.

- Power of Trustee: This clause lays down the powers conferred upon a trustee and the Trustee cannot act beyond the powers mentioned in the Trust Deed.

- Accounts and Audits: The Trustees needs to maintain books of accounts for the Trust and also needs to get the books audited regularly.

- Winding Up: This clause mentions the vesting of assets in the event of winding up.

Drafting of a Deed of Trust

Following guidelines must be followed while drafting:

- The name of the Trustee and the object of the Trust should be specifically mentioned.

- The Powers of Trustee should be specifically stated.

- The procedure for alienation of property should be clearly mentioned once the default in repayment of debt occurs.

- The location of the Trustee’s office should also be mentioned.

- Power of Sale clause should be mentioned.

- Risk mitigating clauses like Indemnity, the scope of liability, dispute resolution procedure, etc. should also be mentioned.

Types of a Deed of Trust

- Express Trust: In case of an Express Trust, the Trust is created expressly either by spoken word or written. The Trustee is nominated by the parties expressly.

- Implied Trust: In case of Implied Trust, the Trust is inferred from the conduct of the parties.

- Public Trust: The Public Trust is created for the benefit of public as a whole or part and is valid as long as the members of the public derive benefit from the trust.

- Private Trust: The Private Trust is created for the benefit of a specified person only.

Pros of a Deed of Trust

- Security of Debt: A Deed of Trust ensures that the debt of the lender is repaid. The property which is secured is sold by the Trustee to make repayment to the lender.

- Less pressure: The creation of Deed of Trust helps remove pressure with respect to debt, and any inquiry with respect to Trust property will be dealt by the Trustee.

- Less Costly: The Deed of Trust is a less costly way of securing debt rather than indulging in litigation for recovery of debt.

Cons of a Deed of Trust

- Loss of Ownership: Once a property is transferred to the Trust, the borrower loses the ownership of the property till the repayment of the loan. Such an asset will be controlled by the Trustee.

- Affect Credit Rating: Entering into this might affect the credit rating of the borrower.

A Deed of Trust is no longer as common as it was. The Deed of Trust requires an impartial Trustee who is very vague and subjective. Issues may arise while negotiating the terms of the Trust Deed with the lender. But, an effectively negotiated Trust Deed helps in the protection of interest of both the borrower and lender.

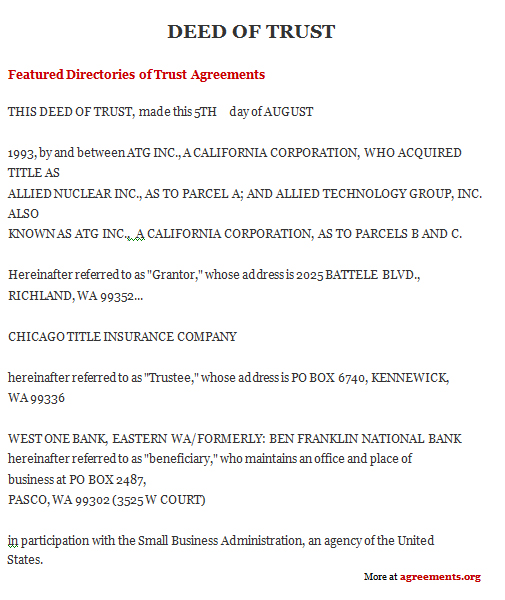

Sample Deed of trust Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.