What Is a Debt Settlement Agreement?

A debt settlement agreement is a contract drafted between a creditor and a debtor when the debtor requires early settlement or a reduced payment due to his inability to pay back his debts. This agreement is mainly used to compromise. This usually happens when the debtor only owes the last payment. To save on time, creditor might accept a reduced payment, usually 70% of the original payment value, for payment early

When Do You Need a Debt Settlement Agreement?

To protect his interests instead of gambling on whether the debtor would repay the debt or not, creditors might decide to collect the dues early even if that means collecting a lower amount. This way a certain part of the burden is also lifted from the debtor’s shoulders without having to sacrifice his credit score or his relationship.

Inclusions in the Debt Settlement Agreement

A standard debt settlement agreement sample includes the following terms:

- The commencement of the contract

- Names and other identifying details of both the parties

- Governing agreement about the original debt

- The total amount of the debt

- The amount of payment that the creditor will accept if paid within a certain period

- An acknowledgement that the payment of the debt absolves the debtor of all further liabilities with respect to the debt

How to Draft a Debt Settlement Agreement?

The following are the steps to follow while drafting a Debt Settlement And Subscription Agreement:

- The solvency of the debtor to make the payment in advance

- Whether the settlement amount compensates for the loss of future income in the form of interest and reduced principal amount

- Whether the debtor can make the payment on time

- How the acknowledgment should be made in case the debtor defaults on his payment

Benefits of the Debt Settlement Agreement

The following are the benefits and drawbacks of this agreement:

- It helps to provide an outline for the settlement of a debt.

- The responsibilities and duties of the debtor are laid out.

- It ensures that the creditor receives his due without the problem of debtor defaulting on his payment

- It helps the debtor pay back a reduced amount without compromising his credit score or his business relationships

Key Terms in the Debt Settlement Agreement

The key terms in a Debt Settlement And Subscription Agreement are as follows:

- Acknowledgement of debt

- Present debt that is owed

- Settlement amount for which the parties are compromising

- Terms of payment of the reduced payment including the amount and the time within which to pay

- Governing law regarding the payment of loan and the reduced payment and the contract acts

What Happens in Case of Violation?

There are only two types of violations in this contract – the debtor does not pay the required amount within the required time period or the buyer’s payment does not go through because he’s insolvent or because he does not have enough funds. In this case, the agreement should have a provision where the original agreement would come back into force in addition to certain penalties. The parties may arbitrate or settle. The last action would be to approach the court for specific performance or compensatory damages.

[Also Read: Debt Restructuring Letter Agreement]

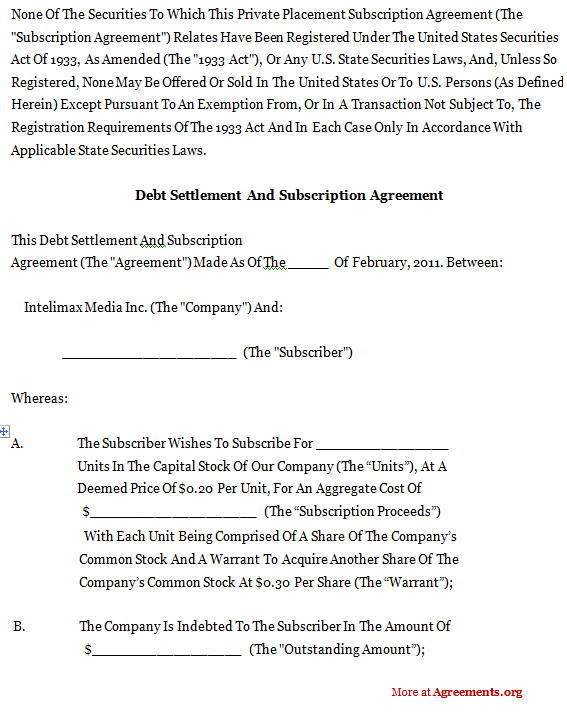

Sample for Debt Settlement And Subscription Agreement

You can download a Debt Settlement And Subscription Agreement PDF or Doc template here

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.