What Is a Debenture Conversion Agreement?

A debenture is a company-issued loan that can get converted into the company’s stock. The terms and conditions followed in this process are quite a few and need to be put down in writing. Therefore, the debenture conversion agreement comes into play. It is an agreement that’s typically issued by a debenture issuing company for the debenture holder. It is a piece of a document necessary for an issuing company, and everyone willing to become a debenture holder for that company.

The debenture conversion agreement holds specific details into it, which are as follows:

- The number of debentures.

- The face value of the debentures

- The conversion rate applied and its date

- Details of any unpaid interest on the debentures

- Shares allocated to the debenture holder

- Mode of allocation (physical certificate/automatic mode).

- The Company declaration in the agreement is about the common stock of the company to be free from any liens or encumbrances for physically transferring them to the debenture holder.

When Do You Need a Debenture Conversion Agreement?

A debenture conversion agreement comes into play when a debenture holder wants to get his debentures converted into the company’s shares. If the company doesn’t or delays paying for the debentures beyond the stipulated time, the conversion of the debenture agreement option gets provided to the debenture holder. An agreement that states this arrangement is called a debenture conversion agreement. It applies to all types of convertible debentures, irrespective of their tenure, redemption and its mode, their security, convertibility, and transferability and also the kinds of interest and coupon rates.

It brings some terms and conditions to be fulfilled by the company and the debenture holder, and they must get guarded within the boundaries of the law. Since both the parties agree to these terms and conditions legally, a debenture conversion agreement is known as a contract.

Inclusions of Debenture Conversion Agreement

You are already aware of what Convertible Debenture means. Still, for the recap and for people hearing the term for the first time- It’s a company-issued loan that can get converted into the company’s stock. You must not confuse it with convertible bonds, which remain secure. Debentures are unsecured; in case there is a bankruptcy, you pay the debentures following other, fixed-income holders. A similar feature increases the share count when factored into calculating the diluted per-share metrics and reduces EPS or the earnings-per-share amounts.

For a better understanding: Capital is obtained by a company through issuing of debt or equity and sometimes, combining the two. The capital thus raised is utilized towards the growth or maintenance of the business. However, in case a company raises more capital using more debt than equity, or vice versa, the convertible debentures are there for the purpose. This hybrid financial product brings the benefits of both debt and equity.

How to Draft Debenture Conversion Agreement?

You are advised to note the importance of adequately checking the following:

- Security Offered: Security terms offered by the creditor must meet the clauses in a clear and crisp way that cannot get tampered.

- Rollover Terms: These are the terms that define the interest you will pay. The initial time increases if the creditor is not there before-hand.

- Interest Rate Risk: The debenture agreement being unsecured and with a fixed interest rate, can’t be accessed for any change once signed by the debtor. It is going to keep you unaware of the new opportunities in the market if not noticed right at the beginning.

- Credit Risk: The debtor doesn’t need to lend the borrowed money to anyone else; neither can the debenture signees use the funds to benefit the company’s financial status upon will. Only the investor can dictate the terms, so make sure there’s no violation of the rule.

- Liquidity Risk: If the issuer tries to exit or break the agreement, they will be cutting a convertible bond. As an investor, you can access their funds under certain circumstances, so make sure the provisions get clearly stated into the agreement.

Benefits of Debenture Conversion Agreement

While bonds are way cheaper than equity (tax advantages of interest payments responsible) and debts need a timely-payback tending to make a company’s earnings volatile despite increasing returns up to a limit, convertible debentures come cheaper than equity since investors accept a lower interest rate. It is because the option to convert debentures into common shares stays present, with the advantage of their ‘no-payback-required‘ nature if converted to common shares. The money thus raised by the debentures becomes a part of the company’s capital and not share the wealth as many people think.

Debentures being the essential method and instrument for raising loan capitals by the issuing company, they enjoy the status of a certificate of the loan; or, you may call it a loan bond that stands as evidence for a specified amount the company is liable to pay with interest.

Key Terms/Clauses in Debenture Conversion Agreement

- A person should become aware of convertible debentures agreement advantages and disadvantages before signing the contract.

- The attributes of a debenture conversion agreement ensure the security of the debtor on several grounds. Thus, make sure if the shares or interest mentioned in the deal get considered as movable and transferable properties.

- This contract doesn’t mention any guarantee regarding the repayments the way Mortgage Bonds do.

- A debenture conversion agreement suffices as a Certificate of Indebtedness and also that the creditor to the issuing company is not or does not become a shareholder.

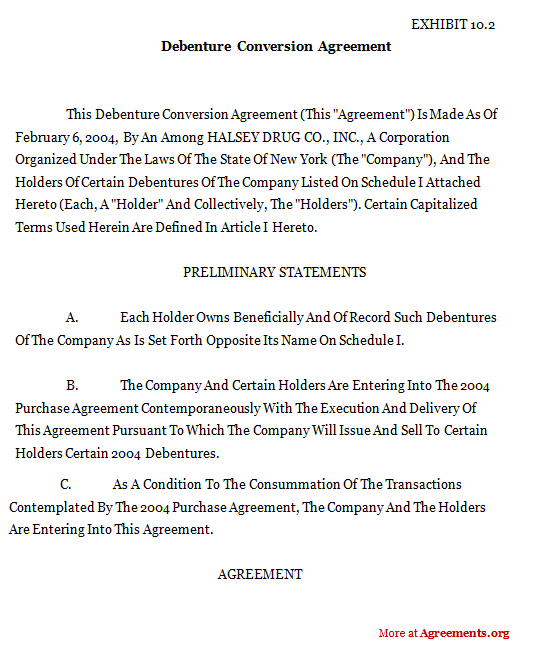

Sample for Debenture Conversion Agreement

A sample of the Debenture Conversion Agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.